Aries Capital of Chicago has closed $46 million in construction, bridge and permanent debt financing for over 414,000 square feet of new and existing self storage facilities in California, Colorado, Florida and Texas. The financing was arranged on behalf of three separate clients by Aries Capital Director of Capital Markets Brandon Perdeck, Director of Acquisitions Matt Carney and Assistant Vice President Steve Adams. The transactions include a $17.5 million construction loan for a self storage facility in Santa Clarita, California for Diamond Development Partners, a unit of Salazar Construction Co.,…

Category: Finance News

Storage Post Secures $33.2 Million in Financing for Staten Island Self Storage Facility

JLL Capital Markets announced today that it has arranged $33.2 million in financing for Storage Post’s new 2,388-unit self storage facility located at 620 Richmond Terr. in Staten Island, New York. JLL worked on behalf of the borrower, Storage Post Self Storage, to secure $33.2 million loan through SoundPoint Capital, an alternative asset management firm based in New York with $28.9 billion of assets under management. Storage Post acquired the brand-new, four-story facility as part of its rapid growth in 2022. Located in the North Shore of Staten Island, the…

What Is an Interest Rate Cap and Why May I Need One?

In order to protect from runaway interest rate risk, lenders often require borrowers to purchase interest rate caps at the time of loan origination to set the maximum interest rate that can be charged on variable rate loans. These caps have historically been at a moderate cost and seldomly triggered, as rates had not trended up in some time. But that changed in the first half of 2022, as interest rates increased dramatically and expectations are for this development to continue for the foreseeable future. As a result, the cost…

Mag Mile Capital Finalizes $4 Million Loan for Self Storage Renovation Project in Heart of Memphis

Mag Mile Capital announced that Matt Weilgus, SVP and Head of Originations, successfully completed a $4 million loan to secure funds needed to purchase and renovate an old Sears store into a modern 854-unit, 83,040 sq. ft. self storage facility. Branded as and managed by Public Storage, the facility is located in the first enclosed mall in the mid-South and is located just minutes from the airport and downtown Memphis. Mag Mile Capital is a boutique firm that offers preferred access nationwide to high-leverage, non-recourse, commercial real estate bridge loans…

Rialto Capital JV Lands $140 Million Credit Facility for Storage Assets

A partnership between Rialto Capital Management and YourStorageUnits has secured $140 million in revolving credit for seven recently built self storage properties—which include a total of 5,000 units—in Florida, Georgia and South Carolina, as well as other storage assets that are currently under construction. Natixis Corporate & Investment Banking provided the credit facility. Rialto paid a combined $42.8 million to Delta Capital Management for four of the assets. The portfolio transaction includes a 111,150-square-foot self storage property in Panama City Beach, Fla., a 104,562-square-foot asset in Kissimmee, Fla., a 101,250-square-foot…

MMCC Arranges $7.2 Million Loan for Refinancing of Self Storage Facility in Suburban Omaha

Marcus & Millichap Capital Corp. (MMCC) has arranged a $7.2 million loan for the refinancing of an All About Storage property located at 11109 Olive St. in the Omaha suburb of La Vista. Built in 2005, the self storage facility features 780 units, 83 percent of which are occupied. Phillip Gause of MMCC arranged the 10-year loan, which features a loan-to-value ratio of 60 percent and an interest rate of 4.1 percent. The lender was undisclosed. Source

1784 Capital Lands $20 Million for Scottsdale Storage Project

Raintree & Pima Self Storage Partners LLC, an affiliate of 1784 Capital Holdings, has landed a $20 million loan for Raintree Life Storage, a self storage facility currently under construction in Scottsdale, Ariz. Principal & Head of Originations Felix Gutnikov of Thorofare Capital has secured a 1.5-year floating-rate, non-recourse loan with two, six-month extension options for the construction and completion of the property. Scheduled for delivery in September 2022, the two-story facility is rising on a 2.3-acre site. Plans call for 944 climate-controlled units totaling 81,435 net rentable square feet.…

Marcus & Millichap Capital Corp. Arranges $5.8M Loan for Self Storage Portfolio in West Virginia

Marcus & Millichap Capital Corp. (MMCC) has arranged a $5.8 million loan for a four-property self storage portfolio in West Virginia. The properties span 770 units and are located at 21 Crawford Quarry Road, 1820 Broad Lane and 9724 Williamsport Pike in Falling Waters, as well as 73 Roaring Lion Drive in Hedgesville. Jared Cassidy of MMCC’s Bethesda, Md., office arranged the 10-year loan on behalf of the borrower, a private self storage operator, through an unnamed balance sheet lender. The loan was underwritten with a fixed interest rate of…

ULLICO Lends $69 Million Loan on NYC, NJ Self Storage Portfolio Buy

Alan Mruvka’s StorageBlue has landed $69 million of first-mortgage financing for its purchase of a three-asset self storage portfolio in the New York City metropolitan region. Union Labor Life Insurance Company (ULLICO) supplied the first-mortgage loan for Mruvka’s acquisition of three self storage properties in New Jersey and Staten Island from American Self Storage. Herb Kolben and Kevin Smith of ULLICO spearheaded the deal. Solaris Capital also provided $14.3 million in preferred equity in a transaction overseen by Anthony Manno. Neptune Capital Partners also kicked in $13 million of additional…

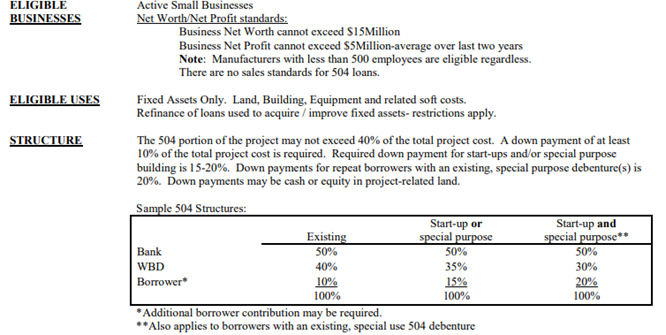

504 Loan Structuring

With the current rising interest rate environment, now is a good time to lock in debt for as long as possible. One option is the SBA 504 program where anywhere from 35-40% of the loan package has a 25-year fixed rate. The maximum amount from the CDC/SBA 25-year rate is $5 million (unless you pursue the “Green” program when it would become $5.5 million). The bank who holds onto the first mortgage can go up as high as they are comfortable with allowing borrowers to receive loans in the $15-$20…