Well, most kids are back in school and summer vacations have come and gone. It is time to get back to work and down to business. First, let’s touch on the economy. Many experts believe we have hit peak inflation and certainly the trend is moderating. The long-term impact on CRE remains to be seen, but the unique attributes of self storage assets (short-term leases, non-concentrated rent roll, etc.) should continue to prove beneficial compared to other sectors. It’s one more reason institutional investors find the self storage business an…

Reeling in Recruits

Demand for workers has been a prevalent topic across the nation in recent months. We have seen more and more opportunities become available to job seekers, meaning more options for employment and a greater need to convince applicants that your company is the place to be. With that being said, how can the recruiting process be adjusted to show greater success? Try Texting Consider communicating with candidates primarily through text. Let’s face it, the spam folder located in everyone’s email inbox is filled to the brim with messages that are…

Featured Broker: Maggie Steury

With an extensive background in self storage operations and management, Maggi brings a wealth of knowledge and unique insights to every transaction. Prior to joining Storage Exchange, Maggi served as vice president of operations at Red Dot Storage, where she oversaw 170+ facilities across 16 states. Subsequent to Red Dot Storage, Maggi served as co-founder and president of StoreLine Self Storage. Maggi earned a BA from the College of Media & Communication at the University of Colorado, where she was also a co-captain of the women’s soccer team.

Recent Transactions: 8.16.2022 – 8.23.2022

Portfolio: Self Storage Portfolio of 11 Properties Locations: San Francisco, CA Bay Area, Portland, OR and Austin, TX Brokers and Brokerage: Steve Mellon, Brian Somoza, Adam Roossien and Matthew Wheeler of JLL Capital Markets Seller: Pegasus Buyer: SecureSpace Self Storage NRSF: 650,000 Unit Count: 6,550 Portfolio: Extra Space Managed Two-Property Portfolio Closing Price: $23.6 Million Locations: Salisbury and Mooresville, NC Broker and Brokerage: Morgan Windbiel of CBRE’s Self Storage Advisory Group Seller: Lakeland Village NRSF: 136,994 Unit Count: 1385 Property: MAX Storage Closing Price: $26.95 Million Location: Hurricane, UT Broker…

RVParkIQ.com Introduces Listing and Data Platform to Serve RV Park and Campground Investment Community

RVParkIQ.com, the premier platform for listing and evaluating RV park and campground investment opportunities, has officially launched with 214 listings and market data on more than 11,100 properties to serve the growing RV park and campground property acquisition community in the US. RVParkIQ.com will be a part of Aggregate Intelligence’s market data division along with List Self Storage (ListSelfStorage.com), which connects buyers and sellers of self storage facilities, development land and conversion opportunities, and StorTrack, the world’s leading self storage market data provider. The RVParkIQ.com platform will offer investors access…

SBA 504 Program Appraisal Rule Change

On July 29, 2022 the Small Business Administration (SBA) released SBA Procedural Notice 5000-835230, revising procedures relating to commercial real estate appraisals that CDCs must submit to the Sacramento Loan Processing Center (SPLC) for approval. Under current SBA procedures, if the appraisal that CDCs must submit for approval to the SLPC is less than 95% of the estimated value of the commercial real estate, the debenture (the 25-year fixed rate loan) must be reduced or the CDC must secure additional collateral or additional investment from the borrower and/or guarantors. SBA…

IWC Approves Commerce Road Self Storage Facility in Newtown, CT

Newtown Inland Wetlands Commission (IWC) voted on a proposed self storage facility during its meeting at Newtown Municipal Center on July 27. IW Application #21‐16 by 19 Commerce Road, LLC, is for a property located at 19 Commerce Road, to construct a self-storage facility with five buildings and 37,000+ square feet of regulated activity including grading, filling and construction. At the IWC’s previous meetings, on July 13 and June 22, the applicant’s representative was Engineer Larry Edwards, of J. Edwards & Associates LLC. He presented plans to the commission for…

Bonus Depreciation Benefits Are Being Reduced: What Does This Mean for Self Storage Owners and How Can You Take Advantage Before It’s Too Late?

Janus International Group, Inc. (NYSE: JBI) (“Janus”), the leading global manufacturer and supplier of turn-key building solutions and new access control technologies for the self storage and other commercial and industrial sectors, today announced that bonus depreciation benefits are being reduced, what that means for self storage owners and how they can take advantage of it before it’s too late. While to some in the self storage industry, cost segregation studies may seem like a bourgeoning concept, the truth is, owners have been taking advantage of the significant tax benefits…

Recent Transactions: 8.9.2022 – 8.15.2022

Property: U-Haul Closing Price: $18 Million Location: East Wenatchee, WA Broker and Brokerage: Christopher Secreto of Marcus & Millichap Property: KO Storage Closing Price: $4.39 Million Location: Rochester, MN Buyer: Storage Rentals of America Seller: KO Storage NRSF: 52,500 Unit Count: 332 Property: KO Storage Closing Price: $2.1 Million Location: Austin, TX Buyer: Storage Rentals of America Seller: KO Storage Property: U-Stor-It Location: Crete, IL Brokers and Brokerage: Jeffrey L. Herrmann and Sean M. Delaney of Marcus & Millichap NRSF: 30,860 Room for Expansion: Yes, 34,000 NRSF Occupancy: 91% Property:…

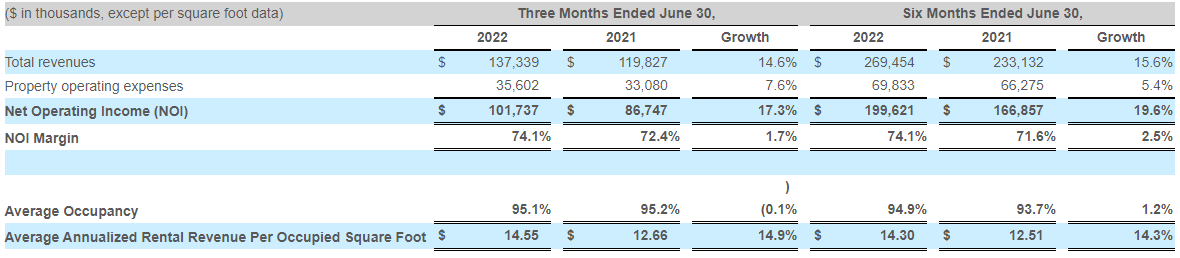

National Storage Affiliates Trust Reports Second Quarter 2022 Results

National Storage Affiliates Trust (NYSE: NSA) today reported the company’s second quarter 2022 results. Second Quarter 2022 Highlights Reported net income of $48.4 million for the second quarter of 2022, an increase of 35.7% compared to the second quarter of 2021. Reported diluted earnings per share of $0.24 for the second quarter of 2022 compared to $0.25 for the second quarter of 2021. Reported core funds from operations (“Core FFO”) of $91.6 million, or $0.71 per share for the second quarter of 2022, an increase of 29.1% per share compared…