Padlock Euro Storage Fund I has agreed to sell its portfolio of 26 self-storage and mixed-use properties in the United Kingdom to an affiliate of QuadReal Property Group.

Under a sale-and-purchase agreement, Vancouver-based QuadReal’s QR CS Padlock LP will indirectly acquire a 95% interest in the holding companies that own the assets, while affiliates of Phoenix-headquartered Clear Sky Capital and members of management will retain an indirect 5% equity interest.

The fund is managed by Toronto-based Padlock Capital Partners, an affiliate of real estate and development firm Clear Sky Capital.

The transaction values the properties at a gross asset value of approximately £270 million. QuadReal will assume the fund’s proportionate share of existing debt on the portfolio.

After debt assumption and working-capital adjustments, the fund expects net cash proceeds of about £93.6 million for its 95% interest. The amount reflects applicable U.K. exit taxes, estimated transaction and closing costs, carried interest, and the assumed full receipt of the closing retention amount.

“Under Clear Sky’s management, the fund, including its predecessors, has assembled a sizable portfolio of high-quality self-storage assets, which allowed us to identify QuadReal as a buyer,” said Iyngaran Muniandy, CEO of the fund. “The sale of the properties is a compelling opportunity for fund unitholders to realize on their investments and achieve liquidity in the fund. We are proud of being able to execute a transaction of this nature in what is currently a difficult U.K. property market.”

The internal rate of return (IRR) will range from 0.37% to 9.31%, depending on the unit class. The post-carried interest estimated distribution per unit will range from £8.35 to C$11.50. Canadians’ consideration will be subject to exchange rates. The fund expects to pay a special distribution around the transaction’s closing date.

The fund cautioned that internal rate of return and distribution-per-unit figures are based on estimates of net asset value, U.K. exit taxes, expenses and carried interest as of the current date, and that actual results may differ, potentially materially, depending on final costs, taxes and the amount of any retention received.

The distribution per unit reflects U.K. exit taxes payable by the fund or its subsidiaries but does not account for taxes payable by unitholders. The purchase price will be subject to post-closing adjustments based on the difference between estimated and actual net asset value at closing, as well as planning-related approvals tied to the Chippenham South property in England and certain tax matters.

Under the agreement, the consideration may be reduced by £3 million if a planning condition related to the Chippenham South property is waived by the purchaser by April 20, 2026. In addition, about £17.2 million will be retained by the purchaser and the fund or its affiliates to address any post-closing net asset value shortfall, with no guarantee that any portion of the retained amount will ultimately be distributed to unitholders.

John Stevenson, a self-storage investment specialist based in Phoenix, currently heads both Padlock Capital and Clear Sky.

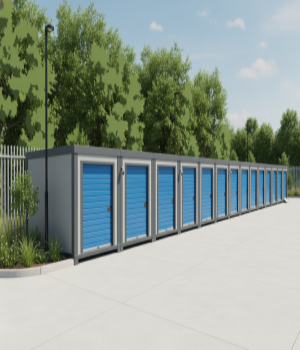

Pictured: Cinch storage facility in the U.K. owned by Padlock Euro Storage Fund I.