One of the keys to success in the self storage industry is setting your rental rates competitively. So, what does it mean exactly to have competitive rates? Pricing your self storage units competitively means that you strategically set the rental rates relative to the competition in your market. Competitive pricing occurs in industries where the products being sold are pretty similar to each other like toothpaste, gasoline and, of course, self storage units. To many customers, a storage unit is a storage unit. That means if you offer a 5×5…

Author: Alison DeJaeger

Nate Paul’s World Class Sells 64-Property Self-Storage Portfolio Across 10 States for $588 Million

Nate Paul’s World Class Holdings has sold a 64-property self storage portfolio across 10 states to global real estate investment firm CBRE (NYSE: CBRE) and facility operator William Warren Group/StorQuest for $588 million in a bankruptcy sale. The portfolio comprises over 4.1 million rentable square feet in Texas, Ohio, Illinois, Colorado, Missouri, Mississippi, Tennessee, Indiana, New York and Nevada. The facilities were previously operated by Great Value Storage, Paul’s operating platform. The sale did not include any of Paul’s facilities in California and any of the firm’s new self storage developments and conversions nationally. We plan to…

Recent Closings: 3.22.22 – 3.28.22

Property: Utah Valley Storage and RV Location: Orem, UT Brokers and Brokerage: Jordan Farrer and Adam Schlosser of The LeClaire/Schlosser Group of Marcus & Millichap NRSF: 76,344 Unit Count: 291 Highlights: Generated 14 Offers Sold for 20% More than Off-Market Offer Property: Rosemount Self Storage Location: Portsmouth, OH Brokers and Brokerage: Sean M. Delaney and H. Paul Robertson of Marcus & Millichap NRSF: 23,000 Unit Count: 178 Property: The Park Self Storage Location: Arlington, WA Brokers and Brokerage: Brett Hatcher, Gabriel Coe, Tasso Douglas, Jesse Cameron and Jacob Becher of The…

My Place Storage’s $300 Million Joint Venture with Nuveen Real Estate

My Place Storage, a self storage facility, and its founder Kurt O’Brien announced the formation of a $300 million joint venture with Nuveen Real Estate focused on acquiring and operating a number of value added self storage properties. Kurt O’Brien has over three decades of experience developing, operating and managing extremely successful self storage companies. This latest collaboration will enable Kurt to continue to acquire and operate self storage projects all over the country and dynamically grow the operations of the new venture. The MoFo team was led by New…

SROA Announces Final Closing of Fund

SROA Capital (SROA), a vertically integrated real estate investment and technology company focused on investing in self storage, has announced the final closing of its eighth flagship fund, SROA Capital Fund VIII (Fund VIII), at $650 million. Fund VIII marks the firm’s largest fund to date, having surpassed its $500 million target. The firm also raised approximately $200 million from limited partners for co-investments alongside Fund VIII. We are thrilled with the success of this fundraise and grateful for the strong support we have received from a diverse group of…

Citi Lends $560 Million on 43-Property Self Storage Portfolio

Citigroup has closed a $560 million refinance for a 43-property self storage portfolio owned by Prime Storage Group, sources familiar with the deal told Commercial Observer. The floating-rate loan is indexed to SOFR. A source said the ultimate execution for the loan is still being mulled, given the current volatile interest rate environment. After thoughtful analysis, our team at Meridian was able to identify a path to strong value creation for our client by including 43 properties across 15 states in the collateral, achieving an ideal risk-adjusted opportunity for lenders.” Meridian Capital Group’s Drew…

Recent Closings: 3.15.22 – 3.21.22

Property: Got Storage Location: Victorville, CA Brokers and Brokerage: Brett Hatcher, Gabriel Coe, Tasso Douglas, Jesse Cameron and Jacob Becher of The Hatcher Group of Marcus & Millichap NRSF: 87,502 Unit Count: 523 Non-Climate Controlled, 19 Lockers and 178 RV Parking Spaces Occupancy: 99% (Physical) Room for Expansion: Yes Highlights: RV Storage with Dump Station All Doors are Individually Alarmed State-of-the-Art Security Wide Drives Shipping Center Located on Site Less than Two Miles from Both Highway 395 and I-15 Dense and Growing Population: 170,052 People Living within a Five-Mile Radius…

Self Storage and Zoning Woes: How Planning to Appease Could Make All the Difference

While self storage may be the current darling of pandemic-wary investors and REITs, a growing number of townships, municipalities and cities are less affectionate. Push back from zoning commissions is nothing a seasoned developer hasn’t encountered and should rarely come as a surprise. Your team’s initial research should include past zoning objections and expected areas of opposition. Some of the most common complaints can be answered in the earliest phases of planning, as explored below. Self storage facilities gained a bad reputation for being unsightly, often described as large, windowless…

