Third-party management is turning out to be an acquisition goldmine for Life Storage. Joe Saffire, CEO of the Williamsville, NY-based self storage REIT, said roughly one-third of the 75 facilities purchased so far this year were part of Life Storage’s third-party management platform. Saffire called the company’s third-party platform a “robust acquisition pipeline.” “The hard work of our acquisitions and third-party management teams over the past several years executing on our relationship-based strategy to be well positioned when opportunities become available is clearly paying off,” Saffire said in a Nov.…

National Storage Affiliates Trust Reports Third Quarter 2021 Results

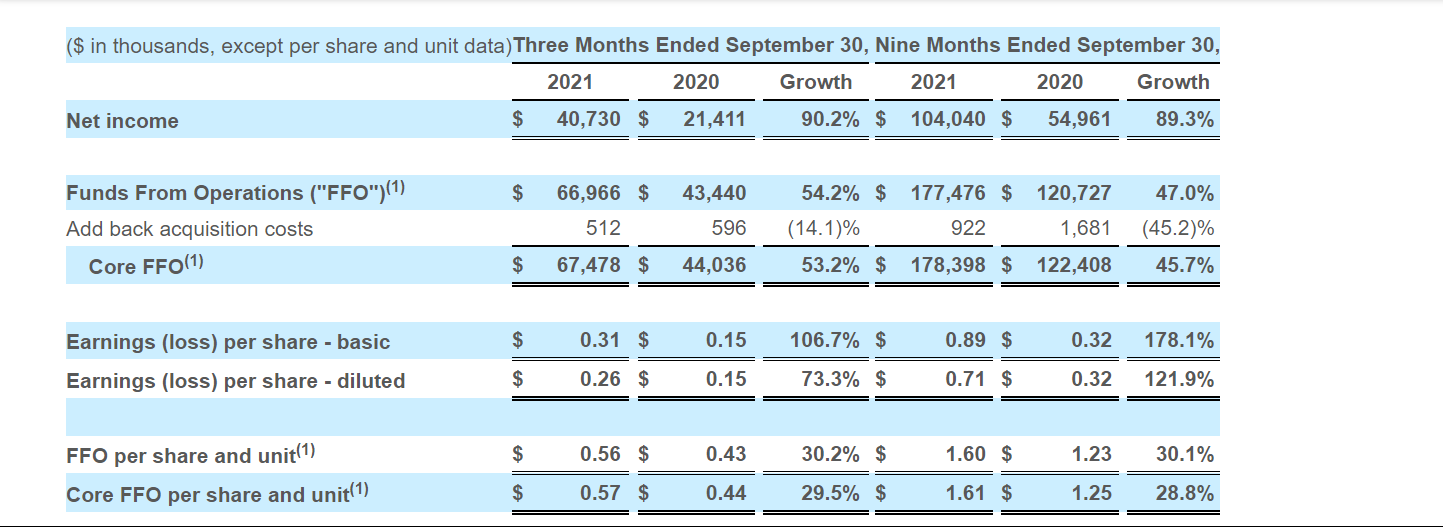

National Storage Affiliates Trust (“NSA” or the “Company”) (NYSE: NSA) today reported the Company’s third quarter 2021 results. Third Quarter 2021 Highlights Reported net income of $40.7 million for the third quarter of 2021, an increase of 90.2% compared to the third quarter of 2020. Reported diluted earnings per share of $0.26 for the third quarter of 2021 compared to $0.15 for the third quarter of 2020. Reported core funds from operations (“Core FFO”) of $67.5 million, or $0.57 per share for the third quarter of 2021, an increase of…

Investor Demand for Self Storage Soars – What Does This Mean for the Sector?

