Raintree & Pima Self Storage Partners LLC, an affiliate of 1784 Capital Holdings, has landed a $20 million loan for Raintree Life Storage, a self storage facility currently under construction in Scottsdale, Ariz. Principal & Head of Originations Felix Gutnikov of Thorofare Capital has secured a 1.5-year floating-rate, non-recourse loan with two, six-month extension options for the construction and completion of the property. Scheduled for delivery in September 2022, the two-story facility is rising on a 2.3-acre site. Plans call for 944 climate-controlled units totaling 81,435 net rentable square feet.…

Author: Alison DeJaeger

Marcus & Millichap Capital Corp. Arranges $5.8M Loan for Self Storage Portfolio in West Virginia

Marcus & Millichap Capital Corp. (MMCC) has arranged a $5.8 million loan for a four-property self storage portfolio in West Virginia. The properties span 770 units and are located at 21 Crawford Quarry Road, 1820 Broad Lane and 9724 Williamsport Pike in Falling Waters, as well as 73 Roaring Lion Drive in Hedgesville. Jared Cassidy of MMCC’s Bethesda, Md., office arranged the 10-year loan on behalf of the borrower, a private self storage operator, through an unnamed balance sheet lender. The loan was underwritten with a fixed interest rate of…

Recent Closings: 6.06.2022 – 6.13.2022

Portfolio: KO Storage of Billings Three-Property Portfolio Location: Billings, MT Brokers and Brokerage: Nathan Coe, Brett Hatcher and Gabriel Coe of the Hatcher-Coe Group of Marcus & Millichap NRSF: 186,520 Unit Count: 147 Climate Controlled and 746 Non-Climate Controlled Highlights: Multiple Offers at and Above List Price Great Visibility at Each Location Growing Surrounding Populations at all Three Locations Affluent Market at 6nd Location – Average Household Income within One, Three and Five Miles Is Well Above the National Average Portfolio: Carroll County Storage Portfolio Locations: McKenzie and Huntingdon, TN…

Featured Broker: Spencer Molnar

Spencer is an experienced associate providing research based and data driven investment solutions to buyers and sellers throughout the self storage industry. Prior to joining the Storage Exchange team, he worked as an advisor for LevRose Commercial Real Estate, specializing in sales and leasing of office, flex and industrial assets throughout the Scottsdale and greater Phoenix markets. Spencer attended Arizona State University where he earned a BS in sports journalism with an emphasis on marketing management and strategic communications. Contact Spencer at spencer@storageexchange.com

SmartStop Self Storage REIT, Inc. Closes Acquisition of Strategic Storage Growth Trust II, Inc. in Stock-for-Stock Transaction

SmartStop Self Storage REIT, Inc., a self-managed and fully-integrated self storage company, and Strategic Storage Growth Trust II, Inc. (SSGT II), a private REIT sponsored by an indirect subsidiary of SmartStop, announced today that the companies have closed their previously announced merger, in which SSGT II will merge into a newly-formed subsidiary of SmartStop in a stock-for-stock transaction that values SSGT II’s real estate portfolio at approximately $280 million. The combined companies will have a portfolio of 152 wholly-owned operating properties, representing approximately 11.7 million net rentable square feet and…

ULLICO Lends $69 Million Loan on NYC, NJ Self Storage Portfolio Buy

Alan Mruvka’s StorageBlue has landed $69 million of first-mortgage financing for its purchase of a three-asset self storage portfolio in the New York City metropolitan region. Union Labor Life Insurance Company (ULLICO) supplied the first-mortgage loan for Mruvka’s acquisition of three self storage properties in New Jersey and Staten Island from American Self Storage. Herb Kolben and Kevin Smith of ULLICO spearheaded the deal. Solaris Capital also provided $14.3 million in preferred equity in a transaction overseen by Anthony Manno. Neptune Capital Partners also kicked in $13 million of additional…

Recent Closings: 5.31.2022 – 6.06.2022

Property: Value Store It Self Storage Location: Worcester, MA Brokers and Brokerage: Nathan Coe, Brett Hatcher, Luke Dawley and Gabriel Coe of the Hatcher-Coe Group of Marcus & Millichap NRSF: 30,393 Unit Count: 440 Highlights: Recently Renovated Self Storage Facility Seller Added 140 Units in Early 2021 Nearly Doubling the NRSF Recent Capital Improvements: Painted Entire Interior, Replaced the Roof, Repaved Parking Lot, Added Keypad Access and Doubled the Number of Security Cameras Worcester Is New England’s Fastest Growing City and Home to Eight Colleges Undersaturated Self Storage Market High…

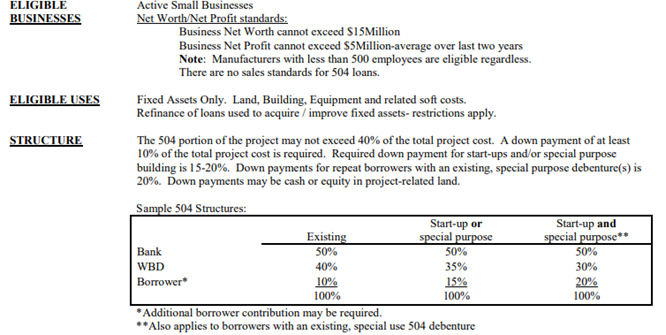

504 Loan Structuring

With the current rising interest rate environment, now is a good time to lock in debt for as long as possible. One option is the SBA 504 program where anywhere from 35-40% of the loan package has a 25-year fixed rate. The maximum amount from the CDC/SBA 25-year rate is $5 million (unless you pursue the “Green” program when it would become $5.5 million). The bank who holds onto the first mortgage can go up as high as they are comfortable with allowing borrowers to receive loans in the $15-$20…

Augusta Considers New Use for Former Kmart Building as Demand for Self Storage Rises

An increasing demand for places to stow personal items and equipment is driving a proposal to convert the vacant former Kmart building, and its parking lot, on Western Avenue into self storage space. The effort is part of a larger trend of repurposing large box stores that were driven out of business into storage facilities. I appreciate the concept, I think repurposing these types of large box retail spaces — since retail is being done differently these days, thank you Amazon — is something that needs to be done.” Several…

First Quarter Results for Absolute Storage Management

Absolute Storage Management (Absolute), a leading third-party management company for self-storage facilities in the United States, announced operating results for the three months ended March 31, 2022. 2022 Highlights for Three Months Ended March 31, 2022: Increased same-store revenue by 18.3% vs. the same period in 2021. Maintained Square Ft. and Unit Occupancy vs. the same period in 2021. Ended the period with 21% increase in GPI vs. the same period in 2021. Acquired nine (9) management contracts: four (4) operating facility and five (5) facilities at the completion of…