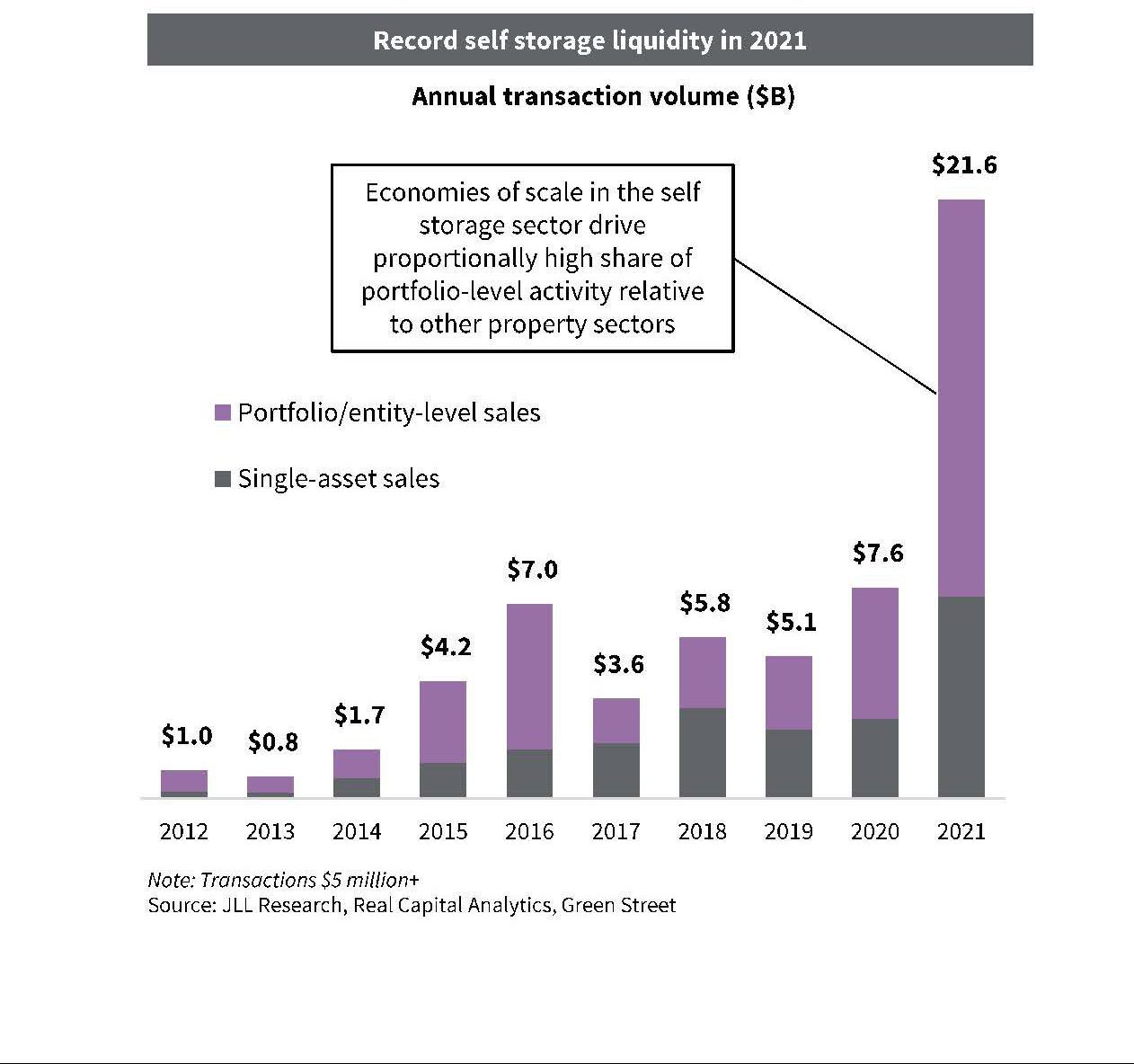

Self Storage Spotlight from JLL

Exceptionally strong fundamentals are driving a flood of capital to self storage. The sector is considered an inflation hedge and the development pipeline has been hampered in the near-term by supply chain constraints. 2021 was a banner year for the self storage sector and, in particular, for the public REITs that posted an average of over 17% same-store NOI growth, far surpassing other sectors. Hence, it was not a surprise that the REITs generated 78% total shareholder returns in the year, ranking among the top of the REIT sub-sector in…

Purchasing a Mismanaged Facility

Many properties that potential buyers find “off market” tend to not have the historical cash flow a bank needs to approve a transaction. The reasons could stem from poor marketing, low occupancy, lack of management or, in some cases, failure to report income incurred. When using an SBA loan product to purchase a facility with poor historical financials, the new deal can be viewed as a “start-up”, as the new buyer will be running the site differently. With realistic projections and a business plan that justifies changes in operations, the…