Whether you are thinking of selling, refinancing, or just want to optimize the income your property generates, here are a few tips I’ve learned from the 18 years helping owners sell their self-storage facilities. There are many, many ways a self-storage owner (or operator) can improve their bottom line, and I’m sure I’ve left out a few ideas that others have uncovered. OPTIMIZE RENTAL INCOME – The most obvious way to increase the net operating income of your self-storage facility is by increasing the monthly rental collections. But how? The…

Category: Sponsored

SBA SOP Rule Changes for SBA 7A Program

The SBA recently released their changes to their SOP rulebook that will go into effect June 1, 2025. Below is a summary of impactful changes. Franchise Directory is returning. Franchises will be required to be listed in the directory. If a borrower operates under more than one franchise agreement, all franchises must be listed on the directory, not just the critical ones Need 100% ownership, including indirect ownership of the business, to include SSN, address, % owned, and DOB. All must be citizens or LPRs and primarily reside in the…

Navigating Price Sensitivity Without Compromising Value in Self Storage

In today’s economy, price sensitivity is at an all-time high, and the self-storage industry is feeling the squeeze. With consumers scrutinizing every dollar, self-storage providers must walk a fine line between staying competitive and maintaining value. Grace Totty, VP of Marketing and Sales at Absolute Storage Management, offers a roadmap for doing just that in her presentation, “Navigating Price Sensitivity Without Compromising Value.” The shifting economic landscape has created a new kind of consumer: one who is more informed, more cautious, and more demanding. According to Totty, although the core…

Lockhart Storage Centers Select White Label Storage as Management Partner

White Label Storage has added six Lockhart Storage Centers facilities to its portfolio, further expanding its footprint in the Southeast and reinforcing its position as one of the fastest growing third-party management companies in the industry. “We’re proud to expand our relationship with Lockhart Storage Centers,” said Jennifer Barroqueiro, Vice President of Operations at White Label Storage. “Following the strong performance at Davenport, Lockhart entrusted us with the management of their additional Class A facilities in Florida, and we’ve already hit the ground running.” White Label Storage initially launched management…

Navigating Offers: Choosing the Right Path to a Successful Self-Storage Sale

When selling a self-storage facility, the selection of the right offer and buyer is critical. Sellers do not want to waste time in a deal that collapses weeks or months later due to easily avoidable due diligence issues that buyers should have determined on the front end. While a buyer’s initial enthusiasm and speed in submitting an offer might seem appealing, a rushed, high-priced bid isn’t always the most secure option. Experienced brokers and sellers prioritize thoughtful, well-researched offers, even if they take a little longer to materialize. An offer…

How to Be Ready When Natural Disasters Strike Self-Storage

With hurricane season officially less than a month away, it isn’t too soon to begin thinking about what you’d do if disaster struck. In fact, whether you’re facing facility fires or wildfires, floods, mudslides, snowstorms, tornadoes, earthquakes, hurricanes or other disasters, there are steps you can take to prepare and protect your facility before the event and to rapidly restore your facility after the damage is done. Prepare Your Facility. Is your facility built to withstand a disaster? One area that can be beefed up to prepare for the unexpected…

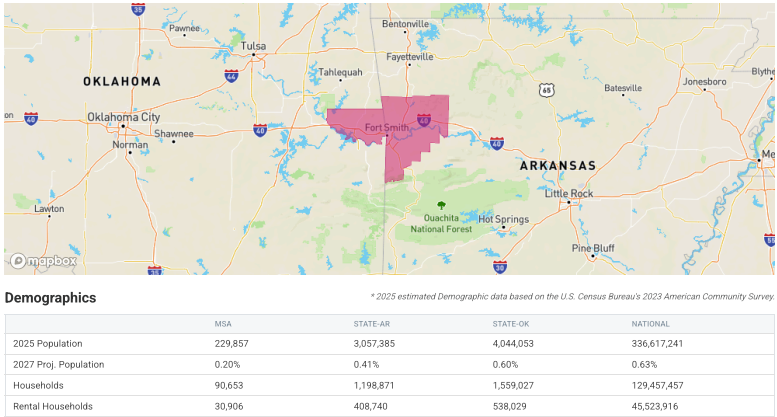

StorTrack Launches Monthly Self-Storage MSA Reports for 360+ U.S. Markets

StorTrack is excited to announce the release of a valuable new feature exclusive to Unlimited Explorer subscribers: Monthly MSA Reports for over 360 Metropolitan Statistical Areas (MSAs) across the United States. These reports are designed to give operators, investors, and developers a reliable, high-level view of local market conditions — compiled monthly using StorTrack’s continuously refreshed dataset. While our platform updates data daily, the MSA Reports provide a consistent monthly snapshot, making it easy to monitor trends over time and compare markets side by side. Whether you’re evaluating a new…

White Label Storage Partners with Ai Lean to Simplify Lien Management

White Label Storage, one of the industry’s fastest-growing management companies, has partnered with Ai Lean—the only end-to-end lien compliance automation platform for self-storage—to simplify how owners and operators manage the lien process. Market data shows that delinquencies are on the rise, meaning more operators will be forced to navigate the notoriously complex lien process. Relying on manual workflows to resolve delinquencies leads to reduced revenue, increased legal risk, and time diverted from growth-focused initiatives. “We know firsthand how challenging delinquency resolution and lien compliance can be. That’s why we’re thrilled…

Are You Ready for Rental Season?

While the last few years have been challenging for the self-storage industry, one of the most positive and productive results of the volatile economy and lower street rents is that it has forced operators to take a hard look at their management platforms, operating procedures, expenses, unit pricing, and how their properties compete within their respective submarkets. We have all learned to survive with lower revenue and NOI growth. Today, we are starting to see signs that self-storage fundamentals are bottoming. External source reports that advertised rental rates are nearly…

JLL Arranges $14.88 Million Construction Loan for a New Class A Self-Storage Development Facility in Montvale, NJ

JLL Capital Markets announced today that it has arranged a $14.88 million construction loan for the development of a new Class A self-storage development in Montvale, Bergen County, New Jersey. JLL worked on behalf of the borrower, a strategic venture between Claremont Development, March Development and Battery Global Advisors, to secure the 42-month, floating-rate loan with extension options through Fulton Bank. Located at 21 Phillips Parkway, the property is currently improved with an 18,500-square-foot medical office building that will be demolished to develop the 129,889-square-foot, three-story building. The property will…