In recent years, Opportunity Zones have become one of the most talked-about strategies in real estate investing. Designed by the U.S. government to encourage investment in underserved communities, these zones offer investors a unique chance to not only grow wealth but also create positive community impact. So, what exactly are Opportunity Zones—and why should you consider adding them to your portfolio? Let’s break it down. What Are Opportunity Zones? Opportunity Zones are geographic areas designated by the federal government to encourage long-term investment and economic development in distressed communities. When…

Category: Featured Home Slider

5 Ways to See a Quick Payoff with Your Renovations

If you’ve been taking a wait-and-see approach to costly renovations or repairs this year, it’s not too late to get started with the right strategies—and by acting now you can see a big payoff. In fact, recent changes to the federal tax code and bonus depreciation offer significant tax savings for property owners who invest in improvements. Check out “The Complete Guide to Self-Storage Renovations and Cost Segregation” to find out what that means for you, including next steps for estimating potential savings. You’ll find that many products and services…

Recent Self-Storage Transactions: 09.24.2025 – 09.30.2025

Recent self-storage transactions show continued investor interest in the sector, with activity spanning a variety of markets and asset types. Deals include stabilized properties, development sites, and portfolio acquisitions, reflecting strategies to expand market presence, increase operational scale, and position for long-term growth. Demand remains steady, supported by consistent occupancy levels and opportunities to enhance revenue through improved management and pricing strategies. Property: Pioneer Storage Location: Mesquite, Nevada Year Constructed: 2015 Seller: TK Storage (Tyler Kohler) Brokers and Brokerage: Jordan Farrer of The LeClaire-Schlosser Group of Marcus &…

