Janus International Group, Inc. (NYSE: JBI) (“Janus”), the leading global manufacturer and supplier of turn-key building solutions and new access control technologies for the self storage and other commercial and industrial sectors, today announced that bonus depreciation benefits are being reduced, what that means for self storage owners and how they can take advantage of it before it’s too late. While to some in the self storage industry, cost segregation studies may seem like a bourgeoning concept, the truth is, owners have been taking advantage of the significant tax benefits…

Author: Alison DeJaeger

Recent Transactions: 8.9.2022 – 8.15.2022

Property: U-Haul Closing Price: $18 Million Location: East Wenatchee, WA Broker and Brokerage: Christopher Secreto of Marcus & Millichap Property: KO Storage Closing Price: $4.39 Million Location: Rochester, MN Buyer: Storage Rentals of America Seller: KO Storage NRSF: 52,500 Unit Count: 332 Property: KO Storage Closing Price: $2.1 Million Location: Austin, TX Buyer: Storage Rentals of America Seller: KO Storage Property: U-Stor-It Location: Crete, IL Brokers and Brokerage: Jeffrey L. Herrmann and Sean M. Delaney of Marcus & Millichap NRSF: 30,860 Room for Expansion: Yes, 34,000 NRSF Occupancy: 91% Property:…

National Storage Affiliates Trust Reports Second Quarter 2022 Results

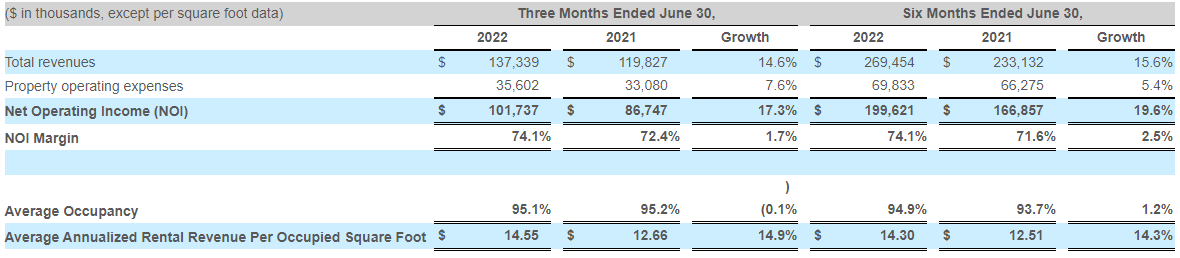

National Storage Affiliates Trust (NYSE: NSA) today reported the company’s second quarter 2022 results. Second Quarter 2022 Highlights Reported net income of $48.4 million for the second quarter of 2022, an increase of 35.7% compared to the second quarter of 2021. Reported diluted earnings per share of $0.24 for the second quarter of 2022 compared to $0.25 for the second quarter of 2021. Reported core funds from operations (“Core FFO”) of $91.6 million, or $0.71 per share for the second quarter of 2022, an increase of 29.1% per share compared…

Featured Broker: Jeff Gorden

Jeffery A. Gorden, CCIM has been active in commercial real estate since 2004 and quickly established himself as an industry expert in site selection and investment properties. He is also an active community member as the 2010 chairman of the Chandler Leadership Institute Steering Committee and current chairman of the Chandler Board of Adjustment. Professionally, he is a member of the Arizona Self Storage Association, National Association of Realtors, CCIM Institute, Chamber of Commerce and Toastmasters International. Jeff earned his graduate and undergraduate degrees from Temple University and the University…

Storage Facility Planned for Vacant Portion of Building in Northville Township

Some new life could come to a commercial area near downtown Northville. The Northville Township planning commission is reviewing plans for renovating a building to add a self storage facility. The building, located at 807 Doheny St., would see major renovations and the addition of dozens and dozens of individual storage units. Renovations would take place in the western part of the building formerly occupied by the Jack Doheny Company. The eastern portion — currently occupied by Jim’s Oil Depot will remain with an existing lease in place. “All the…

Recent Transactions: 8.2.2022 – 8.8.2022

Portfolio: Aubin Lane Self Storage Closing Price: $18.8 Million Locations: Elkton and Northeast Parts of Cecil County, MD Brokers and Brokerage: Andrew Meeder and Tom Mottley of MacKenzie Commercial Real Estate Services NRSF: 125,000 Unit Count: 883 Property: Jetport Boat & RV Storage Location: Fort Myers, FL Brokers and Brokerage: Jordan Farrer and Adam Schlosser of the LeClaire-Schlosser Group of Marcus & Millichap NRSF: 117,552 Unit Count: 239 Property: Aubin Lane Self Storage Closing Price: $1.25 Million Buyer: Wong Cubes, LLC Location: Baton Rouge, LA Portfolio: Minnesota 24-Property Portfolio Location:…

Adams Property Group Adds Five Brand New Self Storage Facilities to Portfolio

It has been a busy season for Adams Property Group, with the addition of five brand new properties to manage in the Southeast. In addition to managing their existing portfolio of almost two million square feet of self storage properties, the real estate investment group now owns and manages the newly built Monster Self Storage facilities in Valdosta, GA and Statesboro, GA. They also took on management responsibilities for the brand new Your Storage Units facilities that recently opened in Kissimmee, FL, Jacksonville, FL and North Augusta, SC. Other expansions…

Blackstone Scores $2.7 Billion CMBS Loan for PSB Purchase

Private equity behemoth Blackstone has taken out a $2.73 billion loan to finance its acquisition of PS Business Parks, public mortgage documents show. Blackstone, one of the country’s largest investment managers, paid $7.6 billion earlier this month for the Glendale, Calif.-based REIT whose portfolio spans 93 properties, serving approximately 4,800 tenants in 27 million square feet of space as of June. The national portfolio includes a range of industrial, office and flex properties in California, Texas, Northern Virginia and Miami, among other places. Nearly a quarter of the properties, 24…

Recent Transactions: 7.26.22 – 8.01.22

Property: Independence Self Storage Location: Grantsville, UT Brokers and Brokerage: Jordan Farrer and Adam Schlosser of the LeClaire-Schlosser Group of Marcus & Millichap NRSF: 82,550 Unit Count: 540 Property: Davie Self Storage Closing Price: $4.2 Million Location: Davie, FL Brokers and Brokerage: Tyler S. Kuhlman and Zachary Levine of Marcus & Millichap NRSF: 19,248 Unit Count: 205 Property: Nalley Valley Self Storage Location: Tacoma, WA Buyer: SecureSpace NRSF: 60,272 Year Built: 1993 Property: Oklahoma City Self Storage Facility Closing Price: $7 Million Location: Oklahoma City, OK Buyer: Andover Properties NRSF:…

Invesco Real Estate Buys Self Storage Building in Brooklyn for $44 Million

Invesco Real Estate picked up a 10-story self storage warehouse at 160 John Street in Vinegar Hill, Brooklyn, for $43.5 million, according to property records made public Monday. An entity tied to Invesco bought the property from Knickpoint Ventures’ Matthew Sprayregen for more than four times the $10.8 million it sold for in 2007, according to public records. Invesco closed on the sale July 12. Knickpoint repaid $38 million in debt dating back to 2017 from M&T Bank three days after the deal closed, according to public records. It was…