Talonvest Capital Inc. has secured a $53 million construction loan on behalf of 1784 Holdings LLC, for the development of a Class A self-storage facility in Bethesda, Maryland. According to Montgomery County records, the loan retires previous debt. The unpaid outstanding principal on the original mortgage refinanced was $20 million. The Ardent Cos. provided the financing.

The note has a maturity date set for 2026, includes two extension options, full-term interest-only payments, an earnout funding upon receipt of the full certificate of occupancy and no lease-up covenants.

The Talonvest Capital team included Senior Director Relationship Management Kim Bishop, Principal Jim Davies, Associate Ivan Viramontes, Co-Founder Tom Sherlock and Closing Manager Lauren Maehler.

The project was previously subject to two other construction loans in 2021 and 2022, amounting to a total of $68.3 million, both funded by Trimont Real Estate Advisors. The developer acquired the land in 2017 from a single-asset corporation for $11 million.

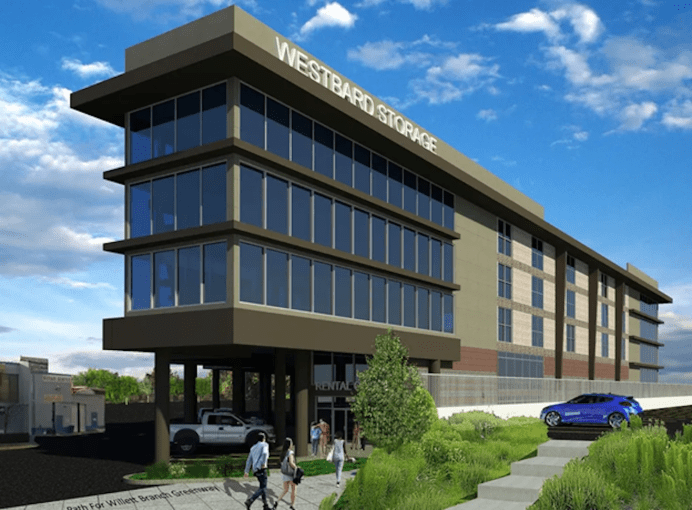

Construction on the 200,000-square-foot property began in July 2022 and its estimated completion is set for the fourth quarter of 2025. The building will feature four stories below ground and five stories above, comprising 1,707 climate-controlled self storage units.

The 1-acre project is at 5204 River Road, near U.S. Route 190 and less than 7 miles from downtown Washington, D.C. The facility will be one out of four available in a 3-mile radius, offering residents 2.4 net rentable square feet per capita. As of January, the Washington D.C. – Suburban Maryland market had 18 properties in various stages of development, set to add 1.4 million square feet to the existing inventory, the same source shows.

Financing the Self Storage Sector

Several significant financing deals in the self storage market took place by the end of last year, including Talonvest Capital securing $67.3 million on behalf of The William Warren Group for two separate portfolio transactions.

In November, Basis Industrial received an $11 million construction loan for the development of a 955-unit facility in Melbourne, FL.

Financing for self storage assets dropped 36 percent in the second quarter of 2023, compared to the first quarter, with less mortgages provided by banks due to overall economic volatility in financial markets.