The self-storage industry continues to attract investors because of its stability and strong returns. But even the most successful facility owners eventually decide it’s time to sell. The reasons vary widely—from personal life changes to strategic investment decisions. If you’re a self-storage owner, understanding the common motivations behind selling can help you evaluate whether now might be the right time for you. Here are the top five reasons owners choose to sell their facilities. 1. Retirement or Lifestyle Changes One of the most common reasons for selling is retirement. After…

Category: Sponsored

Which Management Model Is Right for Your Facility?

Self storage is in the midst of a management model overhaul. From online booking to self service unit access, customers have come to expect a streamlined self storage experience. New technologies are enabling operators to meet those needs while also pushing them to ask fundamental questions about their operational models. In this post, we’ll cover the three main management models in use today: On-site Remote Hybrid Each of these approaches has its strengths, so we’ll break down which model works best for which types of facilities. What Is On-Site Self-Storage…

How to Find Off-Market Self-Storage Deals

In today’s competitive market, the best self-storage deals don’t always show up on social media platforms, or even in your inbox. Some of the most profitable opportunities are off-market properties—facilities that change hands quietly without ever being widely advertised. Why chase off-market deals? The answer is simple: less competition, better pricing, and more upside potential. But uncovering these hidden opportunities takes strategy and persistence. Here are five proven ways to find off-market self-storage investments. 1. Build Relationships With Active Brokers Top-producing brokers often know about deals before they ever hit…

Flight To Quality

Self-storage investors are currently enjoying a rapidly rising stock market and surprisingly very stable debt market, albeit at elevated interest rates to the Covid era, but by historical standards, in line with the 30-year averages. However, it is clear that there is a bifurcation in the investment market with Class A, major market properties commanding a premium valuation and still historically low cap rates, while secondary and tertiary market properties struggle to find buyers. Willing and able buyers, in turn, are expecting widely expanded valuations and meaningfully higher cap rates.…

3 to 10: The Magic Number for the Next Wave of Storage Acquisitions

Institutional buyers are zeroing in on mid-sized portfolios that deliver scale, efficiency, and stronger returns, making owners with 3–10 facilities the most sought-after players in today’s market. Over the past decade, institutional capital has poured into the self-storage sector, driving record-breaking valuations and cap rate compression. But as the market matures and competition tightens, the focus has begun to shift. Large institutions are no longer chasing only the massive, multi-state portfolios; many are now setting their sights on mid-sized groups of 3 to 10 facilities. Why Mid-Sized Portfolios Stand Out…

BETCO, A Janus International Company, Launches Metal Decking Product Line to Enhance Self-Storage Building and Construction Capabilities

BETCO Metal Decking Provides Design Flexibility and Customization for Self-Storage Development BETCO, Inc., a leading innovator in engineering, design, manufacturing, and construction of self-storage buildings, today announced a comprehensive expansion of its decking product line. The new range of custom metal decking systems is designed to meet the unique structural and architectural demands of self-storage development and re-development. BETCO’s new suite of Metal Decking products, pairs advanced engineering and high-quality manufacturing to meet the demand for design flexibility and customization requirements of modern self-storage development across North America. BETCO Metal…

The Hidden Downsides of First-Month Free Promos

First-month free promotions are everywhere in the self storage industry. From nation-wide storage companies to independent operators, facilities rely on this promotion strategy to fill units fast. And for good reason—the words “first month free” catch attention, drive clicks, and get new customers in the door. In the short term, it works. But is it really worth it in the long run? That’s where things get complicated. While first-month free (FMF) promos can be a powerful customer acquisition tool, they come with hidden costs that can chip away at your…

Real Estate Opportunity Zones: What They Are & Why You Should Invest

In recent years, Opportunity Zones have become one of the most talked-about strategies in real estate investing. Designed by the U.S. government to encourage investment in underserved communities, these zones offer investors a unique chance to not only grow wealth but also create positive community impact. So, what exactly are Opportunity Zones—and why should you consider adding them to your portfolio? Let’s break it down. What Are Opportunity Zones? Opportunity Zones are geographic areas designated by the federal government to encourage long-term investment and economic development in distressed communities. When…

5 Ways to See a Quick Payoff with Your Renovations

If you’ve been taking a wait-and-see approach to costly renovations or repairs this year, it’s not too late to get started with the right strategies—and by acting now you can see a big payoff. In fact, recent changes to the federal tax code and bonus depreciation offer significant tax savings for property owners who invest in improvements. Check out “The Complete Guide to Self-Storage Renovations and Cost Segregation” to find out what that means for you, including next steps for estimating potential savings. You’ll find that many products and services…

