Aries Capital is pleased to announce that the firm’s Director of Capital Markets, Brandon Perdeck, has arranged a $19.875 million, interest-only loan for a 54,000-square-foot, climate-controlled wine and self storage facility, Vineburg Wine and Self Storage, in Sonoma, California. “The borrower was seeking to refinance an existing construction loan, as well as to finance a second phase of the project,” said Perdeck. “Given the property’s broad wine storage offerings and current waitlists for storage unit availability locally, we were able to source a qualified lender through our network and arrange…

Category: Finance News

Northmarq Arranges $8M Refi for Tampa Storage Asset

Northmarq has secured $8 million in refinancing for a 90,522-square-foot Extra Space Storage managed facility in Pinellas Park, Fla. Tampa-based Senior Vice President & Managing Director Robert Hernandez arranged the 10-year fixed-rate loan, with an interest rate of 2.8 percent and a 30-year amortization period. Completed in two phases, in 1986 and 2000, the asset comprises 904 climate- and non-climate controlled units, ranging from 20 to 600 square feet. The facility includes outdoor RV and boat slips, security cameras and parking spots. At the time of the transaction, the property was…

Talonvest Secures Acquisition Loan for 16-Property, 1.3 Million NRSF Portfolio

Talonvest Capital, Inc., a boutique self storage and commercial real estate mortgage brokerage firm, negotiated a permanent loan on behalf of Rosewood Property Company for the acquisition of a 16-property storage portfolio. This acquisition is the largest self storage transaction in Rosewood Property Company’s history and consists of approximately 1.3 million net rentable square feet of space in roughly 12,000 units across 12 states. Much of the portfolio consists of traditional storage offerings, although some of the facilities offer climate-controlled interiors, drive-up capabilities, and covered outdoor parking for RVs and…

Talonvest Arranges $112 Million Self Storage Loans

Talonvest has helped structure a total of $111.5 million in permanent financing on behalf of several self storage clients. The firm has arranged four separate loans for a six-property portfolio and three additional facilities in Chicago, Texas and Illinois. The William Warren Co. has closed on the largest financing deal, amounting to $60 million for a collection of six properties in California, Texas and Nevada. The seven-year loan has five years of interest only payments. The assets total 542,483 net rentable square feet and include a 73,128-square-foot facility at 2340…

Bank Hapoalim Lends $32 Million on Queens Self Storage Property

Cayre Equities has inked a $32 million debt package to refinance a New York City self storage asset, Commercial Observer has learned. Bank Hapoalim provided the loan on Cayre’s 95,000-square-foot facility, which is managed by Treasure Island Self Storage and located in Queens’ Glendale neighborhood. Newmark arranged the transaction with a debt and structured finance team led by Dustin Stolly, Jordan Roeschlaub and Daniel Fromm. Located at 7936-7966 Cooper Avenue, the property sits on 2.21 acres of land that Cayre purchased in 2015. The self storage development was completed in…

Talonvest Secures $11.1 Million Construction Loan for NY Development

Talonvest Capital, Inc., a boutique self storage and commercial real estate mortgage brokerage firm, structured an $11,100,000 construction loan on behalf of GoodFriend Self-Storage and their institutional joint venture equity partner, whom Talonvest had previously sourced, to finance the development of a Class A, state-of-the-art self storage facility on a 2.21-acre site in Bedford Hills, NY. Upon completion, the architecturally attractive storage facility with 68,314 net rentable square feet in 691 units will appeal to today’s high-end consumer. The construction loan was funded by a national bank and features a…

SBA 504 Refinance Program

The 504 Refinance Program is designed to help businesses improve cash flow and access the equity of their property to pay down business expenses. With the updated rules provided by the SBA and low, long term FIXED rates, you can’t afford to ignore this program. To Qualify: At least 85% of the original loan must have been used to purchase or improve owner occupied commercial real estate or equipment (self storage is eligible). The note must have been in place for at least six months and the final draw of…

Terrydale Capital Arranges $24.2 Million Acquisition Loan for South Texas Self Storage Portfolio

