Three months after exploring a multi-billion-dollar sale of Manhattan Mini Storage, Edison Properties has found a buyer. StorageMart has reached an agreement to acquire Manhattan Mini Storage and its 18 self storage facilities in the borough, the Missouri-based firm announced Friday. Neither side disclosed the financial terms, but Crain’s reported that StorageMart paid just over $3 billion, citing people familiar with the matter. The acquisition brings StorageMart’s portfolio to 20 million net rentable square feet and more than 200,000 storage units worldwide, including in Brooklyn, where it has two locations, as…

Author: Alison DeJaeger

Recent Closings: 11.9.21 – 11.16.21

Property: Mokena Self Storage Sale Price: $18 Million Location: Mokena, IL Broker and Brokerage: James “Ashley” Compton of the Self Storage Group of Colliers International NRSF: 108,724 Buyer: Trojan Storage Unit Count: 938 Climate Controlled Acreage: 4.086 Highlights: Certificate of Occupancy Sale In Will County, One of the Fastest-Growing Counties in the United States Situated Off 191st Street, a Major Five-Lane East/West Thoroughfare with Prominent Visibility and Ease of Access Along the Primary Artery Property: Central Self-Storage Sale Price: $12.3 Million Location: Chandler, AZ Broker and Brokerage: Steve Mellon, Brian…

Featured Broker: Jon Knudsen

Jon currently serves as director in the Brokerage & Advisory Division at Hanna Langholz Wilson Ellis, based in downtown Pittsburgh PA. He joined in 2016 to focus on landlord agency representation and consulting throughout the Pittsburgh MSA and select markets throughout PA, NY and OH. Prior to joining Hanna Langholz Wilson Ellis, Jon was part of the Manhattan office of SRS Real Estate Partners, North America’s largest full service real estate focused on retail and hospitality. At SRS Jon focused on landlord agency and consulting throughout the New York Tri-State…

Recent Closings: 11.2.21 – 11.8.21

Property: Alta Vista Storage Location: League City, TX Broker and Brokerage: Dave Knobler of The LeClaire-Schlosser Group of Marcus & Millichap NRSF: 34,100 Unit Count: 358 Climate Controlled Acreage: 8.4 Room for Expansion: 3.7 Acres Highlights: Attractive Facade Vertical Pivot Gated Entry with Digital Keypad Full-Service On-Site Management Office 24/7 Video Surveillance Concrete Driveways Roll-Up Doors Property: Cumberland Storage Location: Tyler, TX Broker and Brokerage: Dave Knobler and Charles “Chico” LeClaire of The LeClaire-Schlosser Group of Marcus & Millichap NRSF: 61,713 Unit Count: 539 Climate Controlled Occupancy: 100% Year Built:…

Third-Party Management Fuels Acquisition Activity at Life Storage

Third-party management is turning out to be an acquisition goldmine for Life Storage. Joe Saffire, CEO of the Williamsville, NY-based self storage REIT, said roughly one-third of the 75 facilities purchased so far this year were part of Life Storage’s third-party management platform. Saffire called the company’s third-party platform a “robust acquisition pipeline.” “The hard work of our acquisitions and third-party management teams over the past several years executing on our relationship-based strategy to be well positioned when opportunities become available is clearly paying off,” Saffire said in a Nov.…

