Self-storage investors are currently enjoying a rapidly rising stock market and surprisingly very stable debt market, albeit at elevated interest rates to the Covid era, but by historical standards, in line with the 30-year averages. However, it is clear that there is a bifurcation in the investment market with Class A, major market properties commanding a premium valuation and still historically low cap rates, while secondary and tertiary market properties struggle to find buyers. Willing and able buyers, in turn, are expecting widely expanded valuations and meaningfully higher cap rates.

Over the last 10-15 years, we have seen Class A, major market deals priced at record high valuations, with secondary and tertiary market properties following suit. During this time, the cap rate spread between major market deals and the rest of the industry compressed to levels where they essentially priced at the same risk-adjusted rate of return, with no discount provided for the secondary and tertiary market dynamics. Over the last 6-12 months, we have seen this drastically change as Class B and C properties in secondary and tertiary markets are now valued using cap rates that are 200 to 400 basis points higher than major markets. This puts secondary and tertiary market cap rates in the 7%-9% range, with most deals pricing in mid-7%’s to mid- 8%’s on a cap rate basis.

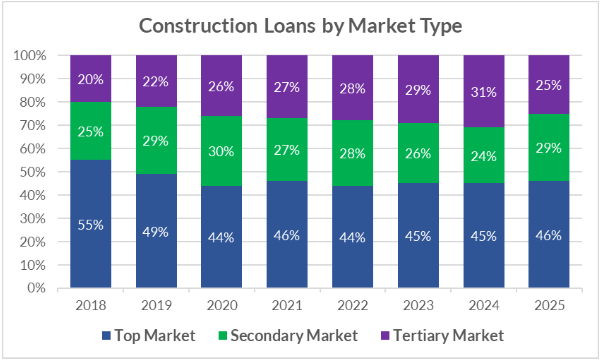

One of the main reasons for this bifurcation in the market is that traditional bank debt is still pricing in the mid-6%’s to mid-7%’s with 25-year amortizations, putting most self-storage deals in a negative leverage situation. The other major stress point is that new development has shifted to smaller markets, with more than half of the construction lending occurring in smaller markets for the last 5 or 6 years, as shown in the chart below. This is largely due to the ease of new construction in secondary and tertiary markets, along with some very aggressive sales comps that were completed during the Covid era, compelling developers to move forward with new developments in these smaller markets.

This increase in new supply and softening market fundamentals has put undue pressure on the self-storage projects in secondary and tertiary markets. It is unlikely that these market conditions will improve anytime soon due to slower population growth, slower new job growth, and persistent soft market fundamentals in secondary and tertiary markets. These market conditions and wavering investor sentiment have pushed most investors to a flight to quality in major markets.

Over the last 6-12 months, Class A stabilized deals in major markets are commanding very aggressive pricing with cap rates in the high-4%’s to mid-5%’s for the very best deals. This has been driven by a meaningful slowdown in new supply, strong job growth, and return to office mandates in many major markets. It’s also worth noting that the buyer pool for major market deals is very deep – our bid sheets are littered with the “who’s who” of self-storage investing – as they all believe that we are bouncing along the bottom of the market. They are buying into currently depressed market fundamentals with the hope that once the housing market picks up steam, there will be a resurgence of self-storage demand.

The self-storage market is putting a high priority on quality over quantity today with a heavy emphasis on population density, population growth, income levels, and overall high barriers to entry that are only present in the major markets today. This change in the self-storage investment landscape has left many secondary and tertiary owners yearning for higher values, while major market owners are continuing to reap the benefits of the flight to quality. However, this has also created an opportunity for investors willing to take more risk and looking for higher yields to make a meaningful impact in secondary and tertiary markets today, with the thesis that we will see compression in cap rates in these markets once the self-storage market rebounds.

Author: Ben Vestal – Argus Self Storage Advisors