Dallas-based Terrydale Capital has arranged a $24.2 million acquisition loan for a portfolio of self-storage properties located in South Texas. The portfolio consists of eight existing facilities, four vacant sites and one site that is under construction. Cody Baker of Terrydale Capital arranged the five-year loan, which carried a fixed interest rate of 3.25 percent, two years of interest-only payments and a 25-year amortization schedule. An undisclosed correspondent bank provided the loan. The borrower was also not disclosed. Source

Ready Capital Closes $9.3 Million Loan for Self Storage Property in Miami Beach

Ready Capital has closed on a $9.3 million loan for the acquisition, renovation and stabilization of a 696-unit, Class A self storage property in Miami Beach. Upon acquisition, the sponsor plans to reconfigure the unit mix to drive occupancy and maximize revenue. The non-recourse, interest-only, floating-rate loan features a 48-month term, one extension option and is inclusive of a facility to provide future funding for capital expenditures. Source

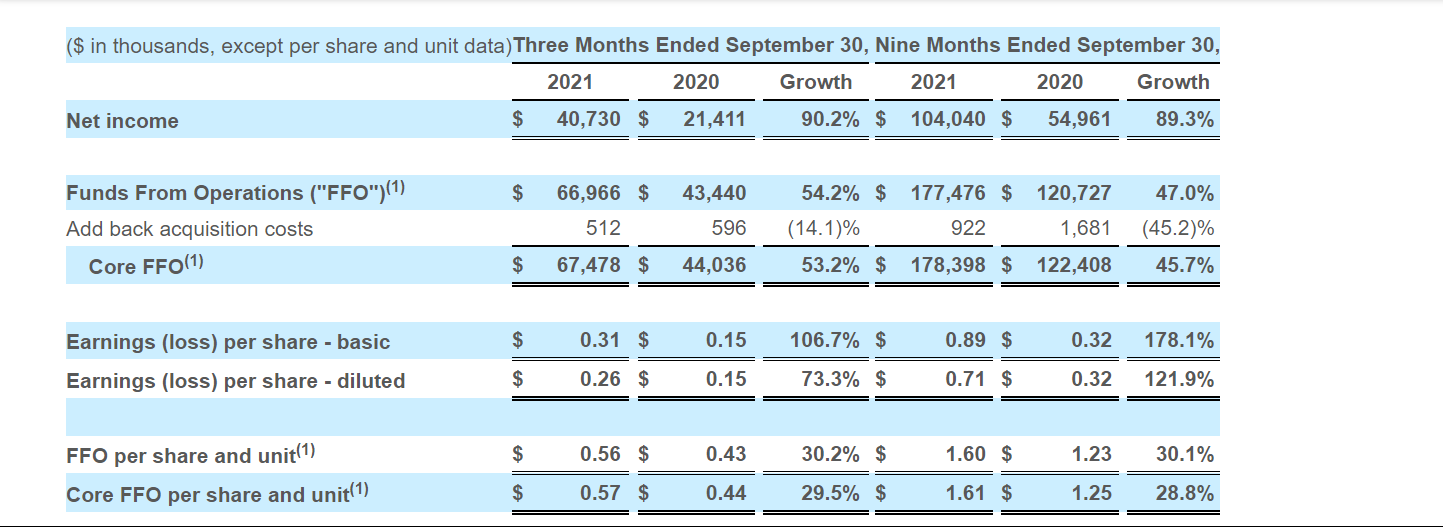

National Storage Affiliates Trust Reports Third Quarter 2021 Results

National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA) today reported the Company’s third quarter 2021 results. Third Quarter 2021 Highlights Reported net income of $40.7 million for the third quarter of 2021, an increase of 90.2% compared to the third quarter of 2020. Reported diluted earnings per share of $0.26 for the third quarter of 2021 compared to $0.15 for the third quarter of 2020. Reported core funds from operations (“Core FFO”) of $67.5 million, or $0.57 per share for the third quarter of 2021, an increase of…