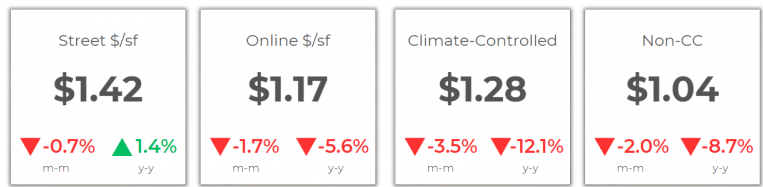

The U.S. self-storage industry, with over 65,000 facilities, remains stable but has seen a pricing decline over the past year. While some markets face oversupply, states like Florida and Arizona are growing due to population increases and the shift to remote work. Notably, the gap between street and online rates has widened by 8%, with online rates dropping 5.6% and street rates rising 1.4%. This trend reflects operators offering aggressive online discounts to attract digital customers while maintaining higher street rates to balance revenue. Dynamic pricing and online marketing are key strategies in response to new supply and changing consumer behaviors.

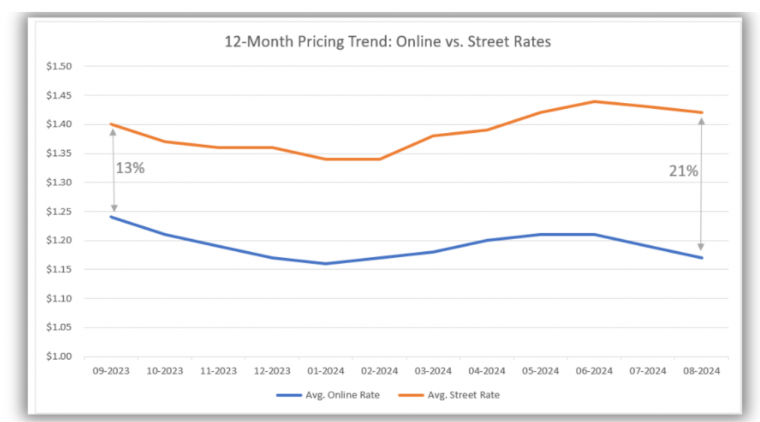

12-Month Pricing Trend: Online vs. Street Rates

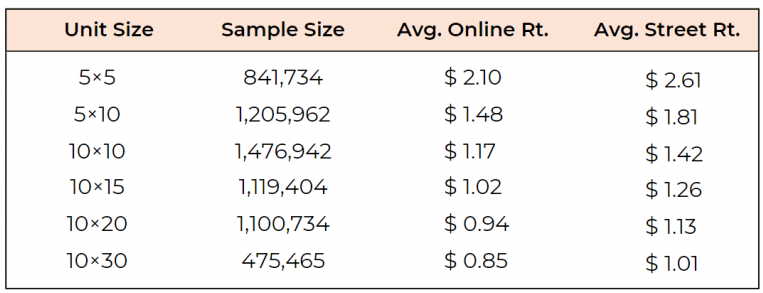

Drawing from a sample of over 6 million units across six popular unit sizes, StorTrack data reveals that street rates on average, are 22% higher than their online counterparts, representing a 9% increase in the pricing gap compared to last year. Over the past 12 months, street rates increased by around 1%, while online rates fell by 7%, with the 5×5 unit experiencing the largest decline at 11%.

Smaller units, such as the 5×5 and 5×10, show the widest price gaps at 24% and 22%, respectively. This suggests a heavy reliance on online discounts to attract customers to these sizes, likely because smaller units are more often used for short-term storage, where price-sensitive consumers are more likely to shop for online deals. Additionally, increased competition in the market may be pushing operators to price smaller units more aggressively online to quickly fill available inventory.

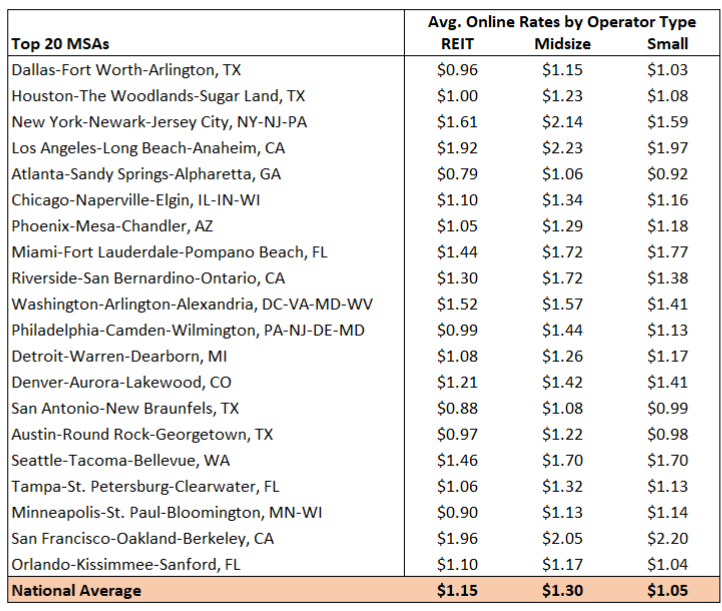

In the top 20 metropolitan statistical areas (MSAs), which represent 35% of the nation’s 2.8 billion square feet of self-storage space, significant pricing trends reveal a growing gap between online and street rates. On a national level, online rates for a standard 10×10 unit average $1.17 per square foot, while street rates average $1.42 – a 21% difference that has expanded by 8% over the past year. This shift reflects increased competition and the use of online discounts to attract price-sensitive, digital-first customers. Read more about trends across these MSAs

Continue Reading the Full Report on StorTrack.com