Portfolio: Store Your Stuff Two Property Portfolio Locations: Clay and Baldwinsville, NY Brokers and Brokerage: Brett Hatcher, Luke Dawley, Nathan Coe and Gabriel Coe of the Hatcher-Coe Group of Marcus & Millichap NRSF: 83,550 Unit Count: 748 Physical Occupancy: 100% Highlights: Two Property, Syracuse MSA Self Storage Portfolio Multiple Offers Well Above List Price Closed Well Above List Price Climate Controlled and Non-Climate Controlled Units Both Locations Have Dense, Growing and Affluent Surrounding Populations Excellent Locations and Street Frontage Property: Mojave Self Storage Location: Mojave, CA Brokers and Brokerage: Keith…

Featured Broker: Jon Danklefs

First Vice President Jon Danklefs joined Marcus & Millichap in October 2012, was promoted to senior associate in 2016 and appointed to first vice president investments in 2020. Based in San Antonio, Jon focuses his brokerage efforts on self storage properties in Central and South Texas and has successfully closed sales in San Antonio, Corpus Christi, Laredo, the Rio Grande Valley, El Paso, Permian Basin, West Texas, Houston and East Texas. In addition to self storage, Jon has a track record of success with multiple land development and redevelopment sales. Taking…

What Is Cloud Computing and Why Does It Matter for Self Storage?

Researchers predict the global cloud computing market size will be worth more than $1,630 billion by 2030. As of 2019, approximately 94% of companies used cloud computing within its operations. This estimate includes usage among small and medium-sized businesses. There are cloud computing services available for businesses of any size. What Is Cloud Computing? In a nutshell, the term “cloud computing” refers to the process of accessing data or software programs over the internet instead of using a server or computer located on your premises. The cloud enables total access…

Preparing Your Storage Operation for What Comes Next

With yet another summer leasing season underway, the self storage industry is off to a solid start. A recent report from Storable showed that operators started leasing season in May with record high rental rates, with an average monthly unit price of $111.31 per square foot. Rates continued to rise through June reaching $115.88 per month average for all unit types. Operators started the leasing season with record high occupancy as well. The report found a healthy rate of churn through May and June, suggesting that tenant demand is holding…

Aztec Group Arranges $23 Million Refinancing for Self Storage Facility in South Florida

Aztec Group has arranged the $23 million refinancing of a five-story, climate-controlled self storage facility in the Miami suburb of Aventura. Glendale, California-based self storage operator Public Storage operates the property. Built in 2018, the facility offers 84,000 square feet of rentable space across 946 units. Jason Shapiro and Charles Penan of Aztec Group arranged the loan through the direct lender, an affiliate of Miami-based 3650 REIT, on behalf of the borrower, South Florida-based America’s Capital Partners. The nonrecourse, fixed-rate loan will be interest-only for the full 10-year term. Source

Recent Closings: 7.12.2022 – 7.18.2022

Portfolio: Nicol Investment Company’s Self Storage Portfolio Closing Price: $102 Million Locations: Franklin, Hendersonville, Nashville and Two Facilities in Murfreesboro, TN Brokers and Brokerage: Ashley Compton of Colliers Self Storage Group Buyer: Hines Global Income Trust NRSF: 341,202 and 13,445 of Retail Space Unit Count: 3,204 Climate-Controlled Units Details: Carothers – 697-unit, 71,925 net RSF of storage on Carothers Parkway in Franklin, TN Hendersonville – 599-unit, 67,893 RSF of storage with 9,545 SF of 4 ground-floor retail suites on Saundersville Road in Hendersonville, TN Murfreesboro – 577-unit, 67,315 net RSF…

Environmental Report Requirements for SBA Loans

In order to qualify for the SBA’s guaranty for 7a and 504 loans, the SBA requires certain levels of environmental due diligence be performed to provide assurance that the property site value is not hampered by previous contamination or environmental degradation. Reasons for diminished property site value may include: The costs of remediation could impair the borrower’s ability to repay the loan and/or continue to operate the business The value and marketability of the property could be diminished Lender or SBA could be liable for environmental clean-up costs and third-party…

Invesco Real Estate Income Trust Inc. Acquires Two Self Storage Portfolios

Invesco Real Estate Income Trust Inc. (“INREIT”), an institutionally managed, public non-listed REIT, announced today two self storage portfolio acquisitions consisting of five properties located in Bend, Oregon and Clarksville, Tennessee. The combined purchase price was $42 million, bringing INREIT’s self storage portfolio to over $128 million. “Self storage continues to be a strategic sector for INREIT given the ability to increase cash flow relatively quickly,” said R. Scott Dennis, President and Chief Executive Officer for INREIT. “These properties exhibit strong demand and are well-located in their respective markets. We…

Aries Capital Closes $46 Million in Self Storage Financing in CA, CO, FL and TX

Aries Capital of Chicago has closed $46 million in construction, bridge and permanent debt financing for over 414,000 square feet of new and existing self storage facilities in California, Colorado, Florida and Texas. The financing was arranged on behalf of three separate clients by Aries Capital Director of Capital Markets Brandon Perdeck, Director of Acquisitions Matt Carney and Assistant Vice President Steve Adams. The transactions include a $17.5 million construction loan for a self storage facility in Santa Clarita, California for Diamond Development Partners, a unit of Salazar Construction Co.,…

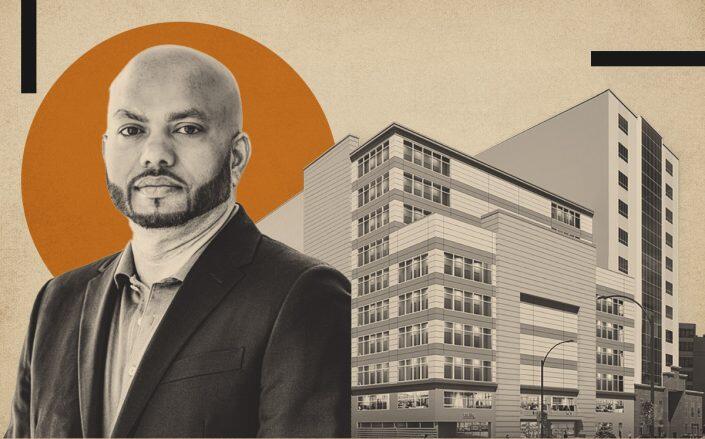

Criterion Sells LIC Self Storage for $80 Million

A few years after Shibber Khan’s Criterion Group first explored selling a Long Island City site on Northern Boulevard, the firm has finally executed a deal. Criterion sold the commercial unit at 31-08 Northern Boulevard to the Carlyle Group for $80 million, public records show. The commercial condo unit spans 180,000 square feet, occupying part of the building’s first floor and the entirety of the remaining floors. The Queens-based development firm bought the development site in 2015 from investor Joel Gluck for $40 million, planning to hold on to it…