Unless you’ve been hiding under a rock for most of 2022, you know that interest rates are on the rise. The best barometers for commercial real estate interest rates are US Treasuries and LIBOR/SOFR. They are the indices most lenders use to price their loans. Since December 2021, the 10-Year benchmark index has risen over 150 basis points to 2.96% as of May 17, 2022. To be sure, this more than doubling of treasury rates over five months has led to disruption in the market and caused lenders to revisit…

Category: Resources

Rising Interest Rates and Inflation – What Does This Mean for the Sector?

In an environment with rising interest rates and inflation, the U.S. real estate market should prove resilient in sectors with pricing power, strong demand and shorter lease terms, which, have historically performed well. Real estate is an ideal place to park capital in stagflation environments, except where markets are oversupplied and lose pricing power. Fortunately, the self storage sector isn’t oversupplied. Development activity in 2021 for self storage fell from activity levels in 2019, with $3.5 billion versus 2019’s $5.0 billion. REITs do not anticipate significant supply challenges this year.…

Five Questions with Brett Hatcher of the Hatcher-Coe Group of Marcus & Millichap

The self storage industry has certainly demonstrated its resilience over the past several years, gaining the attention of bigger players with access to inexpensive capital. Given the highly competitive investment market, we sat down with Brett Hatcher of the Hatcher-Coe Group of Marcus & Millichap to learn trends he’s observed in recent months. Continue reading below for more information. Question: The competitive environment has made investing in self storage challenging for the traditional investor. How are you seeing buyers adapt? Answer: I am seeing buyers put more equity down. There are…

Evaluating Offers from Four Major Self Storage Buyer Groups

Over the last couple of months, top executives and self storage owners from around the country gathered in Orlando for the SSA Spring meeting and in Las Vegas at the ISS Spring tradeshow to discuss industry trends, investor sentiment and overall market conditions. The consensus is that the industry continues to be cautiously optimistic about performance in 2022 and rising interest rates are on the front of everyone’s mind. We saw the 10-year treasury continue to rise the last couple of weeks with market volatility continuing to gain momentum. Meanwhile,…

Introducing The Hatcher Coe Group of Marcus & Millichap

We are excited to announce that The Hatcher Group of Marcus & Millichap is now The Hatcher Coe Group of Marcus & Millichap. For nearly eight years, Gabriel has been essential in the completion of over 348 self storage transactions totaling close to $2.1 billion. He started from the ground up and continues to build upon his success as both a team player and leader.” “Gabriel has been an integral part of our success and has proven himself year after year, making a great name for himself and our team…

National Storage Affiliates Trust Announces Largest Increase in Quarterly Common Dividend Since IPO

National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA), announced that its Board of Trustees today declared regular cash dividends for the first quarter 2022 payable on March 31, 2022 to shareholders of record on March 15, 2022 on the following securities: a dividend of $0.50 per common share, representing an annualized dividend rate of $2.00. This new rate represents a 43% increase from the first quarter 2021 dividend and an 11% increase from the previous quarter. a dividend of $0.375 per share on the Company’s 6.000% Series A…

Cannabis and the Self Storage Industry

The year is 1983. You dance your way into the kitchen while enjoying Lionel Richie’s smashing new hit “All Night Long”, pour yourself a nice tall glass of Tang and flip on Good Morning America. Poised front and center is the always classy FLOTUS, Nancy Reagan, and you hear her utter that infamous phrase for the first time, “JUST SAY NO.” This phrase has echoed throughout the decades but the war on drugs has shifted tremendously since that point in time. All but two states now have some form of…

