The SBA has introduced important updates to its 504 refinance program, enhancing flexibility and benefits for business owners.

Here’s a brief overview of the changes:

- Expanded Access to Working Capital

Previously, borrowers could take out up to 20% of the appraised collateral value for working capital during a refinance, limited to an 85% loan-to-value (LTV) ratio. The new guidelines eliminate this 20% cap and increase the LTV limit to 90%, providing businesses with more financial options

- Eased Refinancing Restrictions on 7a and 504 Loans

Before, businesses had to demonstrate a 10% reduction in monthly payments to refinance existing 7a and 504 loans. Now, any reduction qualifies, making it easier for businesses to secure better terms

- Refinancing “Other Secured Debt”

Previously limited to “eligible debts” (where at least 75% of proceeds were used for real estate or equipment), businesses can now also refinance “other secured debts” that share collateral with eligible debts, expanding refinancing options.

The impact of these updates, effective November 15, is illustrated in the case study below.

Consider This Case Study:

A self-storage facility faced rate adjustments on a 7a loan used to build its facility 5 years ago.

Additionally, they had a term note for working capital and a fully drawn line of credit. Rising rates have strained their cash flow, prompting them to seek lower monthly payments.

Key Factors:

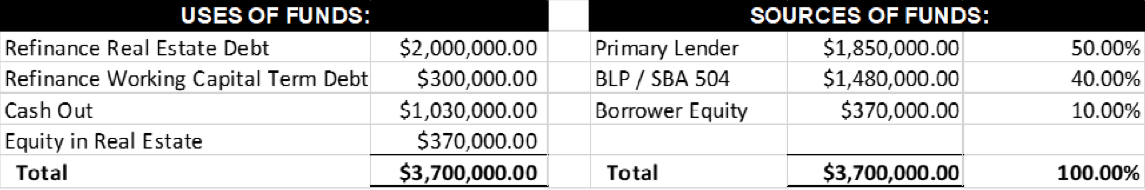

- The firm’s $2 million real estate loan and $300,000 working capital loan qualified for refinancing under the “other secured debt” rule

- With a $3.7 million appraised value, the business was able to cash out enough to pay off a $1 million line of credit while retaining working capital

*Please note the SBA 504 portion has a 25 year fixed rate

Contact:

Nick Collins

Commercial Lender – Vice President at Bank Five Nine

O: (262) 560-2016

M: (262) 468-6169

nick.collins@bankfivenine.com

Source: Bank Five Nine