Local owners of Mini-Maxi Storage proudly announce the acquisition of the self-storage facility at 8891 North Florida Avenue, Tampa, FL 33604. This facility, managed by Absolute Storage Management (Absolute), features 373 units totaling 46,435 rentable square feet. It offers safe and secure non-climate unit options to the local communities of Tampa, Lake Magdalene, and Seffner. The Moser Family Partnership LP has contracted with Absolute Storage Management (Absolute) to provide professional self-storage management services, and the facility is officially under Absolute’s management as of June 16, 2025. Residents and businesses in…

Category: Self Storage News

Spacettes Small Business Park Launches Professionally Managed Storage Facility in Tampa, FL

Local owners of Spacettes Small Business Park – Annex proudly announce the acquisition of the self-storage facility at 8891 North Florida Avenue Tampa, Florida 33604. This facility, managed by Absolute Storage Management (Absolute), features 55 units totaling 35,750 rentable square feet. It offers safe and secure commercial space and parking unit options to the local communities of Tampa, Lake Magdalene, and Seffner. The Moser Family Partnership LP has contracted with Absolute Storage Management (Absolute) to provide professional self-storage management services, and the facility is officially under Absolute’s management as of…

Storage Post Self Storage Brings Three New Storage Properties Under its Management in New York, NY

As of July 1, three Sofia Storage properties in Brooklyn and Manhattan are now under the management of Storage Post Self Storage. With Storage Post employees on site, the company is actively working to transition new and existing self-storage customers to Storage Post, as well as activating on future improvements, including: Electronic Entry Codes: Tenants will receive personal access codes to access the facility and the elevators Climate-Controlled Storage: Facilities will be outfitted with heating and air conditioning systems Elevator Upgrades: Employee-led elevator operations will be replaced with automatic elevators…

Invesco Real Estate Income Trust Inc. Fully Subscribes IREX II Self-Storage Portfolio DST Offering

Invesco Real Estate Income Trust Inc. (“INREIT”), an institutionally managed public non-listed REIT, announced it has fully subscribed IREX II Self-Storage Portfolio Delaware Statutory Trust (DST), which raised $85.7 million in aggregate. The IREX II Self-Storage Portfolio DST consists of eight self-storage properties diversified in four states (TN, TX, NC, and OR) and 3,894 total rental units across 463,495 of net rentable square feet. The asset was sourced by Invesco Real Estate Income Trust Inc. (“INREIT”), which has a $945.3M total asset value as of May 31, 2025, diversified by…

Go Store It Adds Heartland Storage Portfolio to Growing Third-Party Management Platform

Go Store It Self Storage, one of the largest and fastest-growing privately held self-storage companies in the United States, has added the Heartland Storage portfolio to its expanding third-party management platform. The move reflects Go Store It’s continued growth in performance-driven property management by delivering operational efficiency, best-in-class customer service and industry-leading technology. Heartland Storage, owned by HAN Capital, includes 40 properties across 10 states. Since acquiring its first facility in 2009, HAN Capital has grown Heartland into a regional storage brand known for value, customer care and long-term stability.…