Smarter Listings Start with Better Data: How StorTrack Helps You Win Deals

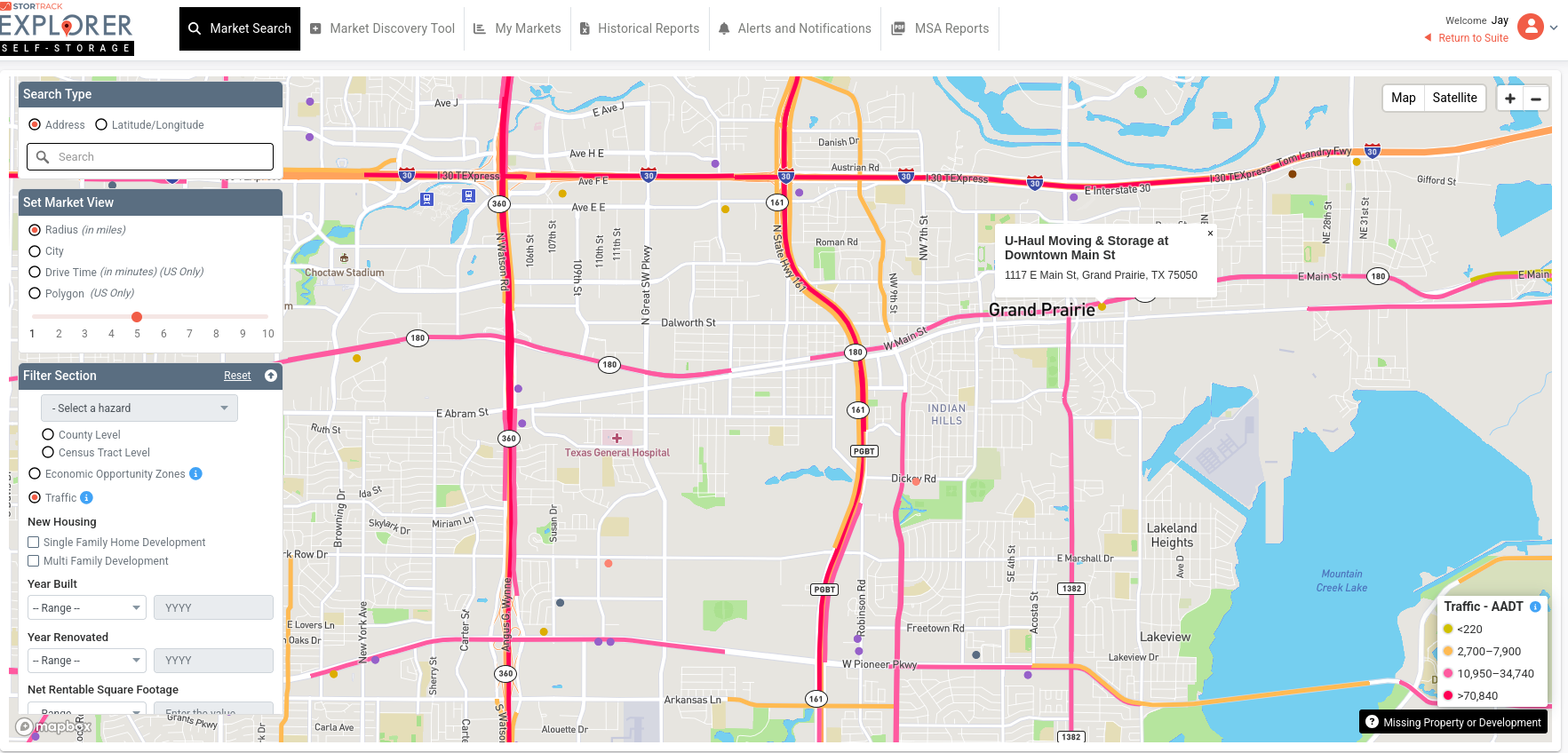

In a market where smarter decisions mean faster deals, StorTrack’s latest Explorer features give brokers and sellers an edge. From understanding where the demand is highest with Traffic Data, to assessing risk upfront with FEMA Risk Zones, and identifying hidden value in Economic Opportunity Zones—Explorer now brings sharper insights that help you market, price, and position listings more strategically. Whether you’re pitching a deal or advising a client, these tools put powerful, real-world data at your fingertips. Why Traffic Data Matters In today’s competitive market, accurate visibility into consumer demand…

New Self-Storage Facility Opens in Ferguson Township, Pennsylvania

One of several new self-storage facilities planned around the State College area recently opened its doors. Brickwork Self Storage, 222 Science Park Road in Ferguson Township, offers 560 climate-controlled units in a various sizes, from compact 5-by-5 units to large 10-by-31 units, as well as drive-up units with power access. Developed by Roeshot Construction of State College and managed by Storage Asset Management, the three-story, 72,000-square-foot facility utilizes keypad entry, 24/7 recording security cameras, on-site management and a smart entry system that allows renters to open their storage units with…

The Hidden Downsides of First-Month Free Promos

First-month free promotions are everywhere in the self storage industry. From nation-wide storage companies to independent operators, facilities rely on this promotion strategy to fill units fast. And for good reason—the words “first month free” catch attention, drive clicks, and get new customers in the door. In the short term, it works. But is it really worth it in the long run? That’s where things get complicated. While first-month free (FMF) promos can be a powerful customer acquisition tool, they come with hidden costs that can chip away at your…

Common Pitfalls in DIY Facility Management And How to Fix Them

At first glance, managing a self-storage facility looks easy. Four walls, roll-up doors, and some locks, what could go wrong? Plenty. We’ve brokered countless deals and seen too many promising properties underperform, not because of bad locations but because of avoidable management mistakes. Here are the most common pitfalls in DIY self-storage management and how to fix them before they drain your NOI. 1. Static Pricing The Pitfall: Setting rental rates once and forgetting them. Meanwhile, demand shifts, competitors adjust, and your revenue falls behind. The Fix: Think like airlines.…

5 Essential Tips for Selling Your Self-Storage Facility

Selling a self-storage facility is a major decision. For many owners, it represents years of hard work and investment, so naturally, the goal is to sell at the right time and for the best possible return. Whether you are preparing for retirement, looking to reposition your portfolio, or simply ready to move on to a new opportunity, approaching the process strategically will make all the difference. Here are five essential tips to help you maximize value and avoid common pitfalls when selling your self-storage property. 1. Understand and Organize Your…

Talonvest Structures $19.2 Million in Life Company Loans

Talonvest Capital, Inc. is proud to announce the successful closing of $19.2 million in financing on behalf of Hanora Investment Group (www.hanoragroup.com), a real estate investment firm specializing in the acquisition, development, and management of self-storage properties, and its institutional joint venture equity partner. The loan is secured by self-storage facilities located in Claremont, CA and American Canyon, CA. Together, the properties have 117,726 net rentable square feet (NRSF) in 785 non-climate-controlled units, 348 non-climate-controlled drive-up units, and 16 locker units. The American Canyon location also offers 125 RV parking…

How to Know When It’s Time to Sell Your Storage Facility

Selling a self-storage facility is one of the most important financial decisions an owner can make. Unlike day-to-day operational choices, the decision to sell shapes the long-term return on years of effort, capital, and risk. The timing has to balance both the numbers and the narrative: how your property is performing today, what the market is signaling for tomorrow, and where you are personally in your investment journey. Some owners sell to capture peak pricing, others to avoid looming capital expenses, and many simply because it fits their broader financial…