Many self-storage facilities hit a “middle plateau” after lease-up, with occupancy stalling between 60–80%. My Space Self Storage was facing this common challenge—occupancy had stabilized in the low 80s, but there was still meaningful room for growth. To push past this plateau and unlock the facility’s full earning potential, the owners began looking for a management partner with proven expertise in marketing, lead generation, and revenue optimization. White Label Storage was selected in October 2024 to take over management. With more than 650 units at the property, the objective was…

Category: Featured Home Slider

A New Self-Storage Facility Opens in Red Lion, PA

A newly constructed self-storage facility in Red Lion was announced Monday by Investment Real Estate LLC (IRE). The property at 905 Belle Road features 701 units and totals 85,350 square feet of rentable storage space housed in four buildings. The facility includes 321 climate-controlled units, 58 of those being drive-up, and 374 non-climate-controlled units, with 68 being drive-up. All units are indoor. “The addition of the Belle Road facility exemplifies our focus on delivering modern storage solutions in high-demand markets,” Tom Kilko, director of development and construction for IRE, said…

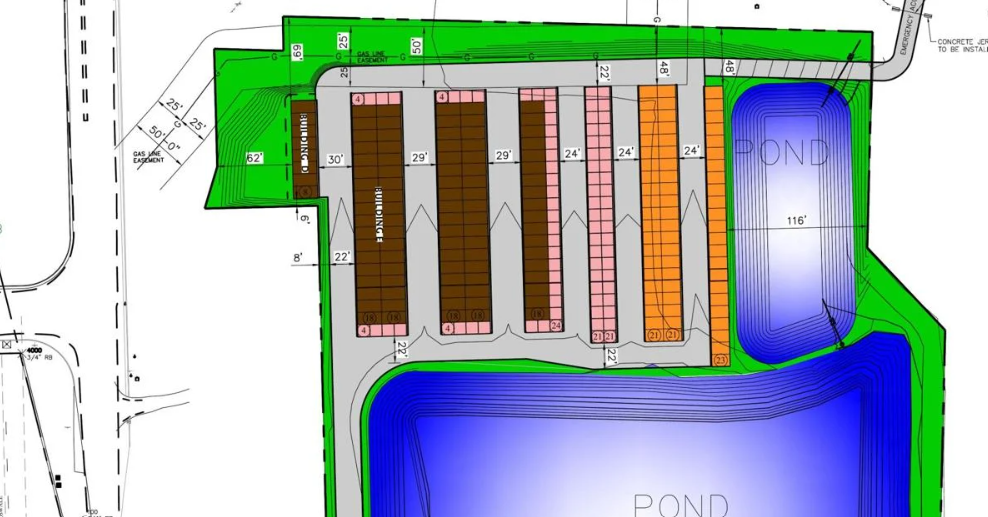

Proposed Self-Storage Facility on College Highway to Restart Permitting Process in Southwick, MA

When the Planning Board meets again, it will hold a public hearing to restart the permitting process for a proposed self-storage facility on College Highway after the developers withdrew their first request once it became clear it had little chance of being approved. The new application for the permit, sought by Southampton-based developers Jim and Ellen Boyle, offers the board a proposal that is a significant departure from its first site plan, which asked for permission to build a nearly 60,000-square-foot, two-story facility between O’Reilly’s Auto Parts and Pioneer Valley…

Brookwood Properties Opens New Self-Storage Facility in Huntsville, AL

Brookwood Properties has opened its latest self-storage facility at 3910 Cypressbrook Drive NW, in Huntsville, Ala. The 850-unit property operates under the Storage Center brand. Rosehill Construction served as the general contractor for the development. Brookwood Properties’ portfolio currently comprises 50 self-storage facilities—41 in Louisiana, three in Texas, three in Mississippi and one in Arkansas—amounting to 42,000 units across 5 million square feet. The 106,600-square-foot, three-story facility features climate-controlled units ranging from 25 to 300 square feet. Amenities include 24-hour video surveillance, covered loading bays designated for moving vans and box trucks,…

Increasing The Value of Your Self Storage Asset – Tips on improving your property’s value

Whether you are thinking of selling, refinancing, or just want to optimize the income your property generates, here are a few tips I’ve learned from the 18 years helping owners sell their self-storage facilities. There are many, many ways a self-storage owner (or operator) can improve their bottom line, and I’m sure I’ve left out a few ideas that others have uncovered. OPTIMIZE RENTAL INCOME – The most obvious way to increase the net operating income of your self-storage facility is by increasing the monthly rental collections. But how? The…

SBA SOP Rule Changes for SBA 7A Program

The SBA recently released their changes to their SOP rulebook that will go into effect June 1, 2025. Below is a summary of impactful changes. Franchise Directory is returning. Franchises will be required to be listed in the directory. If a borrower operates under more than one franchise agreement, all franchises must be listed on the directory, not just the critical ones Need 100% ownership, including indirect ownership of the business, to include SSN, address, % owned, and DOB. All must be citizens or LPRs and primarily reside in the…

Planning Commission OKs Self-Storage Site Despite Environmental Objections in Long Beach, CA

The Long Beach Planning Commission on Thursday approved the environmental review of a new self-storage warehouse wedged between the Los Cerritos neighborhood and the Los Angeles River, despite objections from residents and activists over potential consequences to the surrounding environment. Commissioners voted to recommend the project, a 44-foot-tall, 206,756-square-foot self-storage facility with office space, private car wash and RV parking lot. The project will next come before the Long Beach City Council at a later date. It would replace a 14-acre blighted industrial site, formerly used as a golf range…

Planning Commission OK’s Self-Storage Plan for a Self-Storage Facility Near Rice Lake, WI

Menards obtained approval of its operational plan for a new self-storage facility on the south side of Rice Lake near its retail store, but the Plan Commission had a few contingencies. For a couple of years, Menards has sought to build a self-storage facility on the southeast corner of Wisconsin Avenue and Highway O. Plans call for the construction of 245 non-climate-controlled units of various sizes from 10-by-10 feet to 10-by-20 feet. The self-storage units will be considered an extension of the nearby store, and local staff will be in…

TFE-Owned Self-Storage Property Transitions to Cubesmart in Lakewood, NJ

TFE Properties has expanded its partnership with CubeSmart, tapping the self-storage operator to manage an 820-unit facility near Route 70 in Lakewood. According to TFE, the complex at 925 New Hampshire Ave. is a former EZ Self Storage location that transitioned to CubeSmart in early April. The landlord now hopes to reap the benefits, noting that the 95,000-square-foot facility has been in its portfolio since 2001 and features computerized gate access and climate-controlled, ground-level and oversized units. TFE added that the building’s proximity to Route 70 and to new and…

Go Store It to Launch REIT, Offering Flexibility for Self Storage Investors and Owners

Go Store It Self Storage plans to launch a real estate investment trust (REIT) in mid-2025, consolidating a large share of its portfolio under one entity in a move designed to streamline operations, simplify investor structure and enhance access to capital. The REIT will replace Go Store It’s current tenancy-in-common (TIC) model, offering existing TIC investors a tax-deferred rollover option. The new structure will support more efficient fundraising, improve portfolio-level financing and better position the platform for future transactions, including the possibility of a public listing or portfolio sale. Go…