Newmark announces the firm has brokered a recapitalization and new joint venture between Hines and CubeSmart for a 14-property self-storage portfolio located across the Dallas-Fort Worth Metroplex. Newmark Vice Chairman and leader of the firm’s National Self Storage Capital Markets practice, Aaron Swerdlin, along with Executive Managing Director Andrew Warin and team, advised Hines on the recapitalization. “As one of the largest national self-storage portfolio transactions of 2024, this transaction was a testament to the strength of the Dallas-Fort Worth market and further validation of the durability and appeal for…

Category: Self Storage News

Inland Real Estate Investment Co. and Devon Self Storage Holdings Have Completed Two Class-A Self Storage Properties in Baton Rouge, LA and Holly Hill, FL

Inland Real Estate Investment Co. and Devon Self Storage Holdings have completed two Class A self storage properties, one in Baton Rouge, La., and the other in Holly Hill, Fla. The facilities opened in mid-January and feature a total of 2,099 units. That same month, Inland Real Estate Group of Cos. purchased a majority interest in Devon Self Storage Holdings to expand its self storage portfolio. The companies have been working together since 2018. The 90,760-square-foot property in Baton Rouge is at 415 N 15th St. The building rises four…

Self-Storage Site Selection Guidance with Storage Authority’s Navigator Report!

Are you ready to take the next step in building a profitable self-storage business but unsure where to start? Storage Authority is here to guide you every step of the way with our Navigator Report—a powerful tool designed to save you time, money, and effort in selecting the perfect site for your self-storage venture. What is the Navigator Report? The Navigator Report is your first step toward making an informed decision about a potential self-storage site. By leveraging available online data and the details you provide, we offer a preliminary…

