While the last few years have been challenging for the self-storage industry, one of the most positive and productive results of the volatile economy and lower street rents is that it has forced operators to take a hard look at their management platforms, operating procedures, expenses, unit pricing, and how their properties compete within their respective submarkets. We have all learned to survive with lower revenue and NOI growth. Today, we are starting to see signs that self-storage fundamentals are bottoming.

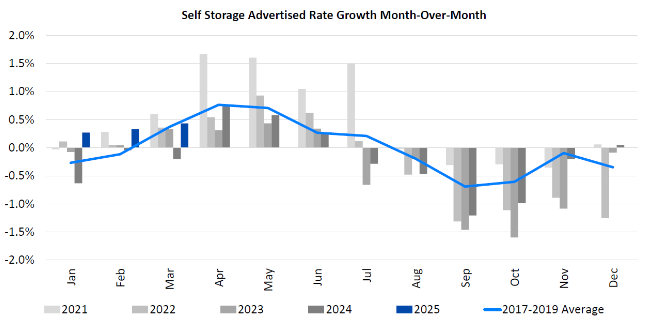

External source reports that advertised rental rates are nearly flat, down just 0.2% in March 2025, and have improved month-over-month throughout 2025, led by Extra Space and Public Storage. Climate-controlled unit rate growth outpaced non-climate-controlled units for the last two months, marking the first time this has occurred since 2021. Owners and operators are looking for a turnaround in the housing market to help boost demand, but that is unlikely in 2025, given still-elevated interest rates. However, a declining new supply pipeline should provide a boost over the next few years, especially in the second half of 2025 and into 2026.

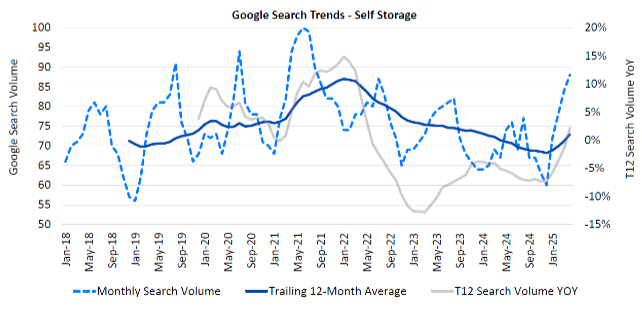

As street rates continue to moderate nationwide, we should see an uptick in demand and occupancy across the board as we head into rental season. In the meantime, savvy operators have been able to combat softer fundamentals with existing customer rate increases and unit pricing strategies to preserve occupancy. It is probably time to scale back existing customer rate increases as demand starts to pick back up. With Google searches for self-storage bottoming in December 2024, we have seen demand for storage searches increasing steadily every month in 2025. We are all hopeful that this leasing season will be better than the past few years.

Many self-storage customers are considered “sticky”, meaning raising existing customer rents above street rates often does not have a major impact on occupancy. However, we all know this trend cannot last forever. The industry is currently experiencing negative churn (high-paying customers being replaced by lower-paying customers). As indicated in the chart below, it appears that advertised rental rates have started to increase in 2025. This, along with slowing existing customer rate increases, should leave all of us in a better position to capitalize on this summer’s rental season.

While we are all optimistic that a strong leasing season is right around the corner, concerns remain. Continued slowdowns in home sales, elevated interest rates, and shrinking consumer savings accounts could lead to a less-than-stellar leasing season. We know that customer movement creates storage demand, and if fewer people move this year, it could dampen leasing activity. However, the silver lining is that more people are searching for storage today, street rates are improving, and we are hopefully past the bottom regarding self-storage demand and declining unit pricing.

With more than 50% of self-storage customers below the age of 45, we know that life events like growing families, home remodels, and other changes will continue to drive storage demand. Remember, self-storage is a need-based product! Ultimately, we are seeing dramatic shifts in how customers are shopping for and comparing self-storage properties. Sophisticated self-storage owners and operators are executing online marketing strategies and revenue management techniques to drive customers from greater distances, achieve higher revenues, and reduce operating expenses, protecting and driving their property’s value higher.

As we head into rental season, storage operators should be mindful of slowing existing customer rate increases and paying close attention to sub-market competitors’ rental rates—you don’t want to be the last one to adjust and miss out on the first strong rental season in several years.

Contact your local Argus broker today to receive a FREE rental rate survey of your sub-market to help you get started!