Public Storage recently reopened its facility adjacent to offices of Apple Inc in Cupertino, CA after completing an expansion and major high-tech upgrades. The facility at 20565 Valley Green Drive, now has two five-level buildings and grew from 51,000 square feet to 195,000 square feet. The number of units has jumped from 585 to 2,593. The facility offers contactless app-enabled digital property access and account management. The remodeled facility is now able to achieve LEED Silver status with the addition of sustainable features such as solar panels and LED lighting.…

Recent Transactions: 12.13.2022 – 12.19.2022

Property: Tiger Town Storage Location: Opelika, AL Broker and Brokerage: Kris Knowles of Midcoast Properties, Inc NRSF: 51,975 Acreage: 5.8 Unit Count: 327 Highlights: Standard drive-up and climate-controlled units 24- hour digital surveillance Fencing and electronic keypad gate access U-Haul truck rentals Property: Newly Constructed Self Storage Facility Location: New Rochelle, NY Brokers and Brokerage: Dustin Stolly and Jordan Roeschlaub of Newmark Buyer: Maya Capital Partners and Artemis Real Estate Partners NRSF: 96,693 Unit Count: 1,120 Property: Pines West Storage Center Closing Price: $17 Million Location: Pembroke Pines, FL Buyer:…

Newmark Arranges $300 Million Self Storage Joint Venture with Maya Capital Partners and Artemis Real Estate Partners

Newmark announces that the firm has arranged a $300 million programmatic joint venture between Maya Capital Partners and Artemis Real Estate Partners focused on high-quality value-add self storage assets in the Northeastern United States. The Newmark team was led by Vice Chairmen and Co-Heads of the Debt & Structured Finance team Dustin Stolly and Jordan Roeschlaub. Transactions will comprise both marketed and off-market acquisitions of high-quality value-add properties and certificate of occupancy lease-up plays with the goal of creating a diverse portfolio of assets. The Venture was seeded by the…

The Year Ahead in Storage

In this educational video chat, we’re joined by industry veterans Mike Mele of Cushman & Wakefield, Shawn Hill of the BSC Group and Liz Schlesinger of Merit Hill Capital to discuss predictions for 2023. Storage has had a great couple of years but what can we expect with changing interest rates and decreasing occupancies? This group offers insights on the how the industry is transforming, development activity, market evaluation strategies and much more. Where is the self storage sector headed in 2023? Tune in to find out!

Recent Transactions: 12.06.2022 – 12.12.2022

Property: Savannah HWY6 Storage Location: Rosharon, TX Brokers and Brokerage: Steve Mellon, Brian Somoza, Adam Roossien and Matthew Wheeler of JLL Buyer: Montfort Capital Partners Seller: Quintet Capital Group Acreage: 6.1 Unit Count: 678 Property: Stafford, VA Self Storage Facility Location: Stafford, VA Buyer: Arcland Property Company Acreage: 7.21 Unit Count: 943 Highlights: Climate-controlled and drive-up storage units On-site manager 24-hour video recording Elevator-accessible units Property: Champion Storage Location: Sheboygan, WI Broker and Brokerage: Sean Delaney of Marcus & Millichap Buyer: Rogers Equity Group IV, LLC Seller: JGSS, LLC NRSF:…

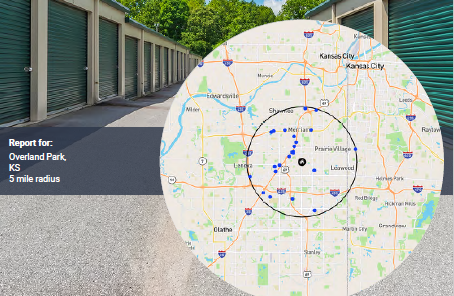

Overland Park, KS

Using the Market Discovery Tool from StorTrack Explorer, we were able to view market data on Overland Park, the second most populous city in the state of Kansas. With 20 stores in the city, the square footage per capita is less than six. There are two development projects in the pipeline, adding an additional 119,000 square feet by the end of 2023. However, with population projections, demand should offset this new supply. While the average rate per square foot remains relatively consistent in Overland Park (see above), the spread between…

Featured Broker: Parker Johnson

With an in-depth understanding of real estate market dynamics and utilization of data driven technology, Parker has proven to be a valuable asset to Storage Exchange and its clients. Prior to joining the Storage Exchange team, Parker worked as a residential real estate agent with Keller Williams in Newport Beach, CA. Connect with Parker: parker@storageexchange.com 949-533-6977

Recent Transactions: 11.29 – 12.6

Property: Michigan Center Storage Location: Michigan Center, MI Broker and Brokerage: Kirk Martin of the Lindsey Self Storage Group NRSF: 41,395 Property: Woodbury, CT Storage Development Opportunity Location: Woodbury, CT Brokers and Brokerage: Luke Dawley, Nathan Coe, Brett Hatcher and Gabriel Coe of the Hatcher-Coe Group of Marcus & Millichap NRSF: 23,690 Units: 217 Climate-Controlled Units Highlights: Fully Approved Class-A, All Climate Controlled, Single-Story Facility Affluent Area: Average Household Income of $138,630 for People Living within a Three Mile Radius Litchfield County Is an Affluent Secondary Home Market with High…

PTI Security Systems Announces David Shaw as Managing Director

PTI Security Systems, the global leader in access control technologies for the self storage industry, announced today that David Shaw will be named as managing director effective December 1, 2022. David Shaw joined PTI as the director of engineering in January 2018. As the director of engineering, he played a key role in advancing PTI’s cloud-based access control solution, StorLogix Cloud, and has led several initiatives to improve the technology enabling PTI’s hardware and software solutions. He has more than 20 years of executive experience in various engineering and information…

Five Ways Cloud Computing Benefits Self Storage Operations

Cloud computing creates new opportunities for self storage operations by relocating data and applications from on-premise servers to the cloud. Although specific features vary based on the cloud solution, there are several ways it can benefit your self storage business. 1. Enhanced control. The cloud improves facility management by extending the functionality of access control keypads, lighting, HVAC and other smart connected devices. The centralization of data expands the potential to monitor, control and command nearly any device in your network. 2. Lower costs. Cloud computing reduces costs by minimizing…