The key driver for asset value in the self-storage space is EBITDA or Net Operating Income. Every $1 in increased Net Income monthly increases the value of a facility by approximately $200.00. If you could invest capital to enhance value, where should you spend it? Here are the three investments that provide the generally largest bang for the buck! 1. Technology Upgrades In 2026, technology is the primary driver of operational efficiency and customer convenience. Management Software: This is the most vital technological investment, serving as the operational hub for…

Filter articles for: US

Filter articles for: Canada

Recent Self-Storage Transactions: 01.14.2026 – 01.20.2026

Recent transactions point to a clear theme in early 2026: investors are leaning into secondary and suburban self-storage markets with identifiable growth catalysts. Notable deals include a mixed-storage asset in Hiram, Georgia, benefiting from metro Atlanta’s outward population growth and a partially leased facility in Simsbury, Connecticut, where buyers are stepping into a market with limited new supply and clear lease-up potential. Properties in North Carolina and Minnesota highlight a similar approach, with investors targeting locations where future expansion or gradual improvements can drive returns over time. Overall, these deals…

Featured Broker: Caroline Holliday

With experience in both residential and commercial property investments, Caroline provides an in-depth understanding of industry insights into the commercial real estate market. Since joining Storage Exchange, she has transacted on $28 million of RV and self-storage assets across the Mountain West markets. Caroline attended the University of Colorado, where she earned her BA from the College of Media & Communication and served as co-captain of the Women’s Soccer team. Contact: Caroline Holliday Associate – Storage Exchange caroline@storageexchange.com 720.281.1719

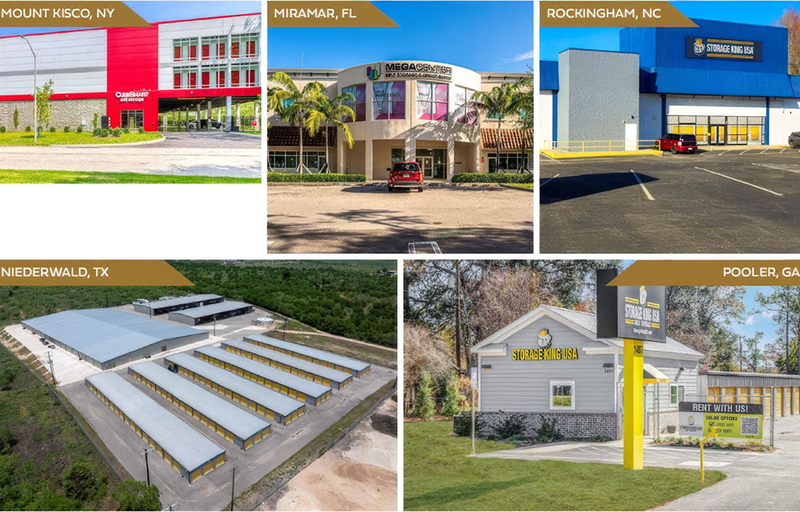

Talonvest Arranges $35 Million Financing For Five-Property Self-Storage Portfolio in Across Five US States

Talonvest Capital has arranged a $35 million, five-property financing on behalf of Andover Properties and its JV partner, TPG Angelo Gordon. The transaction includes 2,552 units and 180 parking spaces across New York, Florida, Texas, North Carolina, and Georgia. Totaling 385,635 net rentable s/f (NRSF), the assets are located in high-growth markets supported by strong demographics and long-term fundamentals. The financing consists of a three-year, non-recourse bridge loan provided by a private, institutional commercial real estate debt fund. The loan was structured with full-term interest-only payments at a fixed interest…

Gantry Arranges $12M Refinancing for Two Self-Storage Facilities in Suburban Detroit, Michigan

Gantry has arranged $12 million across two loans to refinance maturing debt for a pair of National Storage-branded facilities in suburban Detroit on behalf of Pogoda Cos. The stabilized properties offer 1,082 units totaling more than 141,000 net rentable square feet with additional vehicle storage and both climate-controlled and drive-up units. Andy Weiss, Andy Bratt and Nick Severson of Gantry represented the borrower, a private real estate investor. A life insurance company provided the seven-year, fixed-rate loan, which features interest-only payments for the full term and flexible prepayment. Gantry will…

City Council Grants Preliminary Approval for New U-Haul Self-Storage Building in Durango, Colorado

