In the highly competitive self-storage industry, mastering your sales funnel is crucial for turning inquiries into loyal customers. A well-structured sales funnel guides prospects from awareness to action with intentional messaging, follow-up, and service strategies. Start by understanding who manages your funnel—on-site teams, off-site reps, or a hybrid model—and tailor your process to ensure each lead is nurtured effectively. Clear communication is essential. Train your team to build rapport quickly during phone calls, capturing key details early, and ensuring your phone systems, call tracking, and coaching tools are functioning flawlessly.…

Category: Featured Home Slider

Build, Buy, Sell

Over the past decade, the influence of Private Equity investing in all aspects of the self-storage industry has been profound. Up until late 2002, when NCREIF (National Council of Real Estate Investment Fiduciaries) started tracking self-storage as an asset class, there were the REITs and private sources of capital, with very few sources in between. Private Equity started investing in the industry in earnest in the mid-2010s and now accounts for almost half of all self-storage investing (Preqin, Yardi, Nareit). Hold Period A few of the impacts include a more…

Sell Your Facility for 20% More with Seller Financing

We’re seeing an increasing number of self-storage deals closing with the seller being the lender and financing the deal. Any facility we list for sale with seller financing available always attracts higher levels of buyer interest, which results in more offers and an eventual sale price 15-20% higher than the market. As an added benefit, the seller doesn’t have to figure out how to invest the sale proceeds, and they receive monthly interest payments during the loan term. Loan terms are always negotiated between buyer and seller, and the most…

Marcus & Millichap Capital Arranges $7.9 Million Financing For a Self-Storage Property in Hamilton, Ohio

Marcus & Millichap Capital Corporation (MMCC), a leading provider of commercial real estate capital markets financing solutions, arranged $7.9 million in financing for a 928-unit, 122,620-square-foot self-storage property located at 1861 Dixie Highway in Hamilton, Ohio. Doug Brooks, managing director in MMCC’s Columbus office, secured the financing with a national bank on behalf of a private client. “This was a cash-out transaction for a repeat client,” said Brooks. “The process unfolded smoothly, and we were pleased to support the client with a full-term, interest-only structure that met their goals.” Terms…

StateStreet Group, LLC (SSG) Announces Grand Opening of its Newest StowAway Self Storage Facility in Jackson, MS

StateStreet Group, LLC (SSG) is pleased to announce the grand opening of its newest StowAway Self Storage facility in Jackson, near the north Fondren neighborhood. Located at 5330 N. State Street, the facility delivers more than 34,000 square feet of premier storage space with over 250 units, designed to meet a wide range of residential and commercial storage needs. “We’re excited to introduce our latest facility in this community, offering the convenience and flexibility our StowAway customers expect,” said SSG President Justin Peterson. StowAway Fondren is a modern, fully fenced…

Inland, Devon Completes Self-Storage Adaptive Reuse Project in St. Louis, Missouri

Inland Real Estate Investment Corp. and Devon Self Storage have completed an 80,217-square-foot self-storage facility with 797 units in St. Louis. The project at 4222 Union Blvd. involved the conversion of a warehouse into a climate-controlled self-storage property. The three-story facility features a 24-hour security system and is situated near I-70. Approximately 75 per cent of St. Louis’ self-storage inventory is comprised of converted properties from prior uses, according to Inland, which maintains a self-storage portfolio of more than $1.8 billion in assets under management. Devon currently manages 190 properties…

Broadstreet Global Announced Major Expansion of its Self-Storage Investments Across the Southeast

Private equity firm Broadstreet Global has announced a significant expansion of its self-storage investment platform, unveiling plans to develop more than 25 state-of-the-art facilities across high-growth Southeastern U.S. markets. With 15 projects currently underway and over 8,100 units in the pipeline, the firm is doubling down on what it sees as a compelling real estate opportunity driven by demographic and housing trends. Headquartered in Greenville, SC, Broadstreet is aligning its self-storage growth with its broader strategy of co-locating facilities near its infrastructure and residential developments to capitalize on regional population…

Garrett Development, Willmeng Break Ground on Self-Storage Facility in Peoria, AZ

Garrett Development Corp. (GDC), with Willmeng Construction as general contractor, has broken ground on a 110,136-square-foot self-storage facility at 24027 N. Lake Pleasant Parkway in Peoria. Designed by RKAA Architects, the facility will feature 1,129 square feet of office space, 53,939 square feet of storage on the first floor and 55,068 square feet of storage on the basement level. Construction is slated for completion in June 2026, with the facility scheduled to open by the third quarter of 2026. Source

