Talonvest Capital, Inc., a boutique mortgage brokerage firm, is pleased to announce $66,100,000 of construction loan closings for its long-time client, 1784 Holdings, LLC. The first transaction was a $46,700,000 construction loan for the development of a state-of-the-art self storage facility located on a prime thoroughfare in North Hollywood, CA. The property will have almost 98,000 net rentable square feet across 1,144 climate-controlled units. The second financing was a $19,400,000 construction loan for a premier self-storage development in Bordentown, NJ. Situated on 5.4 acres, the project will offer over 77,000…

Category: Finance News

North Palisade Partners Lands $55 Million for Self-Storage Facility in Los Angeles, CA

North Palisade Partners has obtained $55 million for the refinancing of its 3,039-unit self storage facility at 1920 Randolph St. in Los Angeles. By issuing the five-year bridge loan, Goldman Sachs Alternatives originated one of the largest financing packages for a single-asset self-storage property in Southern California. CBRE arranged the transaction. Proceeds retire existing debt. In 2022, Buchanan Street Partners provided two separate construction loans for North Palisade’s facility totaling $55.2 million, according to Yardi Matrix information. Completed in the first quarter of this year, the three-story, 214,000-net-rentable square-foot facility…

Rosewood Lands $125 Million Refinance for Storage Portfolio Across Five States in the US

Dallas-based Rosewood Property Co. has secured a $125 million refinancing loan for a 19-property self-storage portfolio under its ownership. PGIM Real Estate, Prudential Financial’s real estate investment and financing division, arranged the loan, while Newmark represented the borrower in the transaction. The portfolio encompasses 9,970 units across 1.2 million rentable square feet. The facilities are located in five different states, with 13 of them in Pennsylvania, three in Maryland and one each in New Jersey, Indiana and Kentucky. The portfolio has been under Rosewood’s ownership for more than a decade,…

Nuveen Real Estate Announces $150 Million Allocation from CalSTRS to Invest in Self-Storage Sector in the US

Nuveen, the investment manager of TIAA and one of the largest real estate managers in the world with $141 billion in real estate assets under management, has announced the closing of a separately managed account for the California State Teachers’ Retirement System (CalSTRS) to invest in self-storage assets across the United States. This strategic collaboration includes an initial equity commitment of $150 million from CalSTRS, alongside a 10% equity commitment of $16.6 million from the TIAA General Account for a total allocation of $166.6 million. The strategy will focus on…

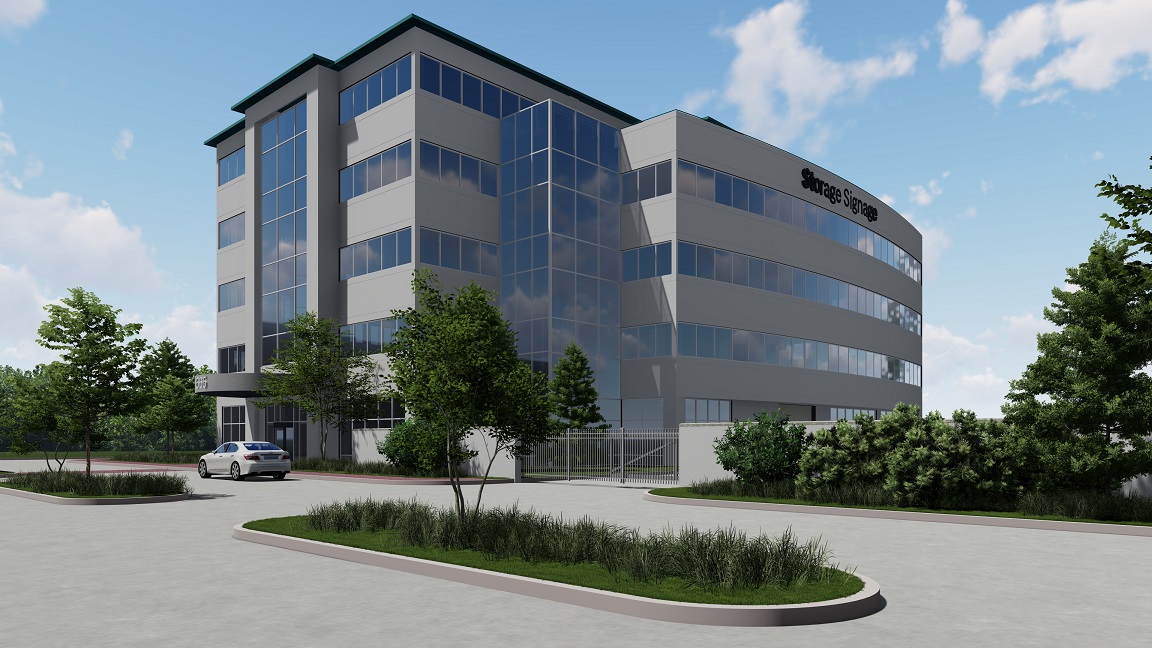

Byline Bank Funds $9.25 Million Office-to-Self-Storage Adaptive Reuse Project in Lombard, IL

