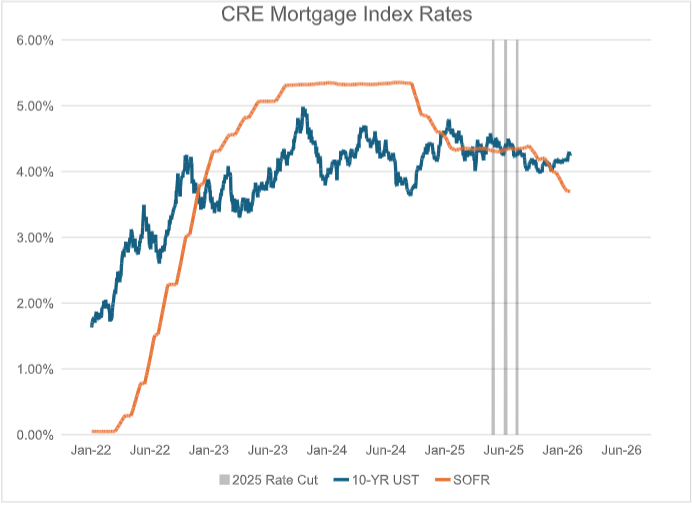

After holding rates steady for most of 2025, the Federal Reserve ended the year by cutting the federal funds rate by 25 bps at 3 consecutive Federal Open Market Committee (FOMC) meetings, for a total of 75 bps of cuts for the year. The primary floating-rate index for commercial real estate mortgages, the Secured Overnight Financing Rate (SOFR), moved in lockstep with the Fed’s rate cuts, as is typical. Other index rates, such as WSJ Prime, which is a preferred alternative to US Treasury rates and SOFR for many regional and local banks that have appetite, also decreased 75 bps in line with the Fed’s rate cuts. This is welcome news for self-storage owners as it has materially lowered borrowing costs for any properties encumbered by floating rate debt or for any new loans originated going forward. Per CNBC’s Fed Survey, two 25 bp rate cuts are anticipated in 2027. The Fed will continue to balance its dual mandate of combating inflation while also supporting the labor market.

CMBS

Domestic CMBS issuance in 2025 totaled $126 billion, an increase of 18% from the prior year, and $15 billion more volume than the previous high of $111 billion in 2021. CMBS issuers continue to view self-storage, as well as industrial and multifamily, as a favored asset class over other food groups such as retail, hospitality, and office. Indicative 5-year CMBS pricing at 70% LTV is 275-325 bps over the US Treasury rate, putting all-in rates in the mid-6% to high-6% range (the 5-Yr UST is at 3.82% as of 1/27/2026).

Banks

Banks originated 33% of commercial real estate loans in 1H 2025, up from 27% market share in 2024, per MSCI. This was due to an increase in lending volume by both regional/local banks (19% share in 1H 2025 vs 17% share in 2024) and national banks (10% share in 1H 2025 vs. 7% share in 2024). Banks will remain major lenders within CRE in general and maintain a strong appetite for the self-storage asset class going forward.

Debt Funds

Debt funds originated 14% of commercial real estate loans in 1H 2025, up from 11% in 2024, per MSCI. Furthermore, average LTV for debt funds increased to 68.6% in 1H 2025, up from 65.1% in 2024. Debt fund lenders posted the highest average LTVs of all conventional lender types in both periods. Numerous debt funds exclusively focused on lending to self-storage investors remain active, with bridge loans being their preferred deal profile.

Insurance

Life insurance company lenders originated roughly the same share of commercial mortgages in 1H 2025 (11%) compared to the prior year (12%), per MSCI. Average LTVs for life co lenders remained steady as well at 60% for 1H 2025. Interest rate spreads for life co lenders in the small-balance (sub $10 million) space are in the low-2% to mid-2% range, putting all in rates in the high-5% to low-6% range today. Spreads for larger-balance life co lenders are in the mid-1% to high-1% range, putting all-in rates in the low-5% to high-5% range today.

Source: Versal