StorageVault (SVI-TSX) has agreed to acquire seven stores from seven vendor groups for an aggregate purchase price of $171,600,000, subject to customary adjustments. Six of the acquisitions are arm’s length and one, totaling $14,000,000, is a related party acquisition with Access Self Storage Inc. as the vendor. It is anticipated that the acquisitions will close in Q2 and Q3 2022. Six of the assets are located in Ontario (four are core GTA) and one in Alberta. The acquisitions will result in StorageVault owning 204 stores and owning and managing 236…

Author: Alison DeJaeger

KKR Buys Five Sunbelt Self Storage Assets for $98 Million

Strong population growth and in-migration across the Sunbelt markets continue to fuel interest by leading real estate firms wanting in on self storage facilities. KKR acquired five new self storage properties totaling approximately 4,100 units from four different sellers through three deals for an aggregate purchase price of approximately $98 million. The properties are located in Phoenix, Arizona; Dallas, Texas; San Antonio, Texas and Palm City, Florida and are expected to bring “outsized demand over the medium to long term,” according to a release. The purchases were made through KKR’s…

Suburban Philadelphia Mixed-Use Project Financed with $42.95 Million Loan

JLL Capital Markets announced today that it has arranged a $42.95 million loan facility for the redevelopment of Drexeline Town Center, a to-be-built, 348,185 square-foot, mixed-use, ShopRite-anchored project with multi-housing, retail and self-storage space in the Philadelphia-area community of Drexel Hill, Pennsylvania. JLL worked on behalf of the borrower, a partnership between affiliates of MCB Real Estate, LLC and The Hampshire Companies, to place the loan with Investors Bank, a division of Citizens Bank. Loan proceeds will enable the borrower to complete the project. Drexeline Town Center will be a cohesive, walkable, “town…

Gantry Secures $130 Million of Permanent Financing for Multi-State Self Storage Portfolio

Gantry, the largest independent commercial mortgage banking firm in the U.S., has secured $130 million of permanent financing for a six-property Trojan Storage-owned self storage portfolio totaling approximately 600,000 rentable square feet across facilities in California, Oregon and Washington. The properties include three newly completed, pre-stabilized storage facilities located in California, and three recently acquired existing facilities in California, Oregon and Washington, targeted for their value-add potential as occupancy and rents are adjusted to market rates while quality is improved to align with the standards of the Trojan Storage brand.…

Global Market Overview

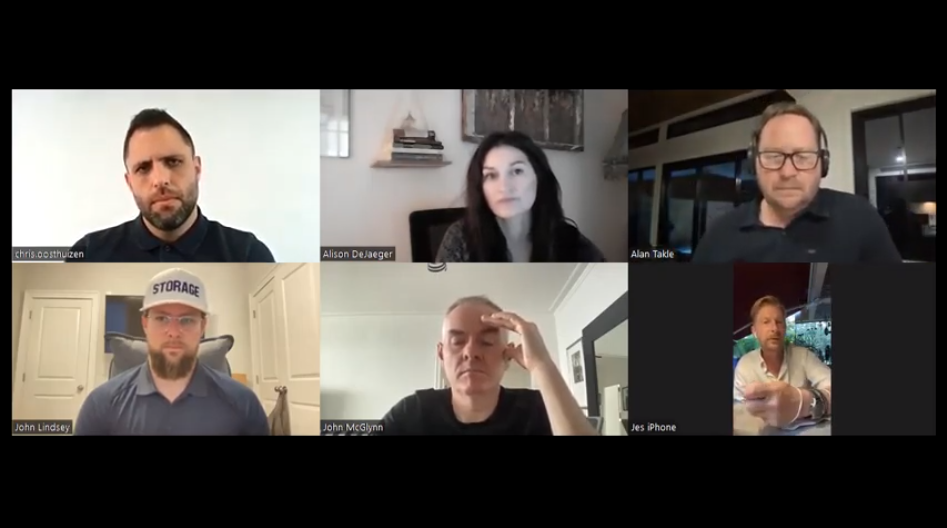

In this global video chat, we’ll discuss trends in different countries, unique storage operational practices, demand drivers in specific areas and more. John C. Lindsey of Lindsey Self Storage Group represents the US, Alan Takle of Takle Developments represents Australia, Chris Oosthuizen of Stor-Age represents South Africa, John McGlynn of Scottish Capital represents the UK and Jes Johansen of Store Friendly represents Singapore.

Schulman Properties Lands Equity Financing for Self Storage Project

Schulman Properties has obtained $8.7 million in joint venture equity financing for Dixie Self Storage, a 1,068-unit self storage facility underway in North Miami Beach, Fla. An opportunity zone fund entered the 10-year partnership arranged by Northmarq. In July, the developer acquired the 1.37-acre site for $5.3 million, with the assistance of Lee & Associates. Dixie Storage SPE, an affiliate of Schulman Properties, broke ground on the facility last month, after landing a $17.8 million construction loan from Pacific Western Bank, public records show. Located at 15699 W. Dixie Highway, in an Opportunity Zone…

Ready Capital Closes $22.8 Million Loan for Acquisition of Self Storage Portfolio in Metro Columbus

Ready Capital has closed a $22.8 million loan for the acquisition and stabilization of a 1,649-unit self storage portfolio located in the metro Columbus cities of Grandview Heights and Upper Arlington. The nonrecourse loan features interest-only payments, a floating rate and a three-year term. The borrower was undisclosed. Source

Recent Closings: 5.3.2022 – 5.9.2022

Property: CubeSmart Self Storage (Managed) Closing Price: $8.505 Million Location: Chattanooga, TN Buyer: York Pc Chtn1 LLC. Seller: Chattanooga Storage LLC. Property: CubeSmart Self Storage (Managed) Closing Price: $4.672 Million Location: Chattanooga, TN Buyer: York Pc Chtn1 LLC. Seller: Dyersburg Self Storage Fund LLC. Property: Storage Star Location: Federal Way, WA Brokers and Brokerage: Tasso Douglas, Jesse Cameron, Brett Hatcher, Gabriel Coe and Jacob Becher of the Hatcher-Coe Group of Marcus & Millichap Buyer: SecureSpace NRSF: 92,244 Unit Count: 803 Non-Climate Controlled Units and 15 Outdoor Parking Spaces Building Count:…

Five Questions with Brett Hatcher of the Hatcher-Coe Group of Marcus & Millichap

The self storage industry has certainly demonstrated its resilience over the past several years, gaining the attention of bigger players with access to inexpensive capital. Given the highly competitive investment market, we sat down with Brett Hatcher of the Hatcher-Coe Group of Marcus & Millichap to learn trends he’s observed in recent months. Continue reading below for more information. Question: The competitive environment has made investing in self storage challenging for the traditional investor. How are you seeing buyers adapt? Answer: I am seeing buyers put more equity down. There are…

Evaluating Offers from Four Major Self Storage Buyer Groups

Over the last couple of months, top executives and self storage owners from around the country gathered in Orlando for the SSA Spring meeting and in Las Vegas at the ISS Spring tradeshow to discuss industry trends, investor sentiment and overall market conditions. The consensus is that the industry continues to be cautiously optimistic about performance in 2022 and rising interest rates are on the front of everyone’s mind. We saw the 10-year treasury continue to rise the last couple of weeks with market volatility continuing to gain momentum. Meanwhile,…