It’s no secret that capital markets and all forms of real estate have been impacted by the rise in interest rates over the past few years. Coming from historically low rates to a higher rate environment comes with plenty of challenges, particularly for those who have bought or built assets over the past 3-4 years.

Of course, interest rates aren’t the only issue facing the self-storage industry and current asset values. Additional headwinds have come from a few different sides, and each of these could be the subject of separate articles:

- Interest rate spikes, from historic lows in the 3% range to 7++%.

- Oversupply in many submarkets pushing market rents and occupancy down.

- COVID-19 impact has waned, and demand slipped back to the pre-pandemic trendline.

- Expense Increases – property insurance, property taxes, payroll, and online marketing.

- Street Rate strategies of the REITs pushing rents down to support occupancy levels.

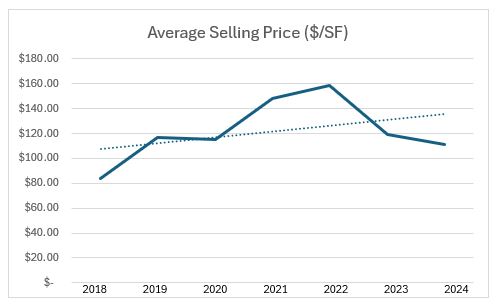

All of these factors combined have been a headwind on the industry and on a combined basis they have accounted for a drop in average selling prices compared to 2020-2022 levels. Looking back to 2018 and before the average price per square foot trendline is still positive. Based on recent sales activity it does appear that the worst of this current cycle may be in the rearview mirror – the caveat being that interest rates don’t go up any further and the economy doesn’t suffer a major setback.

All of these factors combined have been a headwind on the industry and on a combined basis they have accounted for a drop in average selling prices compared to 2020-2022 levels. Looking back to 2018 and before the average price per square foot trendline is still positive. Based on recent sales activity it does appear that the worst of this current cycle may be in the rearview mirror – the caveat being that interest rates don’t go up any further and the economy doesn’t suffer a major setback.

Today more deals getting done with creative financing terms such as, seller financing, lease with a purchase option, sale-leasebacks and more. Acquisitions that require traditional financing remain challenging as interest rates are generally still higher than CAP rates – meaning there is negative cash flow associated with traditional financing.

With the 2024 spring leasing season showing signs of life, interest rates moderating, the unemployment rate remaining historically low and the economy continuing to grow, the market for self-storage asset sales should improve throughout the second half of this year.

About the author:

Tom de Jong, MBA, SIOR is a founding member of the Colliers National Self Storage Group, founder of the de Jong I Becher Self-Storage Team at Colliers – one of the top national self-storage brokerage teams and has been a commercial real estate broker since 2007.