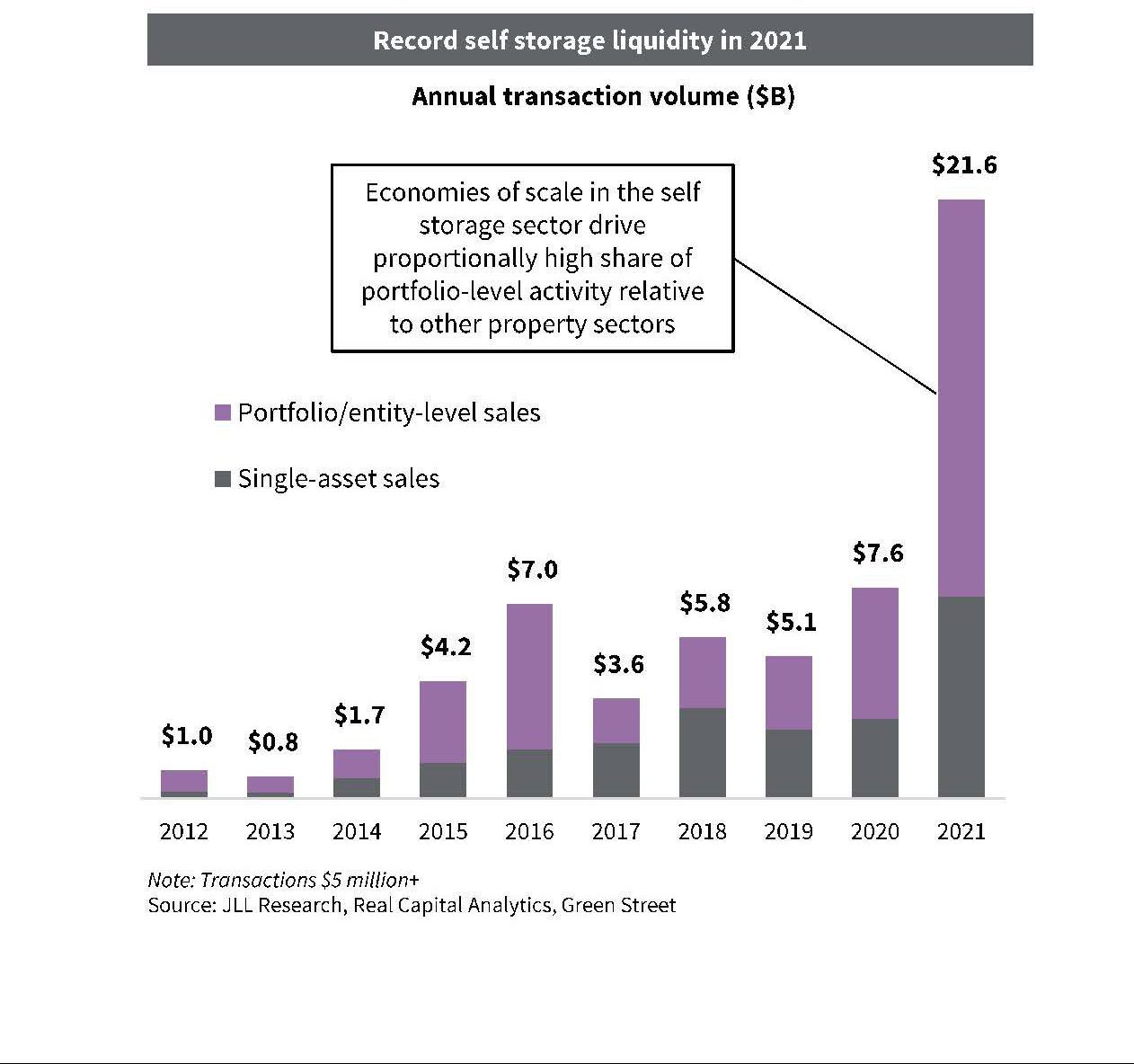

Self Storage Spotlight from JLL

Exceptionally strong fundamentals are driving a flood of capital to self storage. The sector is considered an inflation hedge and the development pipeline has been hampered in the near-term by supply chain constraints. 2021 was a banner year for the self storage sector and, in particular, for the public REITs that posted an average of over 17% same-store NOI growth, far surpassing other sectors. Hence, it was not a surprise that the REITs generated 78% total shareholder returns in the year, ranking among the top of the REIT sub-sector in…

Let the Good Times Roll!

As we kick off 2022, it’s hard to imagine how the self storage market can get any better. Economists continue to prognosticate that the self storage market is sound and actually getting better; brokerage firms continue making rosy forecasts for the industry and your uncle, as predicted, has made his doomsday predictions at the holiday dinner table. The first few weeks of 2022 have confirmed that investor sentiment towards self storage is at an all-time high. Today, stabilized assets are commanding record high pricing while newly developed lease-up properties and…

Storage Property Recognized as Best in State

Local real estate development company, Woodruff Real Estate Services, LLC, has built a self storage facility on a 2.6-acre parcel in Midland, GA. Woodruff Storage of Lakeside opened on May 17, 2021, with the project being completed ahead of schedule. The three-story building provides over 100,800 square feet. Which offers 554 climate-controlled units to the community of the Lakeside Village Apartments and its neighbors in the Columbus/Midland area. Woodruff Storage at Lakeside Village is located at 6950 Ruffie Way, just off the intersection of J R Allen Parkway and Manchester…