Gantry Secures $10 Million Refinancing for Self-Storage Facility in Oahu, HI

Gantry has secured a $10 million permanent loan to refinance maturing debt for a self-storage facility in Kaneohe on the Hawaiian island of Oahu. The two-story, climate-controlled facility features 698 units encompassing 50,135 rentable square feet. Public Storage manages the property, which is located at 46-004 Kawa St. Robert Slatt and Alex Poulos of Gantry arranged the five-year, fixed-rate loan through a regional bank for the borrower, a private real estate investor. Source

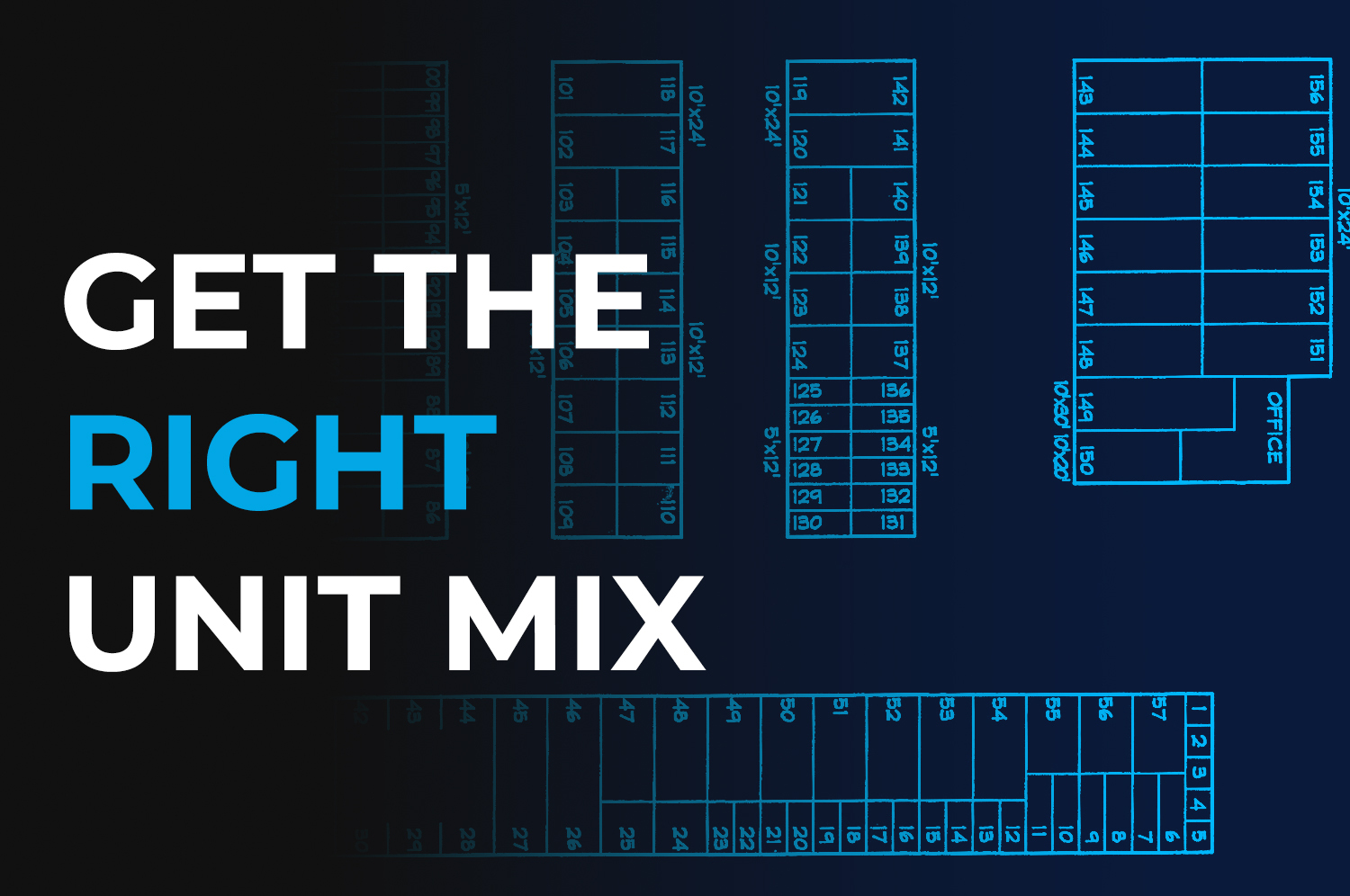

How to Optimize Your Self Storage Unit Mix

If you want to maximize your facility’s revenue, occupancy, and customer satisfaction, you’ve got to have the right unit mix. It’s not just about how many units you have—it’s about having the right types and sizes that fit the needs of your market. Whether you’re opening a new facility or reassessing an existing one, understanding how to tailor your unit mix to meet demand can transform your profitability. Start With Market Demand, Not Assumptions Matching your unit mix to local market demands is an exercise in product-market fit. This concept…