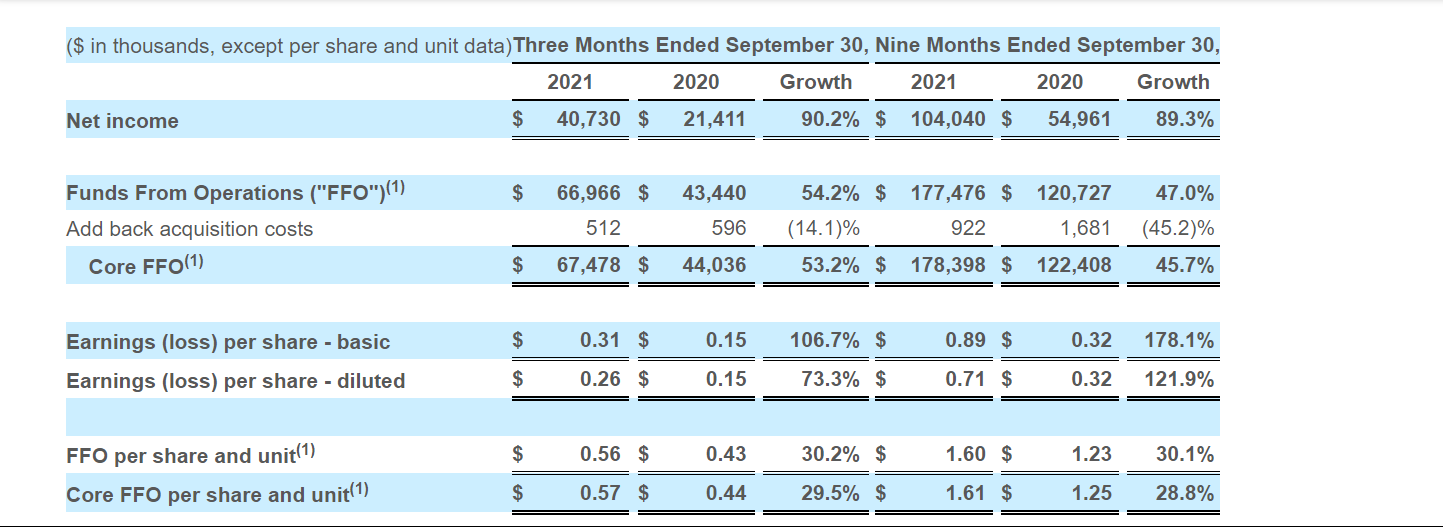

National Storage Affiliates Trust Reports Third Quarter 2021 Results

National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA) today reported the Company’s third quarter 2021 results. Third Quarter 2021 Highlights Reported net income of $40.7 million for the third quarter of 2021, an increase of 90.2% compared to the third quarter of 2020. Reported diluted earnings per share of $0.26 for the third quarter of 2021 compared to $0.15 for the third quarter of 2020. Reported core funds from operations (“Core FFO”) of $67.5 million, or $0.57 per share for the third quarter of 2021, an increase of…

Investor Demand for Self Storage Soars – What Does This Mean for the Sector?

The self storage industry has transformed over the last decade with acquisition volume increasing by more than 35x since 2011 – annual acquisition volume in 2011 totaled approximately $508 million and is expected to reach $18 billion for the year 2021. The resiliency, stable cash flow and low CapEx requirements continue to draw real estate investors to self storage, but more than anything, investors have recognized its relative value versus other real estate asset classes. As stabilized cap rates in the multifamily and industrial sectors compress to historic lows (below…

Cronheim Mortgage Arranges $7.8 Million Refinancing for Self Storage, Retail Asset Near Fort Worth

New Jersey-based Cronheim Mortgage has arranged a $7.8 million loan for the refinancing of a self storage and retail asset located in the Fort Worth area. The property, formerly a grocery-anchored retail center, consists of a CubeSmart-branded self storage facility with roughly 1,000 units and a 10,000-square-foot retail space occupied by Goodwill. David Turley, Janet Proscia and David Poncia of Cronheim arranged the nonrecourse, fixed-rate loan on behalf of the borrower, an affiliate of California-based DealPoint Merrill. An undisclosed national bank provided the loan. The address of the property was…

National Storage Affiliates Trust Acquires 34 Self-Storage Facilities from Inland Private Capital

An affiliate of self storage real estate investment trust and management company National Storage Affiliates Trust (NSAT) has acquired 34 properties from investment-management firm Inland Private Capital Corp. (IPCC) for $265 million. The facilities comprise a total of 2.1 million square feet across four states. They were packaged in three IPCC-sponsored Delaware statutory trust (DST) programs, according to a press release. The storage sector has seen a dramatic increase in institutional demand for large scale, self storage transactions over the past 12 months and, as a result, we believed a…

Absolute Storage Management Reports 2021 Third Quarter Results

Absolute Storage Management (ASM), a leading third-party management company for self storage facilities in the United States, announced operating results for the three and nine months ended September 30, 2021. 2021 Highlights for Three Months Ended September 30, 2021: Increased same-store revenue by 17.1% compared to the same period in 2020. Achieved net operating income (NOI) of 22.5% in the same period in 2020. Acquired three (3) management contracts of operating facilities. 2021 Highlights for Nine Months Ended September 30, 2021: Increased same-store revenue by 13.9% vs. the same period…