The self storage industry has transformed over the last decade with acquisition volume increasing by more than 35x since 2011 – annual acquisition volume in 2011 totaled approximately $508 million and is expected to reach $18 billion for the year 2021. The resiliency, stable cash flow and low CapEx requirements continue to draw real estate investors to self storage, but more than anything, investors have recognized its relative value versus other real estate asset classes. As stabilized cap rates in the multifamily and industrial sectors compress to historic lows (below…

Cronheim Mortgage Arranges $7.8 Million Refinancing for Self Storage, Retail Asset Near Fort Worth

New Jersey-based Cronheim Mortgage has arranged a $7.8 million loan for the refinancing of a self storage and retail asset located in the Fort Worth area. The property, formerly a grocery-anchored retail center, consists of a CubeSmart-branded self storage facility with roughly 1,000 units and a 10,000-square-foot retail space occupied by Goodwill. David Turley, Janet Proscia and David Poncia of Cronheim arranged the nonrecourse, fixed-rate loan on behalf of the borrower, an affiliate of California-based DealPoint Merrill. An undisclosed national bank provided the loan. The address of the property was…

National Storage Affiliates Trust Acquires 34 Self-Storage Facilities from Inland Private Capital

An affiliate of self storage real estate investment trust and management company National Storage Affiliates Trust (NSAT) has acquired 34 properties from investment-management firm Inland Private Capital Corp. (IPCC) for $265 million. The facilities comprise a total of 2.1 million square feet across four states. They were packaged in three IPCC-sponsored Delaware statutory trust (DST) programs, according to a press release. The storage sector has seen a dramatic increase in institutional demand for large scale, self storage transactions over the past 12 months and, as a result, we believed a…

Absolute Storage Management Reports 2021 Third Quarter Results

Absolute Storage Management (ASM), a leading third-party management company for self storage facilities in the United States, announced operating results for the three and nine months ended September 30, 2021. 2021 Highlights for Three Months Ended September 30, 2021: Increased same-store revenue by 17.1% compared to the same period in 2020. Achieved net operating income (NOI) of 22.5% in the same period in 2020. Acquired three (3) management contracts of operating facilities. 2021 Highlights for Nine Months Ended September 30, 2021: Increased same-store revenue by 13.9% vs. the same period…

Ackerman & Co. and Trout Daniel & Associates Represent StorageMart in Acquisition of 73,183 Square-Foot Self Storage Facility

Ackerman & Co. and Trout Daniel & Associates (TD&A) have brokered the acquisition of a 73,183-square-foot CubeSmart Self Storage facility in Fishers, IN on behalf of StorageMart. The facility, located at 10415 Allisonville Road, features a combination of 41 percent drive-up and 59 percent interior climate controlled self storage units. This property offers an outstanding location and demographics. Fishers, Indiana, is an affluent suburb of Indianapolis with a fast-growing population.” David Paulson, Stephen Lapierre and Wyatt Whitaker of Ackerman Co. and Steven Cornblatt and Coleman Tirone of Trout Daniel &…

Featured Broker: Mike Mele

Mike Mele leads Cushman & Wakefield’s national Self-Storage Capital Markets Team. With more than two decades of experience as a self storage advisor, since joining C&W, Mike has galvanized his team to close around 447 self storage transactions totaling more than $5.6 billion. Accomplishments Chairman’s Circle of Excellence Award, Marcus & Millichap Chairman’s Club Award, Marcus & Millichap Top 5 Self-Storage Sales Broker, Marcus & Millichap – 1999 – 2000, 2002 – 2012, 2014 – 2018 National Achievement Award, Marcus & Millichap – 2003 – 2008, 2010 – 2018. 13-time…

Public Storage Enhances Portfolio Coverage

Public Storage (NYSE:PSA), the leading owner, acquirer, developer and operator of self storage properties, announced today the acquisition of the high-quality All Storage portfolio for $1.5 billion. The portfolio comprises 56 self storage properties (7.5 million net rentable square feet) primarily located in the growing Dallas-Fort Worth market. The 52 properties in Dallas-Fort Worth add prominent locations in new, high-growth submarkets in addition to complementary locations in Public Storage’s existing submarkets. With the addition of the acquisition properties, the Company’s Dallas-Fort Worth portfolio will be unmatched in coverage and quality,…

Life Storage Pays $43 Million for Two Buildings in Miami-Dade

A New York-based real estate investment trust made a hefty play on the Miami-Dade County self-storage market with the $43.5 million purchase of two facilities. Life Storage bought the buildings at 201 Northwest 37th Avenue and 6850 Southwest 81st Terrace in two deals. Entities tied to Kirchhoff Companies sold the buildings. Life Storage paid $22.5 million for the eight-story, 142,207-square-foot building on 37th Avenue. The property, which is in Miami, was constructed in 2018, property records show. Kirchhoff’s affiliate bought the 0.7-acre lot in 2016 for $1.3 million. In the…