National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA) today reported the Company’s third quarter 2021 results.

Third Quarter 2021 Highlights

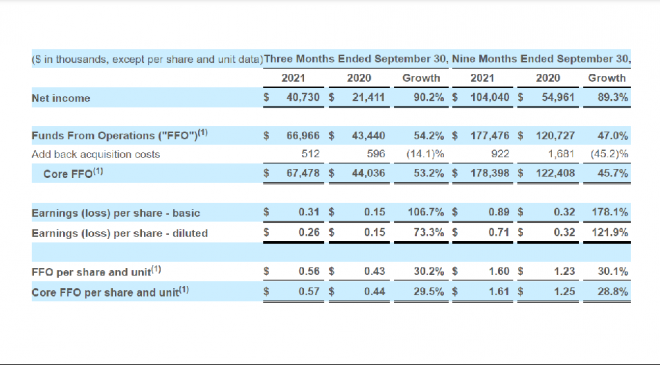

- Reported net income of $40.7 million for the third quarter of 2021, an increase of 90.2% compared to the third quarter of 2020. Reported diluted earnings per share of $0.26 for the third quarter of 2021 compared to $0.15 for the third quarter of 2020.

- Reported core funds from operations (“Core FFO”) of $67.5 million, or $0.57 per share for the third quarter of 2021, an increase of 29.5% per share compared to the third quarter of 2020.

- Reported an increase in same store net operating income (“NOI”) of 24.3% for the third quarter of 2021 compared to the same period in 2020, driven by an 18.4% increase in same store total revenues partially offset by an increase of 4.6% in same store property operating expenses.

- Reported same store period-end occupancy of 96.2% as of September 30, 2021, an increase of 450 basis points compared to September 30, 2020.

- Acquired 76 wholly-owned self storage properties for $599.3 million during the third quarter of 2021. Consideration for these acquisitions included the issuance of $31.1 million of OP equity.

- Completed an underwritten public offering of 10,120,000 common shares resulting in net proceeds of approximately $497.4 million.

- Increased the total borrowing capacity under the Company’s credit facility in September 2021 with the addition of a $125.0 million 5.5-year term loan tranche E.

- Issued the previously announced $35.0 million of 2.16% senior unsecured notes due May 4, 2026 and $90.0 million of 3.00% senior unsecured notes due May 4, 2031 on July 26, 2021 in a private placement to certain institutional investors.

- Entered into an agreement on July 9, 2021 with a single lender for an $88.0 million interest-only secured debt financing that matures in July 2028 and has a fixed interest rate of 2.77%.

- Received approximately $40.0 million of net proceeds from the sale of 782,000 common shares under the Company’s at the market (“ATM”) program.

Highlights Subsequent to Quarter-End

- Acquired 39 wholly-owned self storage properties for approximately $325.7 million.

Tamara Fischer, President and Chief Executive Officer, commented, “Third quarter 2021 was an outstanding quarter for NSA with the investment of nearly $600 million in the acquisition of 76 self storage properties and the continuing outperformance of our same store portfolio which generated 24.3% NOI growth. We’re optimistic that the favorable tailwinds impacting the self storage industry will continue to drive healthy results for the remainder of the year and into 2022.”

Financial Results

(1) Non-GAAP financial measures, including FFO, Core FFO and NOI, are defined in the Glossary in the supplemental financial information and, where appropriate, reconciliations of these measures and other non-GAAP financial measures to their most directly comparable GAAP measures are included in the Schedules to this press release and in the supplemental financial information

Net income increased $19.3 million for the third quarter of 2021 and $49.1 million for the nine months ended September 30, 2021 (“year-to-date”) as compared to the same periods in 2020. These increases resulted primarily from additional NOI generated from the 152 self storage properties acquired between October 1, 2020 and September 30, 2021 and same store NOI growth, partially offset by increases in depreciation and amortization.

The increases in FFO and Core FFO for the third quarter of 2021 and year-to-date were primarily the result of incremental NOI from properties acquired between October 1, 2020 and September 30, 2021 and same store NOI growth, partially offset by increases in subordinated performance unit distributions.

Read Full Report Here