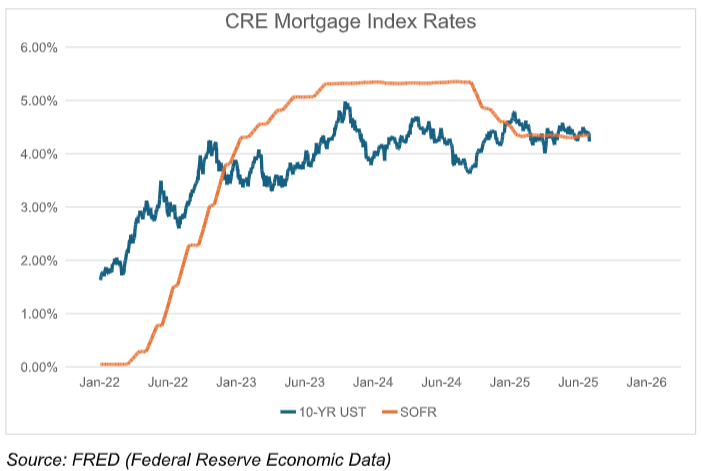

Since the run-up in interest rates began in 2022, understanding the complete opportunity set of commercial real estate mortgage loan types available to self-storage investors has never been more important.

CMBS

In order to remain competitive in a higher interest rate environment, CMBS issuers have modified their underwriting criteria. Most borrowers opt for 5-year fixed-rate loans with full-term interest-only payments. The advantage of this execution is that CMBS issuers are willing to underwrite to a minimum debt service coverage ratio (DSCR) utilizing interest-only debt service payments rather than a mortgage constant with hypothetical amortization. This change in underwriting criteria enables CMBS issuers to offer higher loan proceeds.

As CMBS issuers will generally underwrite to in-place income, this execution type is best for acquiring or refinancing stabilized properties. With respect to a refinance specifically, CMBS issuers generally have much less sensitivity to offering borrowers cash-out in comparison to banks and credit unions. A CMBS refinance can be a great option for investors who have recently repositioned a property or have owned it long-term and are now seeking to pull equity out of the property without selling. Another advantage of the CMBS execution is that it is non-recourse to the borrower.

Debt Fund / Private Credit

The increasingly strict regulatory environment for banks post-GFC created the need for debt funds to enter the market for commercial real estate mortgage loans. Debt funds typically focus on bridge and construction loan requests. Accordingly, loans from debt funds are typically shorter term (three to five years being the most common) and feature a floating interest rate with flexible prepayment. Debt funds are also generally the most comfortable out of all lender types offering high-LTV loans, with most groups maxing out at 75%-80% LTV and some offering even higher leverage. Another advantage of the debt fund bridge execution is that the vast majority of the time, these loans are made non-recourse to the borrower. Further, debt funds are able to offer future funding for CapEx plans and structure interest reserves if in-place cash flow does not cover debt service day one.

The debt fund bridge execution is ideal for acquisitions with a repositioning element to the business plan, such as a value-add renovation plan or management upside play.

Bank / Credit Union

Banks and credit unions offer a variety of loan products for self-storage properties, from permanent to bridge, construction, and SBA. Generally speaking, banks will be the most focused on the strength of the loan guarantor out of all lender types. In the majority of cases, banks will prefer to lend with recourse, which can be a deterrent for some borrowers, but they will generally lend at a lower all-in interest rate than debt funds. Depending upon the nature of the request and varying policies from bank to bank, loan products can be either variable-rate or fixed-rate, and banks will sometimes offer both options for the same transaction. Banks will likely offer prepayment flexibility, regardless of whether the loan is variable-rate or fixed-rate, especially compared to a CMBS execution, which is most likely to require defeasance. In general, banks are focused on relationships and opportunities for repeat business, and they tend to be the easiest lender type to work with post-closing.

A bank execution is ideal for most deal profiles, from acquisition permanent loans to bridge and construction loans, and also refinances. Leverage offered by banks will generally not be as high as that offered by debt funds, and the fact that most banks prefer to lend with recourse should be considered before requesting term sheets.

Life Insurance Companies

Life insurance companies are another great capital provider for commercial real estate mortgages. Though some offer bridge and construction loan products on their balance sheet, the most typical loan product offered by life insurance companies is permanent fixed-rate debt for stabilized properties. Typical loan terms are 5, 7, and 10 years, and it is common for life insurance companies to offer interest-only payments on the front end with amortizing payments on the back end and a balloon payment at maturity. Prepayment is negotiable, ranging from flexible to stepdown to yield maintenance.

With the exception of bridge or construction products offered by some platforms, a life insurance company execution is best suited for the acquisition or refinance of stabilized assets, as loan sizing will generally be calculated based on the in-place income. Further, life insurance companies will have more appetite for mid-sized and institutional-sized transactions, though a subset of platforms will lend on small loan balance requests. It is also worth noting that life insurance companies prefer to lend on relatively newer vintage assets in primary and secondary markets over older vintage properties in tertiary markets.

Source: Jackson Randolph, Versal Partners