![]()

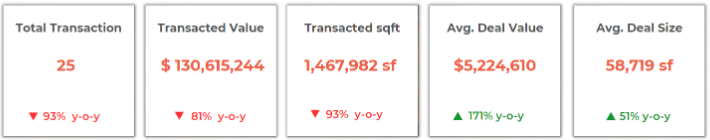

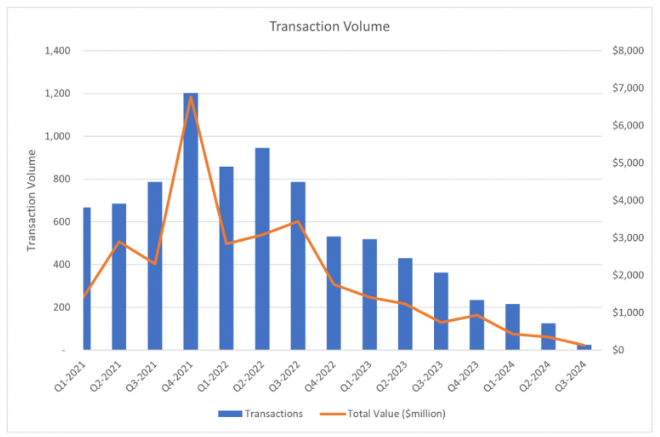

In recent months, investment activity in the self-storage market saw a sharp decline, with just 25 transactions totaling $131 million, a significant drop from the 1,203 deals and $6.77 billion seen in Q4-2021. This downturn, driven by rising interest rates, inflation, and oversupply concerns, has shifted investor focus to larger, high-value properties. By Q3-2024, transaction volume had plummeted by 93% compared to last year. However, the average building size per deal rose by 51%, and the average sale price surged by 171%, indicating more selective investment in high-quality assets.

A closer look at transaction trends among different owner types reveals a similar market pattern: declining transaction volumes, but a focus on larger, higher-value properties in each deal. REITs closed only 9 deals in Q3-2024, a 60% drop in volume, but the average transaction value rose by over 80% to $7.2 million, with the average size per deal increasing by 10% to 73,848 square feet. This pattern was mirrored by multi-operators, highlighting a shift towards fewer but larger and higher-value transactions. For the remainder of 2024, the market is expected to remain cautious, with investors focusing on strategic acquisitions in high-demand areas.

![]()

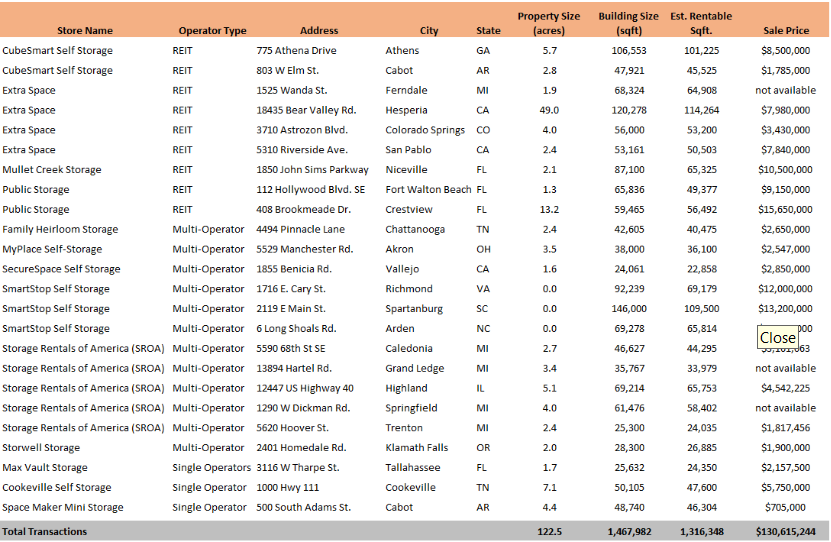

Recent transactions have the potential to reshape a market’s self-storage landscape. Understanding store types and ownership mix within a market is crucial for assessing competitiveness and predicting future pricing trends. The list below highlights where different store types have expanded their presence – whether through direct ownership, third-party management, or branding – shedding light on the market’s overall appeal.

REITs

REITs continue to expand their footprint in markets like Florida, California, and suburban areas near major metros. Their recent focus on properties with more rentable square footage suggests a strategy of long-term, cash-flow-oriented investments.

1. CubeSmart broadened its reach in Athens, GA ($8.5M) and Cabot, AR ($1.78M). The Athens location is in a college town with stable demand, while Cabot is a suburban area experiencing strong population growth and less immediate competition.

2. Extra Space expanded its operations through facilities in Ferndale, MI, Hesperia, CA ($7.98M), Colorado Springs, CO ($3.43M), and San Pablo, CA ($7.84M). The Hesperia acquisition, notable for its 49-acre size, indicates the appeal of suburban markets near metropolitan areas such as Los Angeles. The properties in Colorado Springs and San Pablo further target expanding, economically diverse suburban markets with steady storage demand.

3. Public Storage increased its presence in the Florida market through facilities in Fort Walton Beach ($9.15M) and Crestview ($15.65M). These coastal areas attract high seasonal demand and steady population growth, aligning with Public Storage’s strategy of focusing on high-demand regions.

Read more about transactions for Multi-operators and Single Operators

![]()

The Fed’s recent 50-basis point rate cut is poised to enhance demand for self-storage by stimulating the housing market and easing access to financing. While the rate cut could help boost home sales and increase moving activity—a major driver of self-storage demand—the lag between changes in the Fed Funds rate and mortgage rate adjustments may delay its immediate effects. Moreover, persistent housing supply shortages present an additional challenge to any rapid recovery in the housing market.