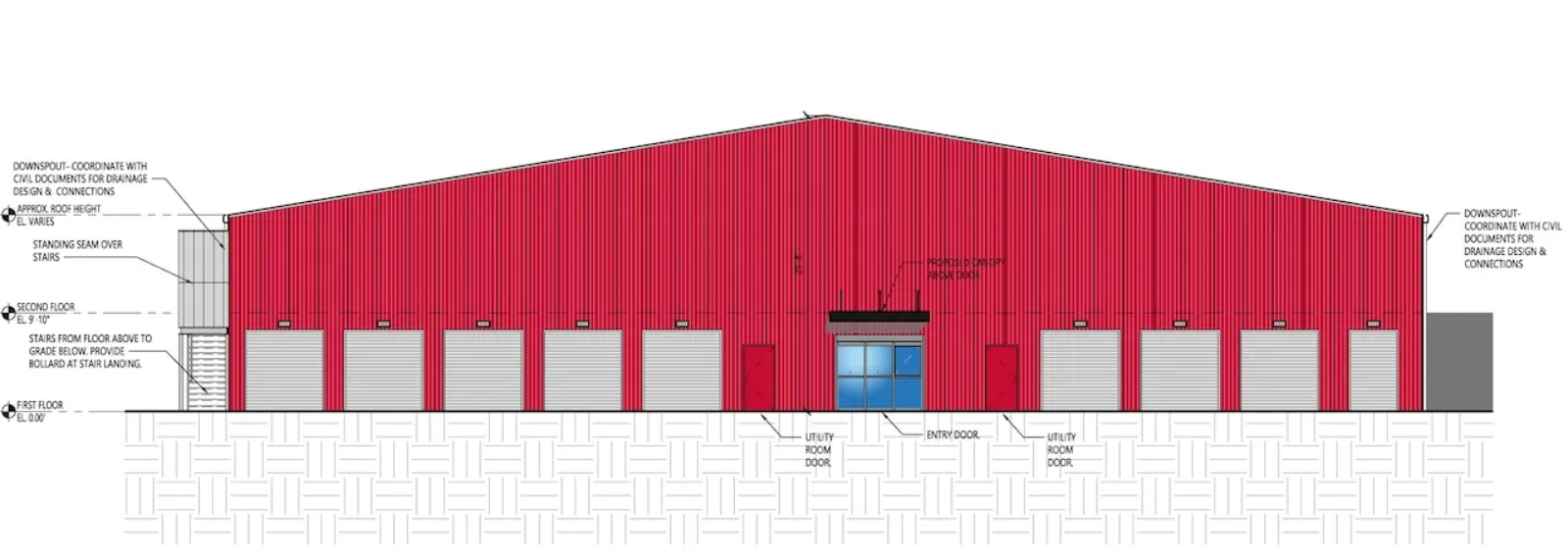

Proposed Self-Storage Facility on College Highway Gets Favorable Response From Planning Board in Southwick, MA

After over two years of fits and starts on a proposal by two Southampton-based developers to build a self-storage facility on College Highway, the project was essentially greenlighted by the Planning Board after a public hearing on the proposal Tuesday night. “This is a great replacement project than what was originally before us,” said Planning Board Chair Jessica Thornton after the facility’s designer, architect, and one of the developers presented its updated plan to build a 34,800-square-foot two-story building between O’Reilly’s Auto Parts and Pioneer Valley Trading Co. on College…

Affinius Capital Originates $33.5 Million Loan to Refinance Storage Portfolio Located Across 7 Markets in Five US States

Affinius Capital LLC announced today the origination of a $33.5 million refinancing loan for a 10 Federal self-storage portfolio, which includes 13 self-storage facilities spanning 3,600 units across five states. Properties in the geographically diversified portfolio are located in Colorado, Georgia, North Carolina, Texas, and Tennessee. The loan will support the portfolio’s ongoing lease-up efforts and operational stabilization. Affinius Capital Senior Vice President Tyler Figley commented, “This transaction represents a compelling opportunity to expand our presence in self-storage, a growing asset class that adds meaningful diversification to our portfolio. We…

6Storage and Calcumate Partner to Enhance Online Rentals for Self-Storage Operators in 25+ Countries

Key messages: 6Storage and Calcumate have concluded a partnership agreement which sees Calcumate deeply integrated into 6Storage, including its brand-new platform, 6Storage 3.0 Orders for the integration are being taken from today, and the integration of Calcumate into 6Storage will be completed in the coming weeks 6Storage, a global self-storage management software provider trusted by operators in over 25 countries, and Calcumate, the world’s leading 3D storage calculator for self-storage and moving providers, today announced a new integration partnership. The collaboration will enable 6Storage users to display Calcumate in an…

Talonvest Secures $17.8 Million in Financing for a Four-Property Self-Storage Portfolio Across Southern California and Arizona

Talonvest Capital, Inc., a boutique commercial real estate mortgage brokerage firm, is pleased to announce the successful closing of a $17,800,000 refinance loan on behalf of Tierra Corporation for a four-property self-storage portfolio located across high-demand markets in Southern California and Arizona. The portfolio includes properties in Riverside, Redlands, and Indio, California, as well as Yuma, Arizona. In total, the facilities span 377,939 net rentable square feet and comprise 2,252 non-climate-controlled drive-up units, 25 climate-controlled units, 4 manager units, and 198 RV parking spaces. The non-recourse, CMBS execution loan was…

Proposed Self-Storage Facility on College Highway to Restart Permitting Process in Southwick, MA

When the Planning Board meets again, it will hold a public hearing to restart the permitting process for a proposed self-storage facility on College Highway after the developers withdrew their first request once it became clear it had little chance of being approved. The new application for the permit, sought by Southampton-based developers Jim and Ellen Boyle, offers the board a proposal that is a significant departure from its first site plan, which asked for permission to build a nearly 60,000-square-foot, two-story facility between O’Reilly’s Auto Parts and Pioneer Valley…