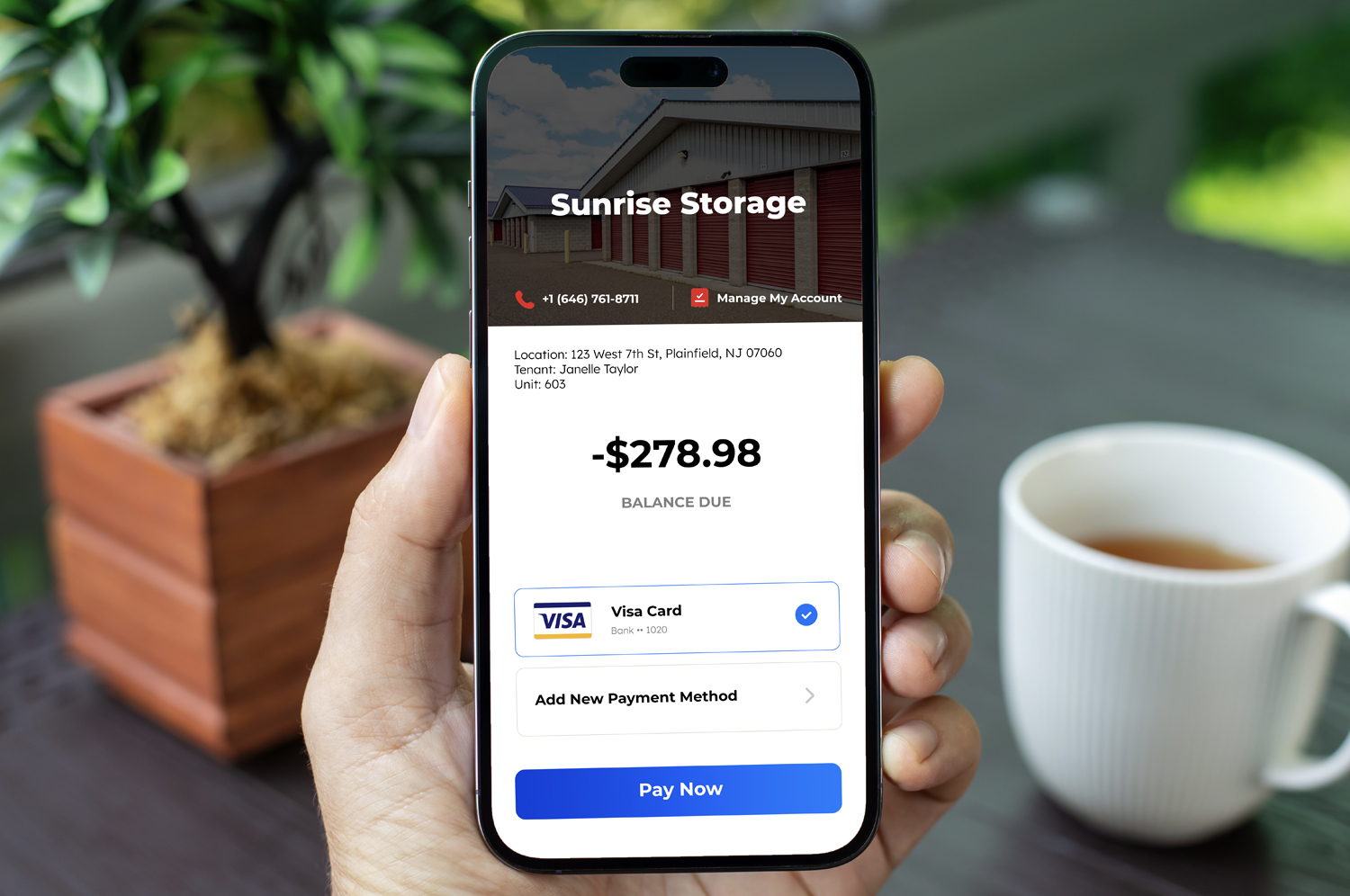

White Label Storage Launches Solution for Delinquent Payments

Managing accounts receivable is a critical aspect of self-storage operations. When tenants fall behind on payments, facilities face increasing risks of revenue loss and the time-consuming and unprofitable auction process. But following up with delinquent tenants is also time-consuming and costly for owners. Building emails, sending them to the right people, and resolving each tenant’s balance keep operators from focusing on other parts of the business. White Label Storage is always working on new ways to help self-storage facilities run more efficiently and profitably, so they have launched a solution…

Highline Storage Partners Launches Strategic Joint Venture with Heitman to Invest in Self-Storage Development and Acquisitions Throughout The United States

Highline’s joint venture with Heitman represents a unique and powerful new investment partnership in the self-storage industry,” said Key Foster, CEO of Highline Storage Partners. “We expect to accelerate our already active pace of investment significantly in the coming years.” Highline Storage Partners (“Highline”), an affiliate of Highline Real Estate Partners, announced today the formation of a new strategic joint venture with Heitman and an institutional investor advised by Heitman to invest in self-storage development and acquisitions throughout the United States. The partnership was seeded with a recapitalization of five…

Extra Space Storage Inc. Has Acquired Yellow Door Storage – Northgate in Denton, TX

Extra Space Storage Inc. has acquired Yellow Door Storage – Northgate, a 520-unit self storage facility in Denton, Texas, from NorthBridge Realty Holdings. JLL represented the seller and procured the buyer. The self storage facility is currently subject to a $5.3 million construction loan originated by Washington Federal Bank in 2021. JLL Capital Markets Managing Directors Steve Mellon and Brian Somoza, together with Directors Adam Roossien and Matthew Wheeler, worked on behalf of the NorthBridge in securing the deal. Yellow Door Storage – Northgate, up close The 65,600-rentable-square-foot facility came…

Cohen Investment Group Lands Refinance for Virginia Self Storage in Virginia Beach, VA

Cohen Investment Group has secured a $51.5 million refinancing loan for Castleton Commerce Center, a 470,618-net-rentable-square-foot flex storage complex in Virginia Beach, Virginia. Eastern Union’s Mid-Atlantic Group Senior Managing Director David Merkin arranged the fixed-rate refinancing loan through Bank of America, on behalf of the borrower. Merkin was the one to secure bridge financing for CIG when the company acquired the facility in 2021. CIG purchased the property from Prime Group Holdings for $58.8 million, with the help of a $58.2 million loan originated through the Chicago office of Prime…

Absolute Storage Management to Provide Professional Self-Storage Management for Smart Storage Facility in Lenexa, KS

Brand new development of Smart Storage is bringing professional self-storage management to the city of Kansas. The facility is located at 8600 Maurer Road, Lenexa, KS 66219. This facility is comprised of 695 units totaling 91,440 rentable square feet, providing safe and secure climate-controlled unit options to the local communities of Lenexa, Summerhill, Pointe West, Maple Falls and Brookwood Place. Smart Storage Lenexa LLC has contracted with Absolute Storage Management (Absolute) to provide professional self-storage management services and the facility is officially under Absolute’s management as of December 10, 2024.…

Major Developer Closes on Land for Class A Self-Storage in Deer Park, IL

Hernandez Development & XSITE Real Estate have successfully closed on a 6-acre parcel of land in Deer Park, Illinois, for a future Class A self-storage facility. The acquisition price for the site was $2,000,000. Deer Park will be the fourth self-storage property in Hernandez Development’s portfolio within the Chicago MSA, joining two operational facilities in Oswego and Bolingbrook, as well as a self-storage project currently under construction in Carol Stream. Key Highlights: Location: 6-acre parcel adjacent to Deer Park Town Center and across from Kildeer Marketplace on Rand Road/U.S. 12,…

StoreEase and Reliant Announce a Two-Year Renewal and Continued Expansion of StoreEase Saas (Software-as-a-Service) Platform

StoreEase and Reliant (Midgard Self Storage) are excited to announce the renewal and continued expansion of their partnership, extending their implementation of StoreEase’s Virtual Technology solution for an additional two years. The renewed commitment follows the success of the initial rollout and has expanded to 97 stores. Reliant’s hybrid operational model leverages StoreEase’s proprietary hardware and software to empower Virtual Managers® to the entire Midgard portfolio and properties of all sizes. Todd Allen, Managing Principal for Reliant, expressed his enthusiasm for the partnership renewal, stating, “We are excited about the…