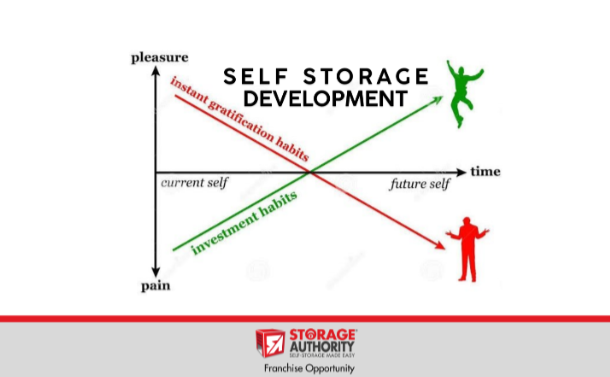

Self-storage development has emerged as a compelling opportunity in the real estate market, offering steady returns and economic resilience. However, success in this sector often requires embracing the principle of delayed gratification – the ability to forgo immediate rewards for greater long-term benefits.

The delayed gratification comes in the form of appreciation, depreciation, cash flow, and the ability to use amortization, which provides several key advantages:

- Equity growth: In an example of a $10M new development, your initial $1.5 million (15% down) investment using a SBA loan could grow to $6.5 million in equity once stabilized, and continue to grow year over year

- Cash flow: A stabilized facility of this size can often produce a six-figure annual residual net cash flow. This cash flow tends to increase over time as you raise rents and optimize operations

- Refinancing opportunity: Once stabilized, you can potentially refinance at a lower interest rate, which would further boost your cash flow and return on investment

- Tax benefits: Self-storage facilities offer significant depreciation deductions, which can shelter a large portion of your income from taxes. The combination of appreciation (which is not taxed until sale) and depreciation creates a powerful tax-advantaged investment

- Amortization: As your tenants essentially pay down your mortgage over time, you build additional equity.

The power of delayed gratification really comes into play here. While it may take 3-5 years to find land, go through approvals & development, and stabilize the facility, the long-term benefits can be substantial:

- Compounding growth of both equity and cash flow over time

- Ability to leverage your growing equity to acquire or develop additional facilities

- Potential for a large windfall if you eventually sell the appreciated asset

Let’s run through a quick example while taking advantage of SBA loan products for a self-storage development project, using the $10 million development cost example we discussed earlier. We’ll compare the SBA 504 loan with a traditional lending scenario for a self-storage asset.

Scenario: $10 Million Self-Storage Development

SBA 504 Loan Structure:

- Total Project Cost: $10,000,000

- Down Payment (15%): $1,500,000

- Bank Loan (50%): $5,000,000 CDC/SBA

- Loan (35%): $3,500,000

Traditional Lending Structure:

- Total Project Cost: $10,000,000

- Down Payment (35%): $3,500,000

- Bank Loan (65%): $6,500,000

Advantages of SBA 504 for Self-Storage Development

- Lower Initial Capital Outlay With the SBA 504 loan, you’re only putting down $1,500,000 instead of $3,500,000. This $2 million difference can be crucial for: Covering unexpected construction costs Marketing and lease-up expenses Maintaining a cash reserve for the first few years of operation

- Increased Leverage and ROI Potential Assuming the stabilized value reaches $15 million (50% appreciation):

-

- SBA 504: Initial investment: $1,500,000

- Equity after stabilization: $6,500,000

- ROI: 333% (($6,500,000 – $1,500,000) / $1,500,000)

- Traditional Lending: Initial investment: $3,500,000

- Equity after stabilization: $8,500,000

- ROI: 143% (($8,500,000 – $3,500,000) / $3,500,000)

- Longer Repayment Terms SBA 504 loans offer terms up to 25 years for real estate, compared to often shorter terms with traditional lending.

- Enhanced Depreciation Benefits With a larger loan amount, you have a higher depreciable basis, potentially leading to greater tax benefits in the early years of the project.

In conclusion, using the SBA 504 loan for a self-storage development project can significantly enhance your return on investment, improve cash flow during the critical lease-up phase, and allow for faster portfolio growth. While it requires patience during the development and stabilization period, the long-term benefits in terms of equity growth, cash flow, and tax advantages make it an extremely attractive option for self-storage investors willing to embrace delayed gratification.

For investors with the patience and capital to weather the development and lease-up period, self storage development can offer returns that are indeed hard to beat in many other real estate sectors. The combination of appreciation, stable cash flow, tax advantages, and the ability to add value through operational improvements makes it an attractive option for those willing to embrace delayed gratification.

Storage Authority Franchising is all about owning your own local self-storage business, supported by professional systems and expertise. We like to say, ‘You’re in business for yourself but not by yourself.” If self-storage is on your mind, don’t hesitate to reach out to me, Garrett Byrd at Direct: 941-928-1354 or Garrett@StorageAuthority.com to learn more about the Storage Authority Franchise opportunity. If you would like to learn more and start your journey to self-storage ownership click the link here: http://www.storageauthorityfranchise.com/opportunity2

Contact:

Garrett Byrd

Storage Authority Franchise

941-928-1354

Garrett@StorageAuthority.com