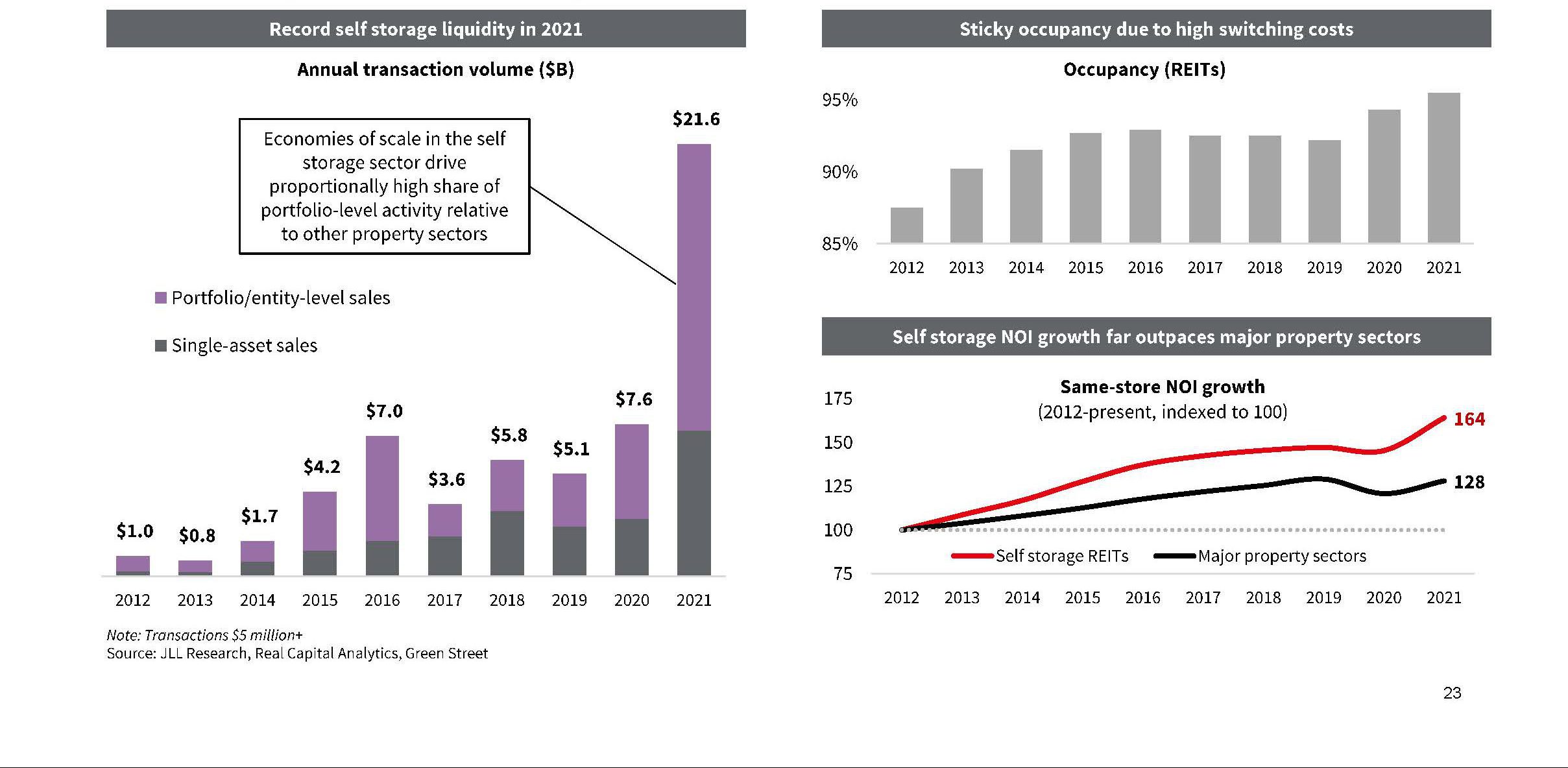

Exceptionally strong fundamentals are driving a flood of capital to self storage. The sector is considered an inflation hedge and the development pipeline has been hampered in the near-term by supply chain constraints.

2021 was a banner year for the self storage sector and, in particular, for the public REITs that posted an average of over 17% same-store NOI growth, far surpassing other sectors. Hence, it was not a surprise that the REITs generated 78% total shareholder returns in the year, ranking among the top of the REIT sub-sector in terms of performance.”

Fears of new supply dragging fown rents were set aside at the onset of COVID-19 as pandemic-related impacts (business closures, remote work, surging home sales and relocations) drove self storage demand, leading to record rent and occupancy gains in 2020 and 2021 for the sector.

Migration patterns have driven outerperformance in non-coastal markets however coastal market fundamentals have been butressed over the past 18 months by barriers to new supply.

Short lease durations and strong pricing power on the part of operators given record high occupany position the self storage sector as an attracticve destination for capital in search of an inflation hedge.

“2021 was a banner year for the self storage sector and, in particular, for the public REITs that posted an average of over 17% same-store NOI growth, far surpassing other sectors. Hence, it was not a surprise that the REITs generated 78% total shareholder returns in the year, ranking among the top of the REIT sub-sector in terms of performance”, noted Managing Director Sheheryar Hafeez.

“2022 looks incredibly strong as well from our vantage point with continuation of strong fundamentals driven by a number of factors in play that have been in existence over the last few years. Namely, the ever-increasing household formation, enhanced mobility among the U.S. population, relatively muted supply given COVID-19 related challenges, among others, have created an attractive environment for existing owners and operators in the space. Couple the strong performance with a large number of new investors actively exploring entry into the space, we expect to continue to see favorable trends in self storage transaction market dynamics over 2022” he continued.

Read the full report here.