Ready Capital has closed on a $9.3 million loan for the acquisition, renovation and stabilization of a 696-unit, Class A self storage property in Miami Beach. Upon acquisition, the sponsor plans to reconfigure the unit mix to drive occupancy and maximize revenue. The non-recourse, interest-only, floating-rate loan features a 48-month term, one extension option and is inclusive of a facility to provide future funding for capital expenditures. Source

Category: Finance News

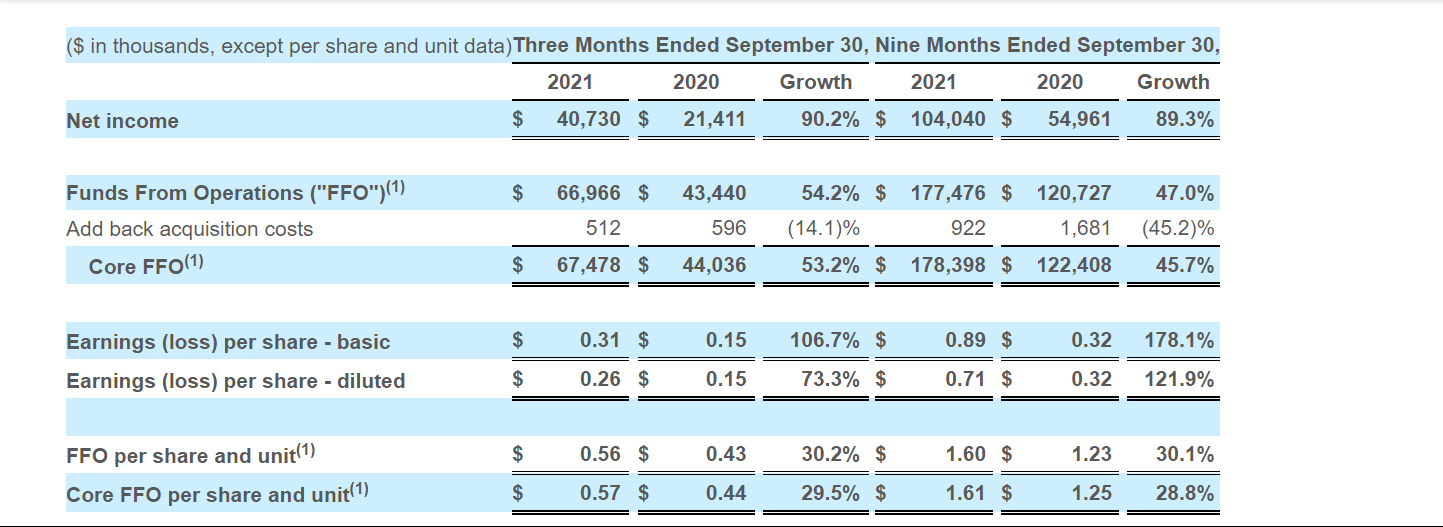

National Storage Affiliates Trust Reports Third Quarter 2021 Results

National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA) today reported the Company’s third quarter 2021 results. Third Quarter 2021 Highlights Reported net income of $40.7 million for the third quarter of 2021, an increase of 90.2% compared to the third quarter of 2020. Reported diluted earnings per share of $0.26 for the third quarter of 2021 compared to $0.15 for the third quarter of 2020. Reported core funds from operations (“Core FFO”) of $67.5 million, or $0.57 per share for the third quarter of 2021, an increase of…

Cronheim Mortgage Arranges $7.8 Million Refinancing for Self Storage, Retail Asset Near Fort Worth

New Jersey-based Cronheim Mortgage has arranged a $7.8 million loan for the refinancing of a self storage and retail asset located in the Fort Worth area. The property, formerly a grocery-anchored retail center, consists of a CubeSmart-branded self storage facility with roughly 1,000 units and a 10,000-square-foot retail space occupied by Goodwill. David Turley, Janet Proscia and David Poncia of Cronheim arranged the nonrecourse, fixed-rate loan on behalf of the borrower, an affiliate of California-based DealPoint Merrill. An undisclosed national bank provided the loan. The address of the property was…

Clutter Refinances New York Self Storage Properties with $118 Million Loan

Los Angeles-based storage operator Clutter has refinanced a four-property portfolio it owns in the New York metro area with a $118.3 million bridge loan. The non-recourse loan was negotiated by Talonvest Capital Inc. and features a low floating rate and a three-year term with two extension options. The level of support we received from Talonvest in managing and executing the lender process was phenomenal. We truly benefited from partnering with a team that understood our needs and kept our best interest in mind.” The four-property portfolio is located in Yonkers,…

California Self Storage Development Lands $28M Loan

Arizona-based 1784 Capital Holdings has received a $28.5 million construction loan for a self storage project in Goleta, Calif. White Oak Real Estate Capital provided the senior secured note, marking the firm’s first debt financing since its launch in July this year as an affiliate of White Oak Global Advisors. Development plans call for a 97,860-rentable-square-foot facility with three above-ground stories and one below-ground level. The project will include 1,023 units, of which more than 900 will be climate-controlled units. The facility is slated for completion within 16 months. Identifying…

Valley National Acquiring Bank Leumi USA for $1.1 Billion

Valley National Bank is making its second major acquisition in the last three months, this time agreeing to acquire Bank Leumi USA for $1.15 billion. Leumi’s shareholders will receive 3.8 shares of Valley National stock and $5.08 for every share they have, according to Bloomberg. Bank Leumi Le-Israel BM, the parent company of the U.S. banking side of the business, will own more than 14 percent of Valley National commons stock. Valley National will be able to take advantage of Bank Leumi USA’s offerings for wealthy and middle-market commercial clients.…

All Storage Courts $1 Billion+ Sale with CBRE

How many self storage units could $1 billion buy? The operators of All Storage appear poised to find out. The self storage company runs 50 facilities in Texas and three in Oklahoma, but the operator appears ready to box up ownership. The company is exploring a sale that could net more than $1 billion, according to Bloomberg. The company has started to solicit interest from potential buyers with assistance from CBRE in the sale exploration, Bloomberg reported, citing people with knowledge of the matter. The outlet didn’t identify any potential…

JLL Capital Markets Arranges $250 Million Acquisition Facility for SROA

JLL Capital Markets announced today that it has arranged a $250 million acquisition facility to finance the purchase of a 30-property, operating self storage portfolio from five separate sellers totaling 23,389 units across 11 states, including Florida, Georgia, Iowa, Indiana, Maryland, Michigan, Mississippi, Ohio, South Carolina, West Virginia and Wisconsin. The acquisition includes, but is not limited to, a 100-percent ownership stake of StayLock Storage, and will be the 40th storage company rebranded to Storage Rentals of America. JLL worked on behalf of the borrower, SROA Capital Fund VIII, to…

Coffee & Conversation: Discussing Market Trends and Investor Strategies

In this installment of Coffee & Conversation, we chat with Brett Hatcher of the Hatcher Group of Marcus & Millichap and Devin Huber of The BSC Group. We’ll discuss: acquisition trends the lending market investor strategies predictions for the future in self storage

The Current Self Storage Landscape

Over the last twelve months, the self storage industry has gone from a desirable asset class to one of the most sought-after investments in the commercial real estate landscape. The uncertainty of the COVID-19 pandemic created a pause but 2020 would demonstrate very strong year-over-year rental growth and occupancy across most major markets. With strong performance during and emerging from the pandemic, we have seen a wave of new inventory hit the market for sale and record pricing in many markets. What is driving this wave of inventory? What is…