Gantry has secured a total of $31.76 million of permanent loans to refinance three separately owned California self-storage facilities since the start of 2025, including two Bay Area properties. The most recent loan provided $9.76 million in May to refinance an 829-unit facility managed by ExtraSpace located at 224 N A St in Lompoc, a Central Coast community in Santa Barbara County. The second loan provided $10 million in April to refinance the 654-unit StoreLocal Oakley facility located at 4700 Main St. in Oakley, an eastern Bay Area suburb in…

Category: Featured Home Slider

Navigating Price Sensitivity Without Compromising Value in Self Storage

In today’s economy, price sensitivity is at an all-time high, and the self-storage industry is feeling the squeeze. With consumers scrutinizing every dollar, self-storage providers must walk a fine line between staying competitive and maintaining value. Grace Totty, VP of Marketing and Sales at Absolute Storage Management, offers a roadmap for doing just that in her presentation, “Navigating Price Sensitivity Without Compromising Value.” The shifting economic landscape has created a new kind of consumer: one who is more informed, more cautious, and more demanding. According to Totty, although the core…

Lockhart Storage Centers Select White Label Storage as Management Partner

White Label Storage has added six Lockhart Storage Centers facilities to its portfolio, further expanding its footprint in the Southeast and reinforcing its position as one of the fastest growing third-party management companies in the industry. “We’re proud to expand our relationship with Lockhart Storage Centers,” said Jennifer Barroqueiro, Vice President of Operations at White Label Storage. “Following the strong performance at Davenport, Lockhart entrusted us with the management of their additional Class A facilities in Florida, and we’ve already hit the ground running.” White Label Storage initially launched management…

Featured Brokers: Matthew Cox and Cole Carosella

Mr. Cox joined Argus Self Storage Advisors in November 2021 and is currently the Director – Valuation & Budgeting. He has been instrumental in elevating the firm’s financial and operational performance within the self-storage industry. With a robust background in development, acquisition, and brokerage, he has underwritten over 3,000 deals across the United States and now oversees financial reporting, revenue management, and underwriting for the national brokerage network at Argus. Prior to joining Argus, he contributed to the development of over $300M in class A self-storage facilities across the Western…

West Coast Self-Storage Group Manages West Coast Self-Storage in Pullman, WA

West Coast Self-Storage Group, a leading self-storage property management company, is pleased to announce that it has begun managing West Coast Self-Storage Pullman, formerly known as Express Storage-Pullman. This addition strengthens West Coast Self-Storage’s presence in Eastern Washington and reflects its ongoing mission to provide high-quality, secure, and convenient storage solutions across the region. Located at 6862 WA-270 in Pullman, WA, just minutes from Washington State University and the Sunshine and Whitlow communities, West Coast Self-Storage Pullman features 99 storage units comprising 44,376 rentable square feet. The facility offers a…

A New Self-Storage Facility Breaks-Ground in Fort Pierce, FL

If you’ve been wondering what’s being built next to Aldi on U.S. 1 in Fort Pierce near Ohio Avenue, you’re not alone. Significant groundwork has taken place in recent weeks on the property at 1300 S. U.S. 1, near the tall nets for the driving range for Indian Hills Golf Course. It turns out the 1.38-acre lot is the future home to a four-story, climate-controlled, self-storage facility with 178 storage units and 23 parking spots, according to a site plan for the project approved by the city. The main 106,830-square-foot…

Spartan Investment Group Opens Self-Storage Facility in Eustis, FL

Spartan Investment Group has opened FreeUp Storage Eustis, a 660-unit self-storage facility located at 36536 S. Fish Camp Road near Lake Eustis in Grand Island, about 47 miles northwest of Orlando. Spartan Construction Management, a general contractor affiliate of the Colorado-based developer, broke ground on the facility in June 2024. FreeUp Storage Eustis features 340 climate-controlled units and 266 non-climate-controlled units across nearly 67,000 rentable square feet. Source

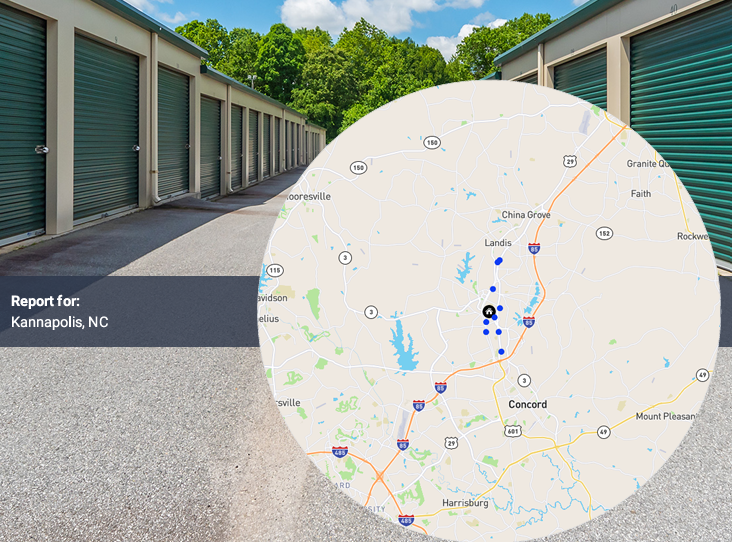

StorTrack Market of the Month: Kannapolis, NC

StorTrack’s featured market this month is Kannapolis, NC. Located just northeast of Charlotte, Kannapolis is one of the fastest-growing cities in the region, with a population increase of over 20% in the last decade. The city is undergoing a major transformation, anchored by the $1.5 billion North Carolina Research Campus, a public-private hub for health, nutrition, and biotech research. How is Kannapolis as a self-storage market, and is it a good place to consider investing in? We’ve used StorTrack’s Explorer platform to look at some metrics to analyze its potential as a self-storage investment. Self…

Navigating Offers: Choosing the Right Path to a Successful Self-Storage Sale

When selling a self-storage facility, the selection of the right offer and buyer is critical. Sellers do not want to waste time in a deal that collapses weeks or months later due to easily avoidable due diligence issues that buyers should have determined on the front end. While a buyer’s initial enthusiasm and speed in submitting an offer might seem appealing, a rushed, high-priced bid isn’t always the most secure option. Experienced brokers and sellers prioritize thoughtful, well-researched offers, even if they take a little longer to materialize. An offer…

How to Be Ready When Natural Disasters Strike Self-Storage

With hurricane season officially less than a month away, it isn’t too soon to begin thinking about what you’d do if disaster struck. In fact, whether you’re facing facility fires or wildfires, floods, mudslides, snowstorms, tornadoes, earthquakes, hurricanes or other disasters, there are steps you can take to prepare and protect your facility before the event and to rapidly restore your facility after the damage is done. Prepare Your Facility. Is your facility built to withstand a disaster? One area that can be beefed up to prepare for the unexpected…