Durango City Council approved a preliminary plan for a new three-story U-Haul self-storage facility and store earlier this month near the Grandview Interchange in eastern Durango. The development is planned for 59 Copper Court below a Starbucks atop a hillside. The property is part of a South Fork Character District master plan and conceptual development plan, said Jayme Lopko, Community Development Department director, at the City Council meeting Jan. 6. The plan calls for a three-story, 108,174-square-foot building. In reviewing the plan, city staff considered access, traffic circulation and parking,…

Three-Story Self-Storage Facility Under Construction in South River, New Jersey

Construction is underway on a massive 105,500-square-foot self-storage facility in South River. The developer, CrownPoint Group Inc., broke ground earlier this month on the three-story, climate-controlled facility at 696 Old Bridge Turnpike. The facility is located at the intersection of Old Bridge Turnpike and Route 18, according to a statement from the developers. More than 1,000 apartments already surround the site, with 218 additional units under development. The residential growth demand created the need for storage space that existing facilities haven’t met, the developers said. The project marks the Parsippany-based…

New Self-Storage Business Planned in Russell, Kentucky

A vacant lot inspired a new business idea for Sok Van, better known as Michael. The owner of Nails Pro said he noticed people with items to sell setting up on a vacant lot at 329 Russell Road. “I thought, they have to load it up, take it there, unload it and load it back up at the end of the day,” Van said. “I thought it would be good to have storage there.” So he bought the lot five years ago with the idea of creating a combination storage…

Extra Space Self-Storage Plans to Expand in Crystal Lake, Illinois

Extra Space Storage in Crystal Lake is looking to expand its existing facility with three more climate-controlled buildings. The self-storage facility at 201 S. Virgina Road is looking to build a large center building of almost 21,000 square feet, along with two smaller buildings that will have drive-up exterior access. All three buildings will be climate-controlled, owner Clint Kleepe said. Kleepe appeared before the Crystal Lake Planning and Zoning Commission recently seeking approval for a preliminary and final planned development, as well as a special-use permit, for a self-storage mini…

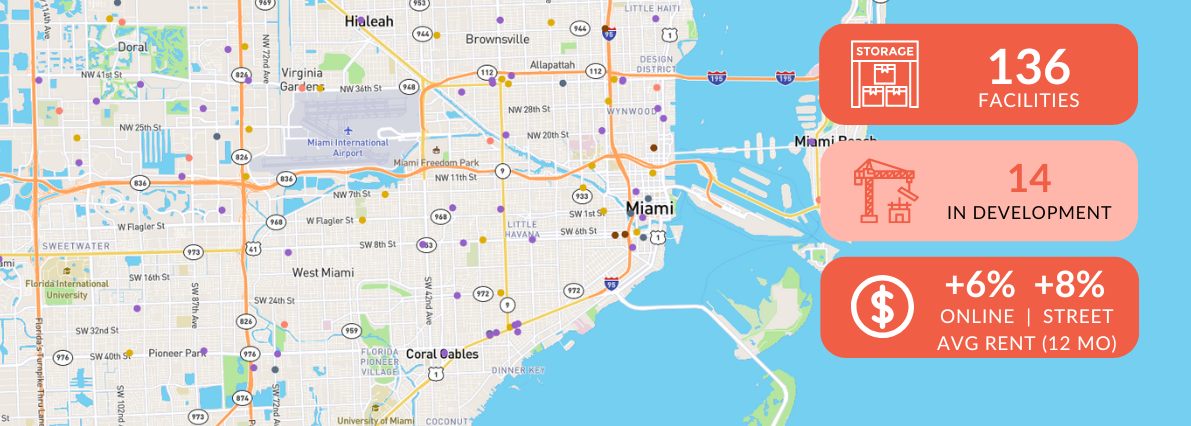

StorTrack’s Market of the Month: Miami, FL

Within the City of Miami, the self-storage footprint is both substantial and intensely urban. The city contains more than 9.3 million net rentable square feet across 136 operating facilities, a level of density that equates to roughly 21 square feet per capita, well above what the industry often flags as a “balanced” market. On the surface, that metric might suggest saturation, but Miami’s underlying demand profile tells a very different story. As the economic and cultural core of Florida, the city continues to absorb population inflows, international residents, and high-velocity…