With the Small Business Administration (SBA) 504 loan program, the property only needs to appraise at 90% of the total costs. This buffer can overcome regulatory loan-to-value restrictions for your financial institution.

Consider this case study:

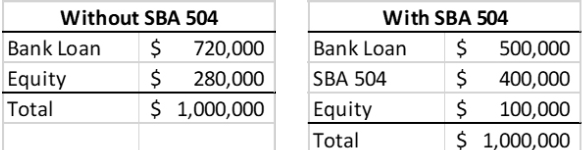

A prospect wants to buy a $1,000,000 building. You propose lending 80%, or $800,000. However, the appraisal comes back at $900,000. Using the 80% LTV limit, your loan would be restricted to $720,000, requiring the prospect to bring an additional $80,000 in cash, potentially killing the deal.

The SBA 504 program allows for a 10% appraisal shortfall without changing the traditional 504 financing structure. Your loan could be reduced to $500,000, with an SBA loan of up to $400,000. The down payment could be as little as $100,000 instead of $200,000. Plus, the effective interest rate on the SBA 504 note is approximately 6.56% fixed for 25 years as of May 2024.

Appraisal shortfall case study comparison with and without SBA 504

Contact:

Nick Collins – VP Commercial Lending

Bank Five Nine

P: 262-560-2016

E: nick.collins@bankfivenine.com