Byline Bank’s Commercial Real Estate Group (BCREG) has closed on a $9.25 million loan with LSC Development to fund the conversion of a 2000 vintage office building, prominently located at the intersection of I-355 and North Avenue, into a fully climate-controlled, state-of-the-art self-storage facility. The 103,109-square-foot building, located on a 10.5-acre site at 665 W. North Avenue in Lombard, Ill., will be transformed into a 67,853-square-foot Class A, climate-controlled self-storage facility and provides 64 secured surface parking spaces for both RVs and regular vehicles across 14,800 square feet. Two loading…

Eastern Union Secures $9,424,405 to Refinance Renovation Project That Will Deliver 43,000-Square-Foot Self-Storage Facility and 55,000 Square Feet of Retail Space in Springfield, VT

Eastern Union, one of the country’s largest commercial mortgage brokerages, has arranged $9,424,405 in construction-to-permanent refinancing for the first stage of a multi-phase renovation project at 100 River Street in Springfield, VT. This portion of the initiative will create a 43,000-square-foot self-storage facility and 55,000 square feet of retail space. Springfield is located along the Black River about 95 miles northeast of Albany, NY and about 130 miles northwest of Boston. The renovation is being undertaken by Integrity Community Partners, LLC based in San Diego, CA with offices in New…

Baranof Holdings Purchased an Industrial Land Site for $28 Million to Pave Way for a New Self-Storage Facility in Hollywood, CA

The largest land sale in Hollywood for the first quarter goes to Baranof Holdings, which acquired a 1.29-acre industrial land site for $28 million. Dallas-based Baranof Holdings, a developer and asset manager of self-storage facilities, has purchased a 1.29-acre industrial land site in Hollywood for $28 million in order to pave the way for a new Los Angeles self-storage facility. The transaction marks the largest land sale in Hollywood during the first quarter of the year. Baranof Holdings acquired the site at 956 Seward St., which previously operated as a…

SmartStop Self Storage REIT, A Premier Owner And Operator Of Self Storage Facilities in the United States and Canada, Announces Pricing of Underwritten Public Offering

SmartStop Self Storage REIT, Inc. (“SmartStop” or the “Company”), an internally-managed real estate investment trust and a premier owner and operator of self-storage facilities in the United States and Canada, announced today the pricing of its public offering of 27,000,000 shares of common stock at a price to the public of $30.00 per share. SmartStop has granted the underwriters a 30-day option to purchase up to an additional 4,050,000 shares of its common stock at the public offering price, less underwriting discounts and commissions. Shares of SmartStop’s common stock are…

Talonvest Capital and Madison Capital Secure Bridge Loan for Class A Self Storage Facility in North Las Vegas, NV

Talonvest Capital, Inc., a boutique self-storage and commercial real estate advisory firm, has successfully arranged an $11,900,000 bridge loan for a state-of-the-art, Class A storage facility in North Las Vegas, NV. The transaction was completed on behalf of longstanding client Madison Capital Group, reinforcing the strength of the strategic partnership. Located at 345 East Ann Road, the facility features 661 climate-controlled units and 60 non-climate units and is professionally managed by Go Store It, Madison Capital’s in-house management company. As part of the business plan, Go Store It aims to…

PSRS Arranges Bridge Loan for Self-Storage Facility Conversion in Los Angeles, CA

The borrower plans to convert a vacant 150,000-square-foot flex property in Los Angeles into a self-storage facility. PSRS has arranged a $38.2 million bridge loan to convert a vacant approximately 150,000-square-foot flex property in Los Angeles into a self-storage facility. Jonny Soleimani and George Gianoukakis of PSRS secured the financing for the undisclosed borrower. The financing included a $12.8 million cash-out refinance, fully funded construction costs and an 18-month interest reserve, providing the borrower with the capital needed for the successful repositioning of the asset. Source