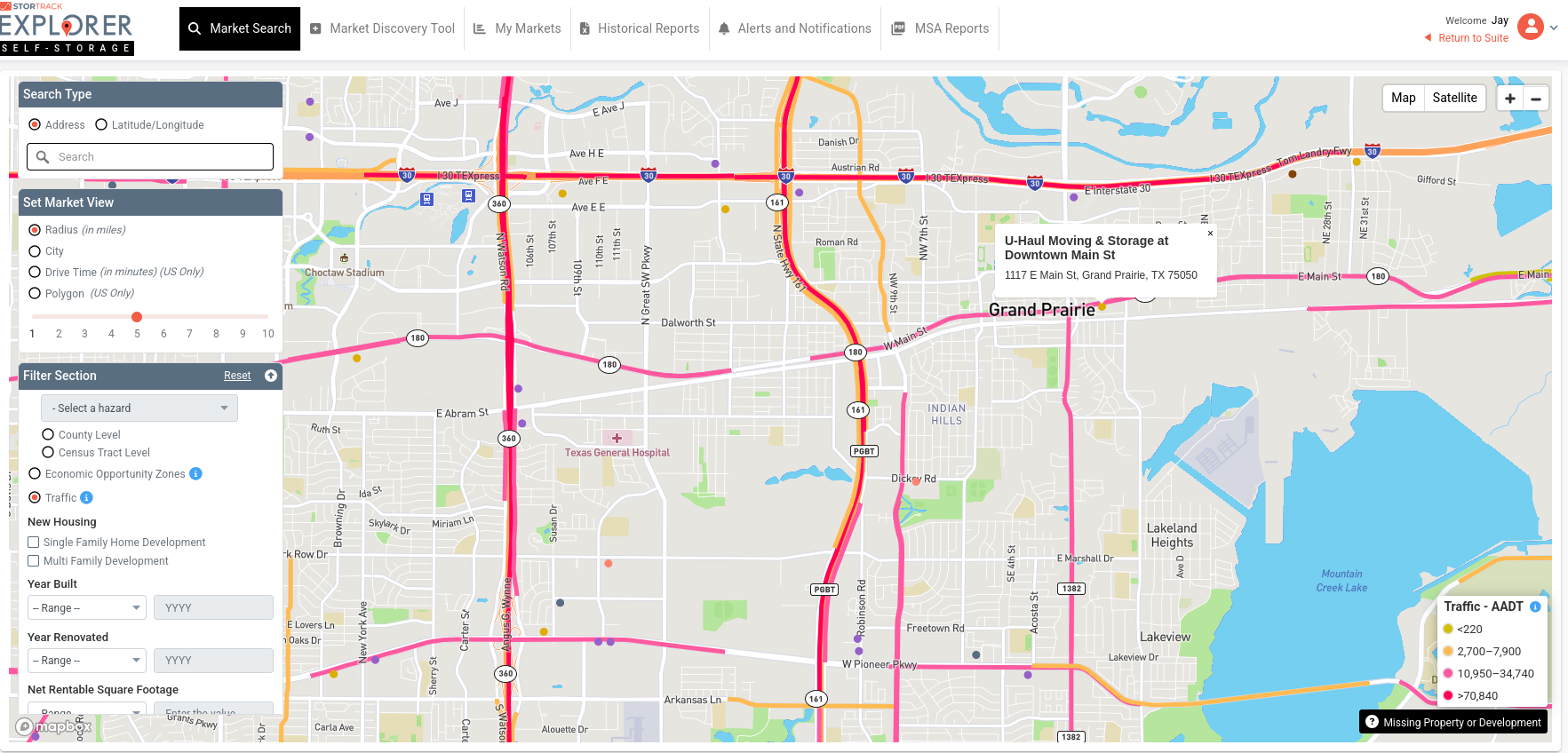

Smarter Listings Start with Better Data: How StorTrack Helps You Win Deals

In a market where smarter decisions mean faster deals, StorTrack’s latest Explorer features give brokers and sellers an edge. From understanding where the demand is highest with Traffic Data, to assessing risk upfront with FEMA Risk Zones, and identifying hidden value in Economic Opportunity Zones—Explorer now brings sharper insights that help you market, price, and position listings more strategically. Whether you’re pitching a deal or advising a client, these tools put powerful, real-world data at your fingertips. Why Traffic Data Matters In today’s competitive market, accurate visibility into consumer demand…