REITs and UPREITs Real Estate Investment Trusts (REITs) are investment vehicles that own, operate, and manage a diversified portfolio of real estate assets. They offer public investors a way to participate in the real estate market without directly owning property. Most investors are familiar with REITs that are listed on the public market. Publicly-traded REITs are highly correlated with the stock market and are subject to market volatility. Umbrella Partnership REITs (UPREITs) are a variation of the REIT model structure that involves an operating partnership (the “Umbrella Partnership”) in which…

Category: Resources

StorTrack’s Self-Storage U.S. Pricing Trends Update: January 2025

Self-storage pricing is undergoing a transformation as operators navigate shifting economic conditions, consumer behavior, and competitive pressures. While the industry has long been considered recession-resistant, the latest data reveals a more nuanced landscape – one where supply expansion, evolving pricing models, and strategic revenue management are shaping the road ahead. With more than 66,000 facilities covering 2.6 billion net rentable square feet (NRSF) and an additional 4,000 projects in the pipeline, the sector is adapting to new challenges that could redefine pricing strategies in the…

The Smart Entry and Facility Automation Experts at Janus International Group Announce an All-New, Hardwired Nokē™ Smart Lock

Janus International Group, Inc (NYSE: JBI) (“Janus” or the “Company”), a leading provider of cutting-edge access control technologies and building product solutions for self storage and other commercial and industrial sectors, today announced the addition of Nokē Contact, an on door, contact charged, hardwired smart locking solution, into their award-winning line of Nokē Smart Entry products. In addition to the all-new, hardwired smart locking solution, Nokē Contact, Janus’s Nokē Smart Entry platform also offers a high-tech, battery-powered external smart locking solution, known as Nokē ONE. Nokē Contact is an easily…

2022 Closing Highlights

Closings from the National Self-Storage Advisory Group of Cushman & Wakefield: Portfolio: Tuck It Away Storage (REIT Managed) Three-Property Portfolio Sale Date: July 2022 Location: New York, NY Square Footage: 154,592 Unit Count: 3,665 Portfolio: CubeSmart Palm City Two-Property Portfolio Sale Date: April 2022 Location: Palm City, FL Square Footage: 24,131 Property: San Antonio, TX Self Storage Sale Date: June 2022 Location: San Antonio, TX Square Footage: 91,909 Unit Count: 1,086 Acreage: 2.0 Year Built: 2020 Overall National Self-Storage Advisory Group of Cushman & Wakefield highlights: Over $1.8 billion in…

Cyber Security Measures You Need to Implement Now

By Shane Carlson, Technology Manager When was the last time you evaluated your cyber security measures? Cyber security entails so much more than just having anti-virus software on your computer – it requires knowledge and attentiveness. The tools are important and you need reputable and reliable cybersecurity programs and software, but it is just as important to educate yourself and your team on what you should and should not do. Cyber Security Practices To Implement Encrypt your emails. Are we sending sensitive information such as bank information through emails? If…

Why User Engagement Is the New Key to Your Website’s Success

Do you know how many people come to your website every day? Or how many go on to make a reservation or become a lead? If you have set up Google Analytics on your website, you may already have these answers and you can also see how well your website is performing over time. However, Google is retiring their existing version of Google Analytics, in favor of Google Analytics 4 (GA4), on July 1, 2023. This change will have little to no impact on how your customers interact with your…

Growth Momentum for JLL’s Valuation Advisory Group Continues

JLL’s Valuation Advisory group announced today that it has expanded its team in Seattle, Washington, with five new hires: Aaron DeCollibus, MAI, Executive Vice President; Keith Lee, MAI, Executive Vice President; Andrew Chapman, Senior Vice President, Derek Mason, MAI, Senior Vice President and Jimmy Ryerson, Associate. The Seattle team will be responsible for driving growth, enhancing the customer experience and providing value to clients in the Pacific Northwest and the entire West Coast region across several in-demand property types including multi-housing, industrial, manufacturing housing, self storage and office. “One of…

RVParkIQ.com Introduces Listing and Data Platform to Serve RV Park and Campground Investment Community

RVParkIQ.com, the premier platform for listing and evaluating RV park and campground investment opportunities, has officially launched with 214 listings and market data on more than 11,100 properties to serve the growing RV park and campground property acquisition community in the US. RVParkIQ.com will be a part of Aggregate Intelligence’s market data division along with List Self Storage (ListSelfStorage.com), which connects buyers and sellers of self storage facilities, development land and conversion opportunities, and StorTrack, the world’s leading self storage market data provider. The RVParkIQ.com platform will offer investors access…

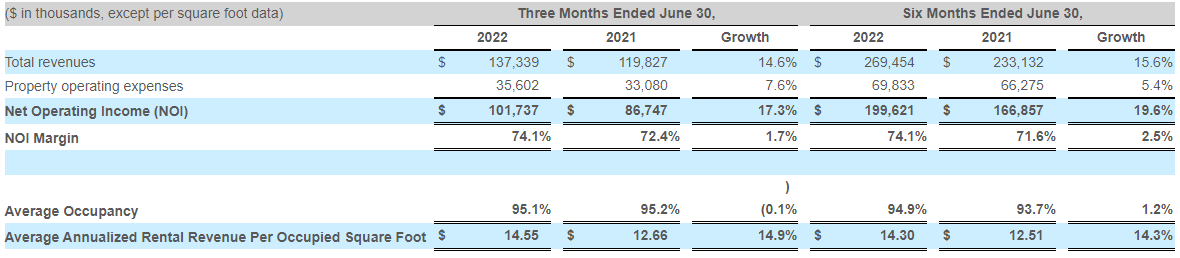

National Storage Affiliates Trust Reports Second Quarter 2022 Results

National Storage Affiliates Trust (NYSE: NSA) today reported the company’s second quarter 2022 results. Second Quarter 2022 Highlights Reported net income of $48.4 million for the second quarter of 2022, an increase of 35.7% compared to the second quarter of 2021. Reported diluted earnings per share of $0.24 for the second quarter of 2022 compared to $0.25 for the second quarter of 2021. Reported core funds from operations (“Core FFO”) of $91.6 million, or $0.71 per share for the second quarter of 2022, an increase of 29.1% per share compared…

Leveraging Security Technology to Enhance the Customer Experience: Part One

Customer experience is currently one of the most popular topics in self storage, so it’s no surprise that facilities are facing increased expectations to differentiate themselves. In a recent study conducted by Deloitte, companies that considered themselves customer-centric were 60% more profitable than companies that were not focused on the customer. As facilities continue to focus more on acquiring new business through an improved customer experience, owners and operators need to adapt quickly to keep up to avoid losing potential revenue. In this three-part series, we will explore the opportunities…