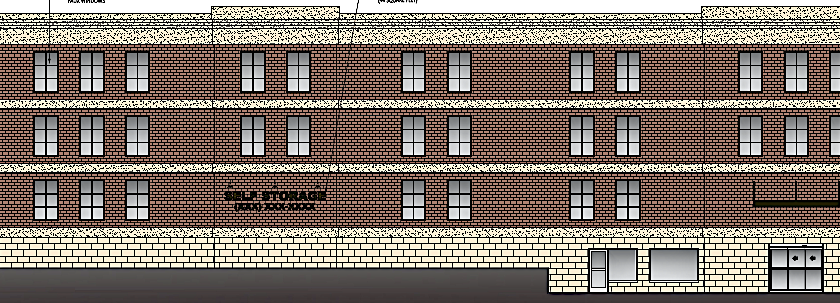

Mag Mile Capital announced that Matt Weilgus, SVP and Head of Originations, successfully completed a $4 million loan to secure funds needed to purchase and renovate an old Sears store into a modern 854-unit, 83,040 sq. ft. self storage facility. Branded as and managed by Public Storage, the facility is located in the first enclosed mall in the mid-South and is located just minutes from the airport and downtown Memphis. Mag Mile Capital is a boutique firm that offers preferred access nationwide to high-leverage, non-recourse, commercial real estate bridge loans and permanent mortgages with cash out for hotels, self storage, multifamily, industrial, retail, office and other commercial real estate property.

It is a complicated deal, considering the plans to transform this space from a retail store to a facility with individual storage units.”

“Global Storage Partners reached out to us months ago with the plan for a new storage facility, and we’ve been working on this since then,” said Matt Weilgus. “It is a complicated deal, considering the plans to transform this space from a retail store to a facility with individual storage units. But we were able to get the borrower team a competitive rate with terrific flexibility and recourse burn-off. It’s the ideal loan for this type of project and we’re always very happy to help a great client get exactly what they need.”

Mag Mile Capital: Planned Self-Storage Facility for Downtown Memphis

- Address: 1200 Southland Mall

- Total Loan Amount: $4,000,000

- Interest Rate: Floating rate of WSJ Prime + 1% with a floor of 4.25% (current rate: 5%)

- Amortization: Interest-only payments for the first 36 months, followed by 30-year amortization for the subsequent 24 months.

- Loan Terms: Construction-to-mini-permanent loan structure. Floating rate of WSJ Prime + 1%, 5-year term, three years of I/O followed by 30-year amortization schedule for two years, 48.2% loan-to-cost, 0.5% lender origination fee, 0.5% lender exit fee, no prepayment penalty, full recourse guaranty at closing, but burn-off of recourse to 50% once the property demonstrates a DSCR of 1.4x for 6 months.

- Investor Type: Global Storage Partners LLC – Privately held self-storage platform.

- Closing Date: 05/27/2022

“Mag Mile Capital and Matt Weilgus delivered best-in-market financing terms on this retail-to-self storage conversion project,” said Joe Zummo, Vice President, Global Storage Partners. “A competitive rate and terrific flexibility allowed us to execute our business plan to perfection. The entire Global Storage Partners team appreciates the smooth execution by everyone involved at Mag Mile Capital.”

For the latest details on Mag Mile Capital investments, follow them on social media: Facebook, Twitter, LinkedIn, Instagram.

About Mag Mile Capital – Turning Relationships Into Closings Since 1991

Mag Mile Capital is a full-service commercial real estate mortgage banking firm headquartered in Chicago with offices in New York, Massachusetts, Connecticut, Florida, Texas, Michigan, Colorado and Nevada. Mag Mile Capital is a national platform comprised of talented capital markets advisors with extensive experience in real estate debt placement and equity arrangement throughout the full capital stack and across all major asset classes nationwide.

Offering preferred access to premier structured debt and equity advisory solutions and placement for real estate investors, developers, and entrepreneurs, Mag Mile Capital leverages a wide variety of lending relationships and equity capital connections as a leading American real estate mortgage facilitator. Learn more at: MagMileCapital.com.