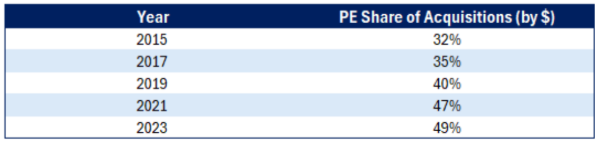

Over the past decade, the influence of Private Equity investing in all aspects of the self-storage industry has been profound. Up until late 2002, when NCREIF (National Council of Real Estate Investment Fiduciaries) started tracking self-storage as an asset class, there were the REITs and private sources of capital, with very few sources in between. Private Equity started investing in the industry in earnest in the mid-2010s and now accounts for almost half of all self-storage investing (Preqin, Yardi, Nareit).

Hold Period

A few of the impacts include a more defined hold period versus REITs and private capital sources – REITs will generally acquire self-storage assets and hold them indefinitely, while in many cases, private capital is building for generational wealth impacts. Of course, there are always exceptions, but in my 18 years of experience, we have seen very few REIT sales (besides large portfolio deals). Private equity generally follows a structured investment lifecycle, somewhere between 5-7 years, to allow the distribution of capital back to its investors.

Geographic Diversity

Another impact of private equity investment has been on how assets are managed. Most private equity investors use REITs for 3rd party management (Extra Space Storage, Public Storage and CubeSmart have been the biggest beneficiaries of this trend). Having 3rd party management allows the money to flow into many more markets than it would have if management were kept in-house, while also providing capital partners comfort that the assets are being managed by best-in-class operators.

Development

One of the most noticeable trends over the past decade has been the type of properties built. Most new buildings are now multi-story, climate-controlled buildings. The average budget for a new self-storage facility has mushroomed as a result. Today, it is common to see construction costs more than $12 mm +++ with the average size of a facility at 100,000 SF gross and costs to build at $120+/SF. Most are bigger and more expensive. That doesn’t include land and entitlement costs! Most independent developers are challenged to spend that amount on a single property, opening the door to private equity capital, who usually have a “bigger is better” investing model.

A Market on Ice

Since the Federal Reserve made its first interest rate increase in March of 2022, the investment sales market has been stifled. Higher interest rates, combined with lower rental rates and occupancies, have been significant headwinds for the industry. Most private equity investments are in their exit window based on initial capital commitments, but are unable to sell based on capital return commitments. Lots of pent-up demand to sell for sure, but the inability to hit their projected returns is still holding most back from bringing their assets to market. The second quarter of 2025 finally saw the investment sales market show signs of life, as a result of improving operating metrics, pent-up demand to sell, and capital on the sidelines becoming slightly more optimistic.

With the passage of the Big Beautiful Bill (HR-1) on July 4, 2025, many predict an acceleration of deal volume as a result of the return of 100% bonus depreciation, SALT and interest deduction improvements, increased REIT interest deduction allowances and opportunity zone changes, among others.

The remainder of 2025 will be the start of a multi-year process of private equity capital cycling through investments in self-storage assets. Of course, the buyers may well be other private equity funds, so the party goes on! For those on the sidelines, your time to jump in is approaching, so get ready!

About the Author:

Tom de Jong is Principal and Founding member of the De Jong Self Storage Team I COLLIERS and was an original founding member of the Colliers Self Storage Group within Colliers with 18 years of dedicated self-storage brokerage experience and over $2 billion in self-storage sales. The team helps investors buy, sell and build self-storage assets nationwide.

Tom de Jong is Principal and Founding member of the De Jong Self Storage Team I COLLIERS and was an original founding member of the Colliers Self Storage Group within Colliers with 18 years of dedicated self-storage brokerage experience and over $2 billion in self-storage sales. The team helps investors buy, sell and build self-storage assets nationwide.

Tom can be reached at (408)724-0337 or tom.dejong@colliers.com